Copper price settles within the bullish track– Forecast today – 4-8-2025

AI Summary

- Copper price settles within the bullish track, with main support at $4.0500 and extra support at $4.2600

- Price may experience mixed sideways trading but stability above main support suggests potential gains towards $4.6300 and $4.7500

- Expected trading range for today is between $4.2600 and $4.6300, with a bullish trend forecasted

Despite the continuation of the negative pressure on copper price, its main stability within the bullish channel levels that its main support is located at $4.0500, besides forming extra support at 61.8%Fibonacci extension level at $4.2600 supports the chances of renewing the bullish attempts in the near and medium period.

The price might be forced to form some mixed sideways trading, but the stability above the main support makes us wait to gather positive momentum, attempting to achieve some gains by its rally towards $4.6300 and $4.7500.

The expected trading range for today is between $4.2600 and $4.6300

Trend forecast: Bullish

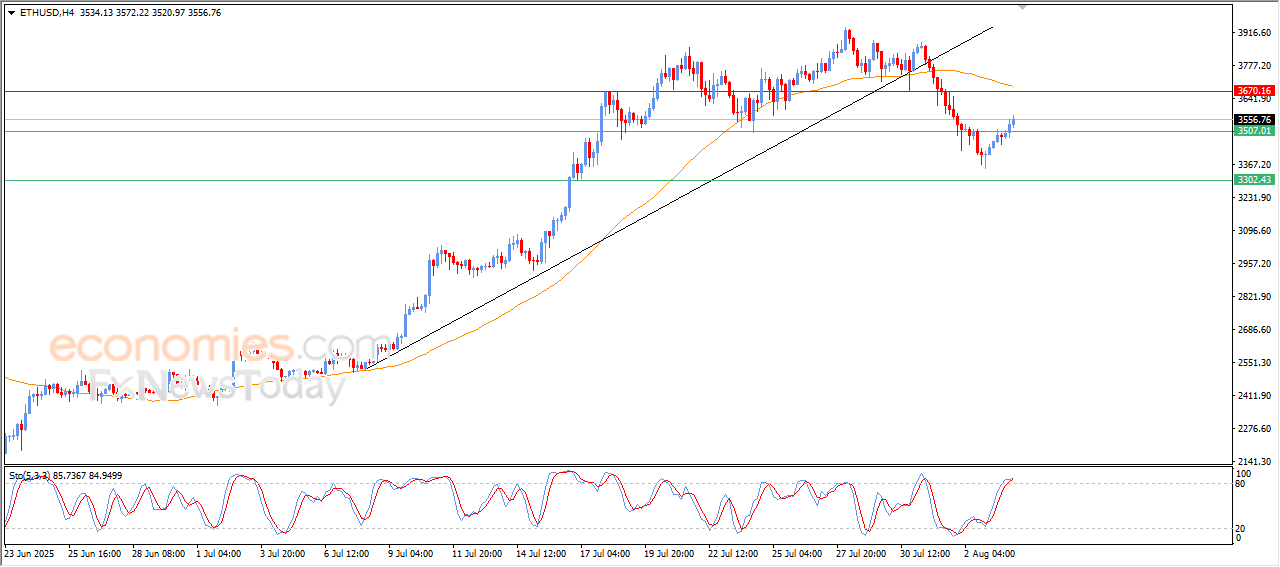

The (ETHUSD) is attempting to recover some of its losses-Analysis- 04-08-2025

The (ETHUSD) price continued its last intraday trading, in attempt to recover some of its previous losses, amid the dominance of the bearish correctional trend on the short-term basis and its affection by breaking a bullish trend line, with the continuation of the negative pressure that comes from its trading below EMA50, besides the (RSI) reach to the overbought levels, which suggest forming negative divergence, especially with the emergence of negative overlapping signals.

BestTradingSignal.com – Professional Trading Signals

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramVIP Trading Signals Performance – July 28 – August 1, 2025

To view the full performance report for this week, visit the following link:

