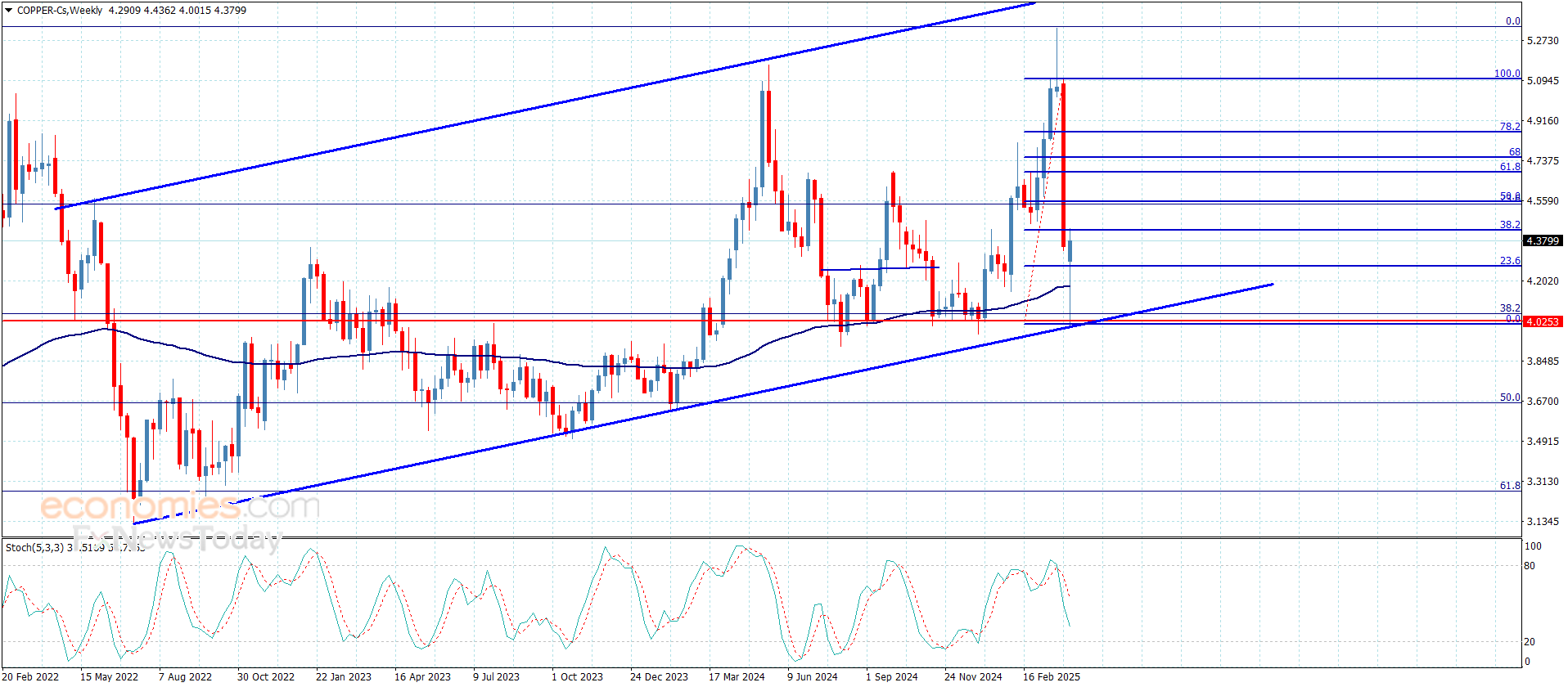

Copper price begins recording targets – Analysis – 10-04-2025

Copper price get advantage from the repeated positive stability within the bullish channel’s levels, forming a strong bullish rally after testing the support at $4.000, to notice recording some of the main targets by hitting 38.2% Fibonacci correction level at $4.4300.

The contradiction between the main indicators might assist forming some of the sideways trading, to keep waiting for gathering extra positive momentum that allows it to resume the rise and reaching the extra positive stations near $4.5600 reaching $4.6800.

The expected trading range for today is between $4.2300 and $4.5600

Trend forecast: Bullish

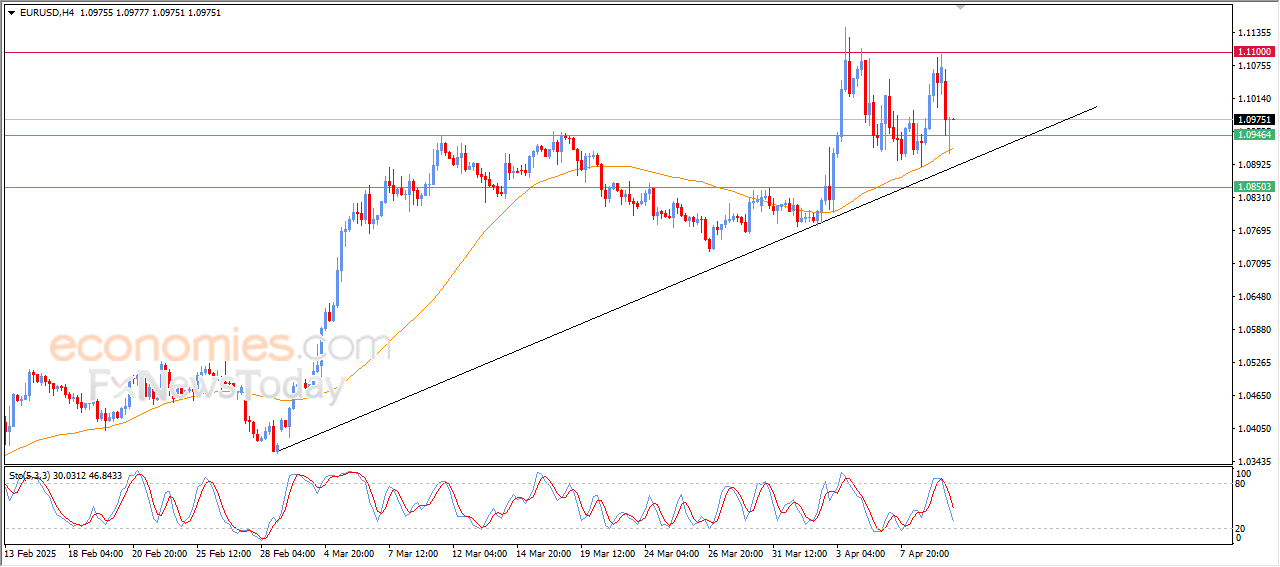

The EURUSD Receives Some Support – Analysis – 10-04-2025

The (EURUSD) experienced highly fluctuated trading during yesterday’s session, ending with a slight decline, as negative signals emerged from the Relative Strength Index (RSI) after reaching extremely overbought levels. In an attempt to gain positive momentum that could support a recovery and upside moves, to lean on the support of the EMA50, beside its leaning on the critical support level at 1.0945. All that provided some positive momentum and helped it to rebound higher on its recent intraday trading, getting advantage from the main bullish trend that remains the dominant and the pair’s stability above the ascending trendline.

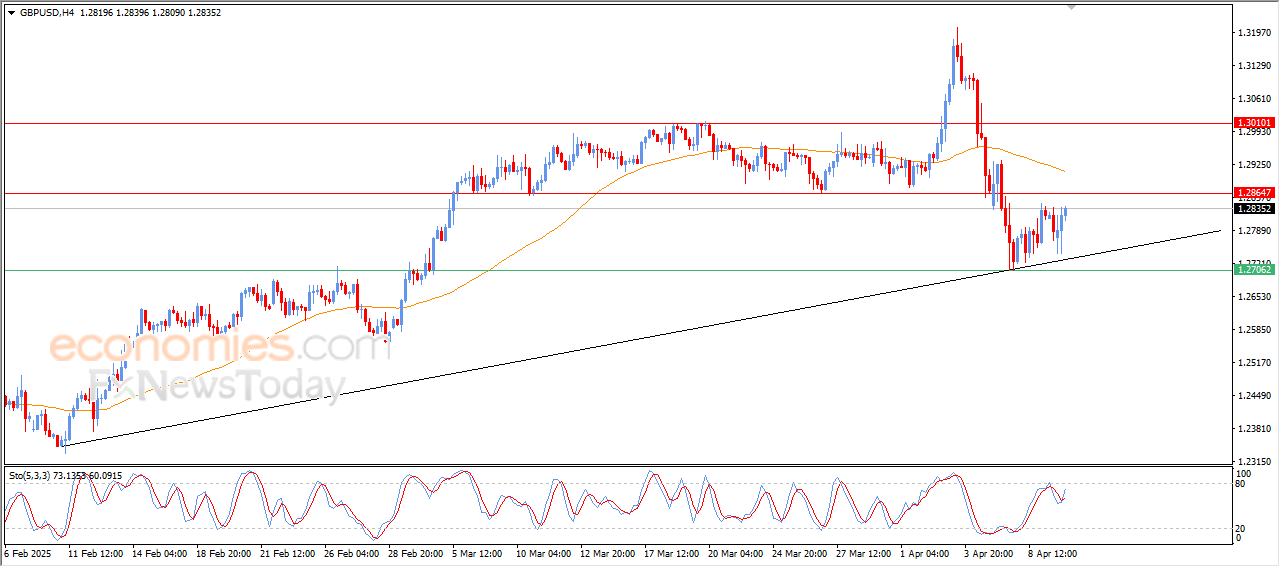

The GBPUSD gets ready to attack the key resistance – Analysis – 10-04-2025

The (GBPUSD) pair’s price rose in its latest intraday trading, as positive signals began to reappear in the Relative Strength Index (RSI) after the pair successfully get rid of some of its previous overbought pressure, beside the domination of the main bullish trend on the short-term basis and trading along a rising trendline, which prepares the pair to attack the key resistance level at 1.2865.

The USDJPY Faces Negative Pressure – Analysis – 10-04-2025

The (USDJPY) pair’s price declined in its latest intraday trading, following the stability of the key resistance level at 148.15. accompanied with the pair facing resistance from the EMA50, which added to the negative pressure and forced it to head downside, especially under the influence of the dominant bearish trend and trading along a bearish trend line.