3 Best Commodities To Invest In Before The End Of 2024

There is a saying among investors that has almost reached the level of a fixed rule or principle: "Don’t put all your eggs in one basket." This means not concentrating all your financial resources in one sector or single asset, and it is known as portfolio diversification. This principle is the cornerstone of successful investment strategies adopted by smart and expert investors in the financial field, with the aim of protecting capital from sharp fluctuations that may hit a particular sector or market.

There are many different investment vehicles to choose from, including stocks, bonds, investment funds, futures contracts, and currencies. And don’t forget about commodities, which is the focus of this article.

Commodities are things people need, like food and energy. Commodity trading has been around for centuries, long before stock and bond trading, and has formed the basis of trade between individuals and nations. What makes it unique compared to other investments is that it tends to protect investors from the effects of inflation, which is why demand for commodities tends to increase during periods of high inflation.

Today, we will highlight the top three commodities we believe are worth noting and are expected to rise in the coming period, along with the factors driving their prices upward.

-

Crude Oil

- Increased demand from developing countries like China and India, which are still in a growth phase, boosts prices.

- Geopolitical factors also play a significant role in crude oil prices. Rising tensions in the Middle East, where a large part of the world's oil is produced, can drive prices up.

-

Gold

- Increased geopolitical tensions in Ukraine or the Middle East, with a high likelihood of other conflict hotspots around the world, like Taiwan.

- Rising demand from China, the world's largest importer of gold, after the Lunar New Year.

- Increased demand in India, which is expected to continue through the end of the year.

-

Wheat

- Russia is the largest exporter of wheat, followed by the U.S., Canada, France, Ukraine, Australia, and Argentina.

- Russia and Ukraine together accounted for nearly 30% of global wheat exports before Russia's invasion of Ukraine.

Crude oil generally responds to the laws of supply and demand. When demand exceeds supply, prices tend to rise, and when demand stays consistent with supply, prices tend to fall. For example, during the summer driving season in the United States, fuel prices, one of crude oil’s byproducts, rise at gas stations, translating to higher crude oil prices.

The U.S. Energy Information Administration (EIA) expects the average price of Brent crude to reach about $88.38 per barrel in 2025, up 3.7% from previous estimates, and West Texas Intermediate (WTI) crude is expected to average $83.88 per barrel in 2025.

| Commodity | Current Estimate | 2025 Forecast |

|---|---|---|

| Brent Crude | $88.38 | +3.7% |

| WTI Crude | $83.88 | +3.7% |

How to invest in crude oil: Investing in physical crude oil isn’t as easy as other commodities because you can’t buy a barrel of oil directly. As an investor, you may consider futures contracts, the most direct way to indirectly own the commodity. Investors might also consider buying shares in companies that extract, transport, or process crude oil, or invest in energy sector ETFs.

Gold is often referred to as the safe haven or guaranteed hedge against inflation or economic and geopolitical tensions. Over the past 20 years, gold has delivered an average return of more than 8% annually.

What makes this commodity particularly interesting right now is that we have entered a phase of U.S. interest rate cuts. When interest rates fall, gold tends to rise due to its increasing attractiveness as a safe-haven asset.

Goldman Sachs analysts expect gold to reach about $2,900 per ounce by early 2025, a 7.41% increase from its current price.

Global wheat prices rose throughout most of September due to drought concerns in winter wheat-growing regions in Russia and the United States. Wheat prices in Russia and the European Union were generally $14 per ton higher throughout the month.

Given these geopolitical challenges and the impact of conflicts, especially in Ukraine and the Middle East, wheat prices are expected to rise gradually in the coming period. Analysts forecast that wheat prices in 2025 will range between $620 and $720, a 20% increase from their current levels.

Best Commodity Brokers 2024

- Pepperstone - Best overall commodity futures trading broker for beginners. Founded 2010. Multiple regulated licenses. Minimum deposit: $0. 20% discount on deposit.

- Plus500 - Best licensed broker for investing in commodity CFDs. Founded 2008. Multiple regulated licenses. Minimum deposit: $100.