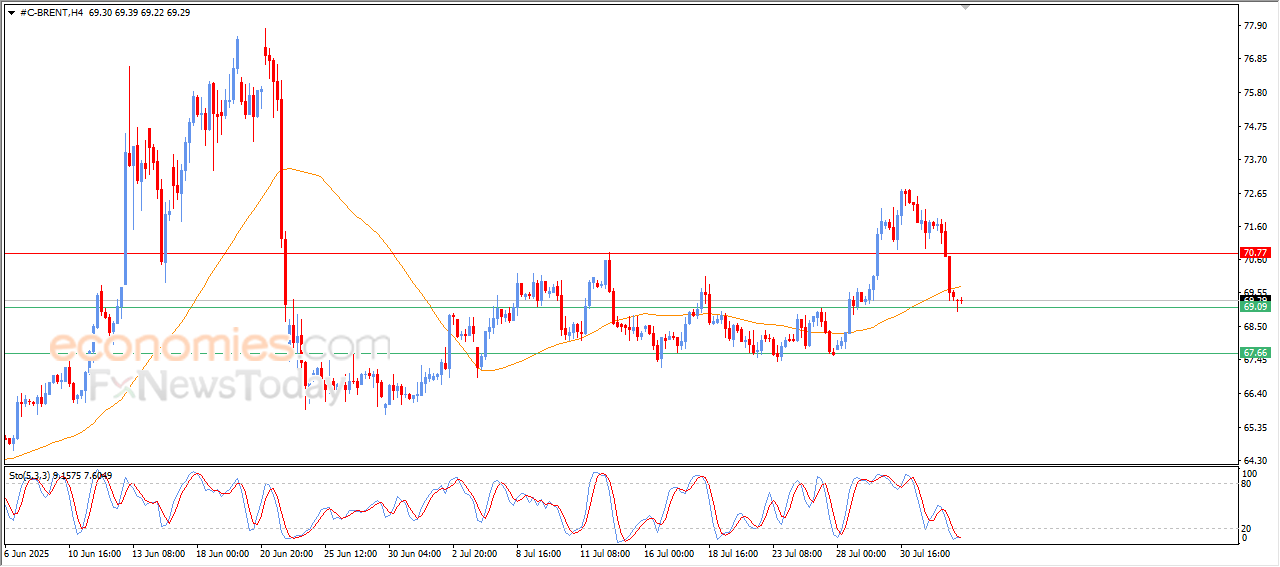

Brent crude oil settles with sharp losses- Analysis-04-08-2025

The (Brent) price settled with strong losses in its last intraday trading, to lean on the current support at $69.00, which reduced the losses especially with the (RSI) reach to the oversold levels, besides the emergence of positive overlapping signals from there, which might push the price towards cautious bullish rebounds to attempt to offload this oversold condition, at the same time it attempts to recover its previous losses.

BestTradingSignal.com – Professional Trading Signals

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramVIP Trading Signals Performance – July 28 – August 1, 2025

To view the full performance report for this week, visit the following link:

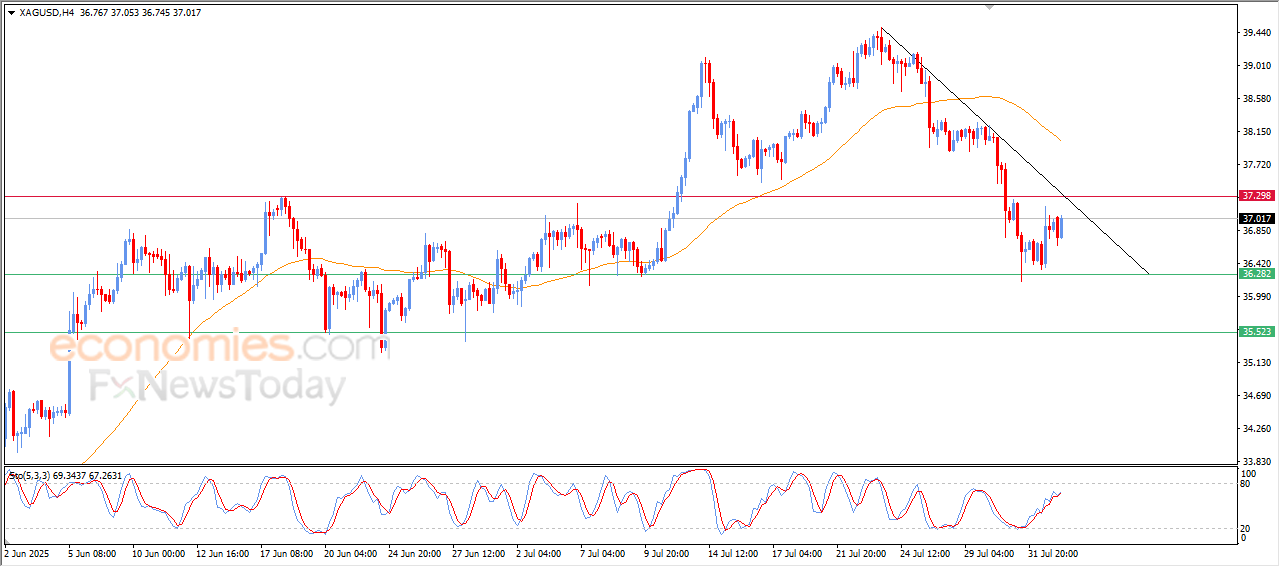

Silver Price is rising carefully -Analysis-04-08-2025

The (silver) price rose in its last intraday trading, but it remains under the dominance of the bearish correctional trend on the short-term basis, with the continuation of its trading alongside a bias line that indicates the negative pressures, and its stability below EMA50 reinforces this pressure and limits the strength of the current rise.

The (RSI) began showing negative overlapping signals after reaching overbought levels, indicating the weakness of the positive momentum and a potential return to the selling pressure on the near-term basis unless they breached the resistance levels.

BestTradingSignal.com – Professional Trading Signals

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramVIP Trading Signals Performance – July 28 – August 1, 2025

To view the full performance report for this week, visit the following link: