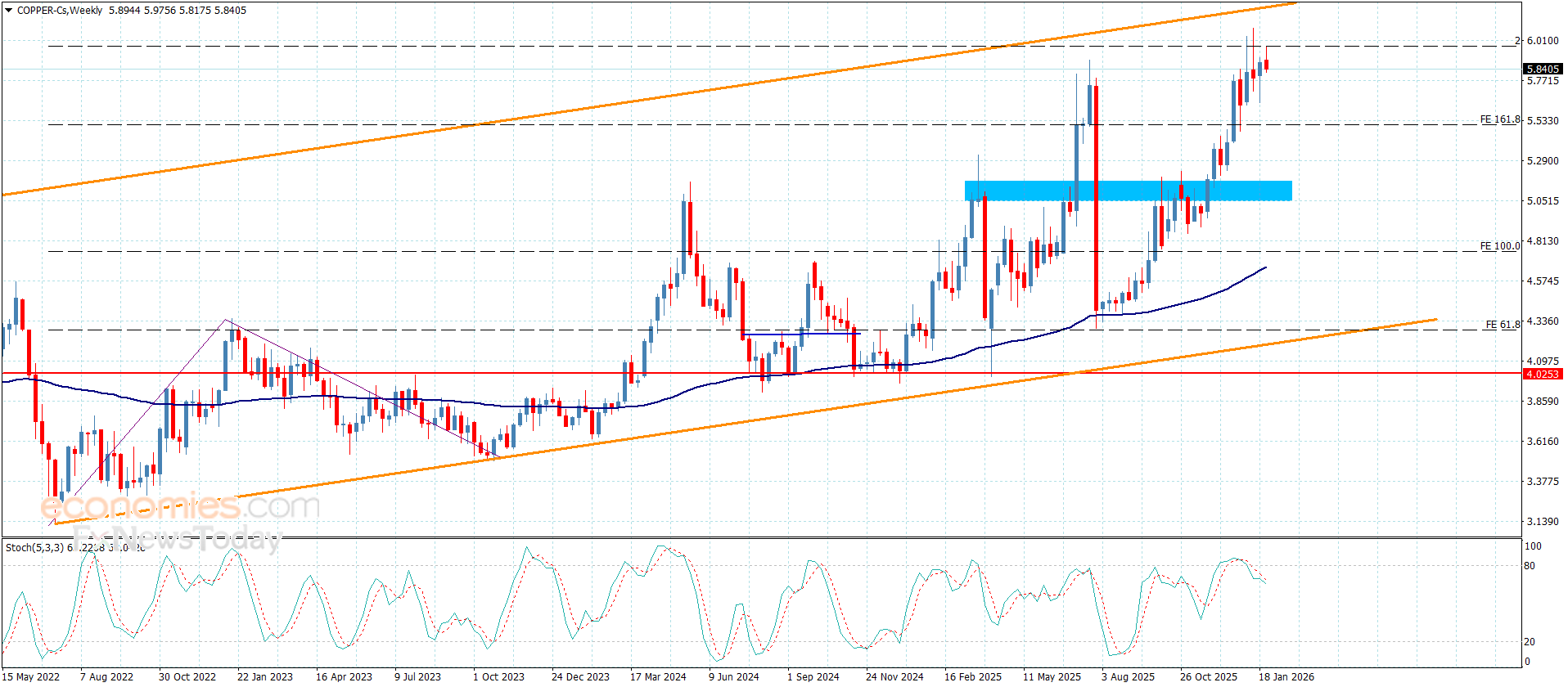

Copper price is fluctuating below the barrier– Forecast today – 27-1-2026

Copper price reached $5.9700 level yesterday to settle below it, affected by the continuation of the contradiction between the main indicators, especially by stochastic exit from the overbought level, which forces it to fluctuate in sideways range by its stability near $5.8300.

We expect the price to be affected by a state of instability due to the ongoing divergence of the main indicators, despite the presence of an opportunity to edge toward $5,720.00. However, exposure to negative pressure may force it to retest the solid support near $5,510.00, while surpassing this level and holding above it will reinforce the chances of recording new gains that might extend towards $6.1200 and $6.2400.

The expected trading range for today is between $5.7500 and $6.000

Trend forecast: Fluctuating

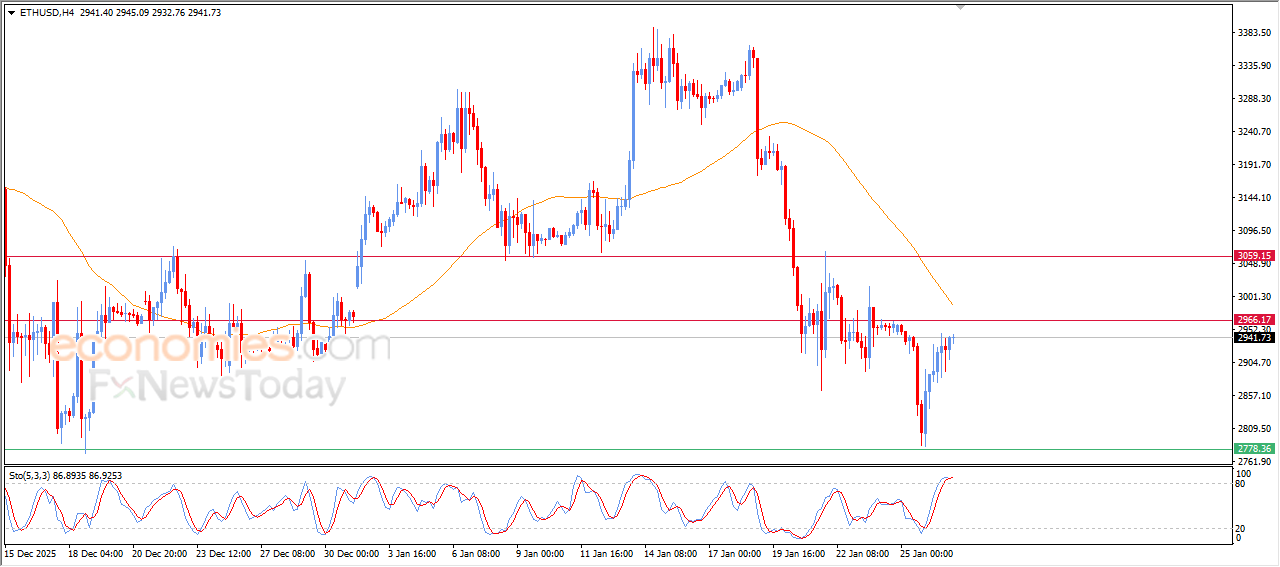

The (ETHUSD) is experiencing cautious gains- Analysis- 27-01-2026

The (ETHUSD) price rose in its last intraday trading, to recover some of its previous losses, amid the dominance of the main bearish trend due to its trading below EMA50, with the continuation of the negative pressure due to its trading below EMA50, which reduces the chances of the price’s sustainable recovery on near-term basis, especially with the beginning of forming negative divergence on relative strength indicators, after reaching overbought levels, exaggeratedly compared to the price move, with the emergence of negative overlapping signals.