- XM - Top commodity futures trading platform for educational materials and copy trading. Founded 2009. Multiple regulated licenses. Minimum deposit: $5. Periodic competitions and bonuses.

Compare the Best Commodity Brokers Right Now

| Broker | Trade | Special Features | Regulation | Account Types | Leverage | Spread | Minimum Deposit | Trust Score |

|---|---|---|---|---|---|---|---|---|

| Pepperstone | Trade | Fast execution, tight spreads on major commodities | ASIC, FCA, DFSA, SCB | Standard, Razor | Up to 1:500 | From 0.0 pips | $0 | 9.5/10 |

| XM | Trade | Wide range of commodities, loyalty program | IFSC, CySEC, ASIC | Micro, Standard, Zero, Ultra | Up to 1:888 | From 0.1 pips | $5 | 9/10 |

| Plus500 | Trade | Commission-free trading, easy-to-use platform, commodity CFDs | FCA, CySEC, ASIC, FMA | Retail, Professional | Up to 1:30 | From 0.6 pips | $100 | 9/10 |

4 Reasons Why Bitcoin is Set to Skyrocket in 2025

The year 2024 will be remembered as a turbulent year for cryptocurrencies, with several significant developments that ultimately helped "clean up" the space, making it more attractive to mainstream investors.

As of October 20th, Bitcoin recorded a price of $68,393, 7.20% off its all-time high in March of this year, but it has risen 11.60% last month and by 3.90% so far this month.

After the Federal Reserve cut interest rates, Bitcoin's value reached $64,000. The Fed lowered rates by 50 basis points, while the Bank of Japan kept rates unchanged. However, this did little to push Bitcoin higher, as its value only rose by about 3% one day after the announcements from both central banks. On September 26, 2024, the Swiss National Bank lowered rates by 25 basis points to 1.0%, pushing Bitcoin to $65,000, an increase of 2.41% the next day.

While the recent sentiment surrounding Bitcoin may have turned positive, there are several compelling reasons to remain optimistic as we head toward the end of the year. In fact, four key factors could push Bitcoin to new heights by 2025.

1. The Impact of Bitcoin Spot ETFs

One of the most significant developments in the cryptocurrency space this year was the introduction of Bitcoin Spot ETFs by the U.S. Securities and Exchange Commission (SEC). ETFs already exist for everything from oil to the FTSE 100 index and even for regions and countries. They track underlying assets, creating an easy way for people to invest without directly buying the assets. They provide institutional investors with a regulated and easy way to gain exposure to Bitcoin, and as more institutions adopt this asset class, the potential for price increases grows.

In the first quarter of 2024, these 11 new funds played a pivotal role in pushing Bitcoin’s price up by around 60% at its peak. These funds were collectively buying more than 10 times the daily production rate of Bitcoin, driving up demand and thus prices.

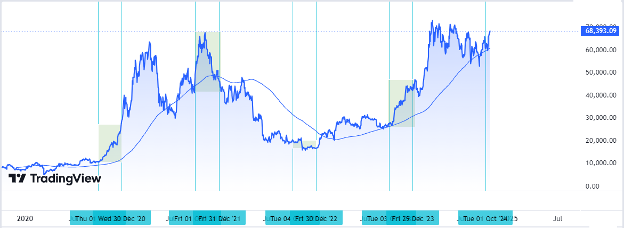

Bitcoin’s rise from the start of 2024

Moreover, regulators in Hong Kong announced they are open to Bitcoin Spot ETF applications and have issued guidelines that allow for several types of funds, including the standard model seen in the U.S., where investors buy Bitcoin ETFs with dollars. Hong Kong is also open to a second type known as "in-kind."

This would make it possible to convert shares in a Bitcoin ETF into Bitcoin and vice versa, allowing for more flexibility and attracting more institutional investors into the space.

2. Interest Rates

The second reason for optimism about Bitcoin is the expected shift in Federal Reserve policy. After more than two years of aggressive rate hikes, Federal Reserve Chair Jerome Powell hinted that rates might have peaked, and the Fed is likely to cut them in 2025. Similarly, in the UK, the leading mortgage lender Halifax lowered its lending rate in anticipation of a Bank of England rate cut.

If rates are lowered or even stabilized in 2025, this could make Bitcoin (and other digital assets) more attractive to investors, as its limited supply makes it a hedge against traditional currencies that lose value over time.

Bitcoin is often viewed as a "risky" asset, meaning it performs well when investors are willing to take more risks in search of higher returns in a low-interest-rate environment.

Furthermore, lower interest rates generally lead to a weaker dollar. Bitcoin's unique monetary policy with its limited supply and decentralized nature provides a hedge against inflationary pressures that can erode the value of fiat currencies.

3. Halving

The Bitcoin “halving” is a major event where Bitcoin’s blockchain rewards miners with half of the Bitcoin they previously received for solving complex mathematical puzzles. This event occurs every 210,000 blocks (approximately every four years).

The reward started at 50 BTC in 2009 and was reduced from 6.25 BTC to 3.125 BTC in mid-April 2024. This reduction decreases the number of Bitcoin sold on the market, as it squeezes out less efficient miners, reducing the overall supply of the currency. Previous halvings have driven dramatic increases in Bitcoin’s price, and we’re still awaiting the market's response to the most recent halving that took place in April this year.

The impact of the 2020 and 2024 halvings

Historically, halving events are seen as excellent indicators of future upward momentum for Bitcoin's price. While the halving that occurred on April 20, 2024, did not immediately cause the value to spike as experts predicted, it appears that the trend has reversed, and Bitcoin’s price is set to rise once again to create a new peak.

4. Historical Patterns Indicate a Strong Q4

The fourth reason for optimism is rooted in Bitcoin’s historical performance. Over its fifteen-year history, Bitcoin has shown a clear pattern of quiet summer months followed by a strong fourth quarter, and this year appears to be following the same trajectory.

The impact of Q4 on price

On average, Bitcoin has returned -4% in September, 26% in October, 36% in November, and 11% in December. If these historical averages hold, Bitcoin could see a significant surge in the coming months, potentially pushing its price beyond six figures to around $107,000. While past performance is not a guarantee of future results, the consistency of this pattern over the years suggests that Bitcoin may be set for another impressive year-end rally.

While Bitcoin’s future appears optimistic, individual investors should exercise caution with each move Bitcoin makes, as it has experienced violent disruptions before due to several other factors. Therefore, it’s crucial to remember that investing in Bitcoin should be approached with a long-term perspective.

Best Bitcoin Trading Platforms 2025

- Pepperstone - Best overall Bitcoin BTC trading broker for beginners. Founded 2010. Multiple regulated licenses. Minimum deposit: $0. 20% discount on deposit.

- Plus500 - Best licensed broker for investing in Bitcoin BTC (CFDs). Founded 2008. Multiple regulated licenses. Minimum deposit: $100.

- XM - Top Bitcoin BTC CFDs trading platform for educational materials and copy trading. Founded 2009. Multiple regulated licenses. Minimum deposit: $5. Periodic competitions and bonuses.

The GBPCHF keeps the bullish track – Forecast today – 21-10-2024

Despite the GBPCHF price’s lack of the positive momentum and fluctuating near 1.1275, the continuous consolidation within the bullish channel that its major support line located at 1.1210 confirms the continuation of the positivity for the upcoming period.

The above chart shows the MA55 attempt to form additional support by settling near 1.1245, allowing us to wait to gather the required additional positive momentum to confirm breaching 1.1300 obstacle and ease the mission of achieving the additional gains by reaching 1.1335 and 1.1365.

The expected trading range for today is between 1.1260 and 1.1335

Trend forecast: Bullish

Natural gas price touches the first target – Forecast today – 21-10-2024

Natural gas price continued to form the negative trades, to move away from 2.440$ resistance line and notice its consolidation near the first negative target at 2.250$.

Note that stochastic consolidation within the oversold areas might force the price to form some sideways trades, with chances to test 2.340$ level followed by attempting to gather the additional negative momentum to ease the mission of resuming the negative attack and reach the next main target at 2.140$.

The expected trading range for today is between 2.140$ and 2.340$

Trend forecast: Bearish