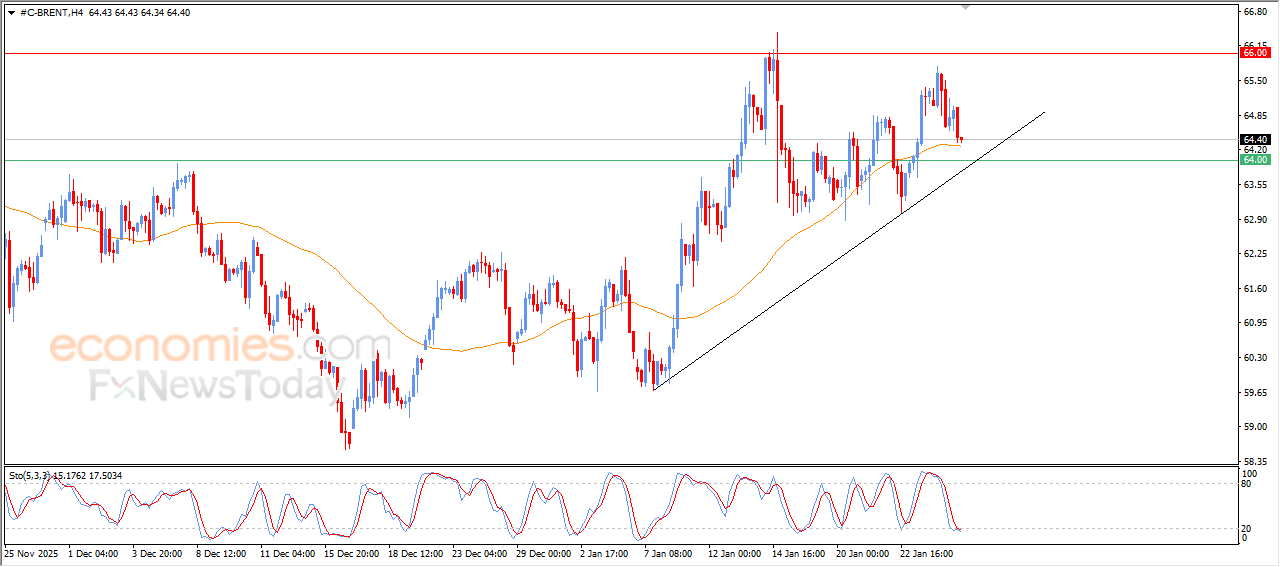

Brent crude oil is looking for higher low- Analysis- 27-01-2026

The (Brent) price declined in its last intraday trading, attempting to look for higher low to use it as a base for gaining the required bullish momentum for its recovery, amid the dominance of the main bullish trend on short-term basis, with its trading alongside supportive minor trend line for this track, with the relative strength indicators’ reaching oversold levels, exaggeratedly compared to the price move, indicating the beginning of forming positive divergence, leaning on EMA50’s support, which reinforces the chances of the price recovery on near-term basis.

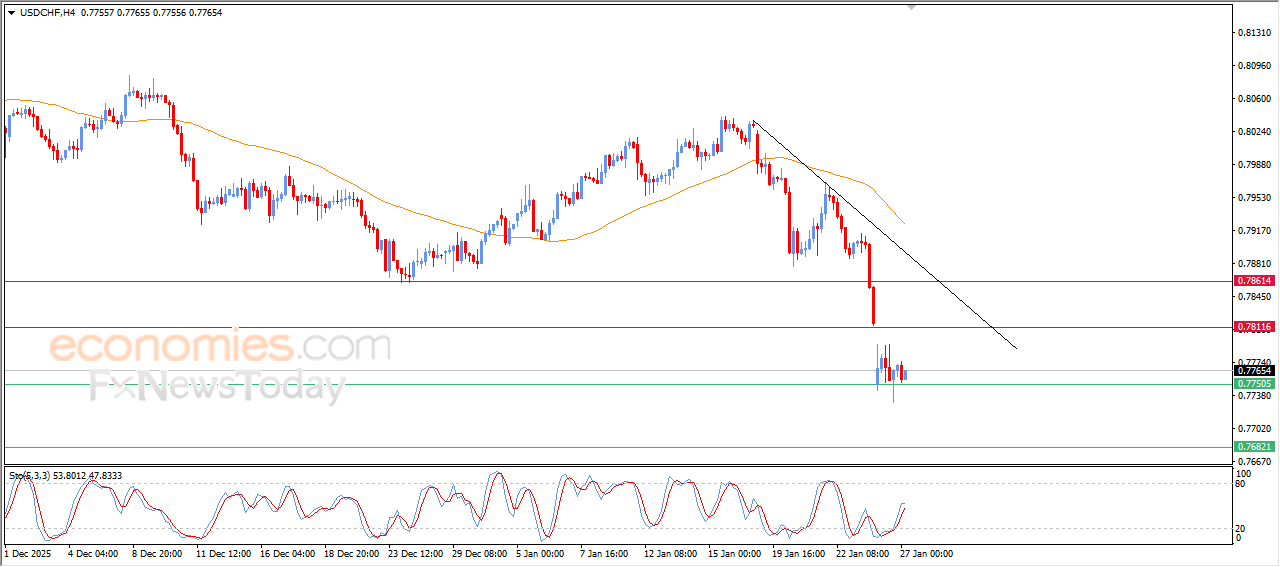

The USDCHF Price remains steady, supported by its current support- Analysis-27-01-2026

The (USDCHF) price witnessed fluctuating trading on its last intraday levels, due to the stability of 0.7750 support, gaining some bullish momentum that helped it to offload its clear oversold conditions on relative strength indicators, amid the dominance of the main bearish trend on short-term basis, with its trading alongside minor supportive trend line, with the continuation of the negative pressure due to its trading below EMA50, reducing the chances of the price recovery on near-term basis.