Coffee: The Pricey Perk – How Your Morning Brew is Getting Costlier

At the end of November, coffee dominated the headlines as its prices reached the highest levels since 1977, raising widespread concerns about the global availability of this vital commodity. The main reason for this significant rise is the escalating fears of a supply shortage, driven by declining production in the two largest coffee-producing countries: Brazil and Vietnam. This potential shortage warns of increased costs for both consumers and traders alike, amidst the continued rise in global demand for coffee as one of the most essential consumer goods.

Brazil, "the world's largest coffee producer," is facing unprecedented climate challenges. Repeated drought waves and rising temperatures have directly impacted the production of Arabica beans, the type most in demand in global markets. Despite recent seasonal rains, the damage inflicted on the crop might be long-term, raising doubts about the possibility of a quick recovery in production.

Vietnam, "the second-largest coffee producer in the world," is experiencing similar conditions to those in Brazil. The production of Robusta coffee, which is primarily used in making instant coffee, has deteriorated due to climatic conditions and limited investments in renewing old farms. With growing demand for Robusta as a cheaper alternative to Arabica, pressures on global markets have intensified, leading to unprecedented price inflation.

It’s not just the climate factors; global supply chain bottlenecks, rising shipping and fuel costs have also played a role in driving up prices. Given these interrelated factors, the coffee crisis is expected to continue in the coming months, raising questions about how this will impact global coffee consumption habits.

In this context, a broad question arises: Will coffee prices continue to soar, possibly reaching new record levels? And how will markets handle this challenge? Experts predict that prices will remain under upward pressure until the end of 2024 and into early 2025 unless there are significant changes in the fundamental factors affecting the market.

About Coffee Beans

Coffee beans are the seeds extracted from the fruit of the coffee tree and serve as the primary ingredient for preparing coffee, one of the most popular beverages in the world. Coffee is grown in tropical regions, especially in countries located between the Tropic of Cancer and the Tropic of Capricorn, where ideal climatic conditions for coffee plant growth are available.

Types of Coffee Beans

- Arabica Beans (Arabica): They constitute about 60-70% of global production, known for their smooth flavor and mild acidity with lower caffeine levels, making them the first choice for coffee enthusiasts. They are cultivated in high-altitude countries like Brazil, Ethiopia, and some African regions.

- Robusta Beans (Robusta): They contain higher caffeine levels compared to Arabica, characterized by a more bitter and stronger flavor. Therefore, they are often used in instant coffee production. They are grown in lower-altitude regions such as Vietnam and parts of Africa.

Coffee Production Cycle

- The cycle begins with planting coffee trees, which require a moderate tropical climate, rich soil, and medium to high altitudes.

- After the coffee cherries mature, they are harvested and processed to remove the skin and extract the seeds.

- The seeds (beans) are dried and roasted before being ground to enhance their natural flavors. Roasting ranges from light to medium to dark, depending on consumer preferences.

Uses of Coffee Beans

- Coffee Beverage: Roasted and ground beans are used to prepare a wide range of coffee types (Espresso, Turkish coffee, and drip coffee).

- Secondary Uses: Coffee residues are used as natural fertilizers or in cosmetic products.

Global Coffee Trade

Coffee is one of the most traded commodities globally, with Brazil ranking first in production, followed by Vietnam and Colombia. Factors such as climate, global demand, and trade policies influence coffee prices, as seen in the recent price hike due to production shortages.

Benefits of Coffee

- Coffee contains antioxidants and caffeine, which boost energy and reduce fatigue.

- Moderate coffee consumption has potential health benefits, such as improved focus and mood. However, excessive intake may lead to negative effects like insomnia and increased heart rate.

Overview of Coffee Prices

• Coffee prices are currently trading around the $300 per contract level, near all-time highs.

• Coffee prices increased by 19.5% in the third quarter of this year, marking the second consecutive quarterly gain due to global supply shortage concerns.

• Coffee prices aim to trade above the key technical resistance at $330, with the next target being $350 by the end of the year or in the first quarter of the next year.

Conversion from Contract to Ton

- 1 Contract = 100 Pounds

- Price per Pound = Price per Contract ÷ 100

- 1 Metric Ton = 2204.62 Pounds

- Price per Metric Ton = Price per Pound × 2204.62

Bullish Factors for Coffee Prices

- Adverse Weather Conditions: Brazil and Vietnam are facing weather challenges that negatively impact production.

- Rising Global Demand: Increasing coffee consumption in emerging and developed markets drives demand.

- Declining Global Inventories: Lower inventories add pressure to prices.

- Higher Production and Transportation Costs: Increased costs lead to inflation in prices.

- Currency Fluctuations: Weak local currencies in producing countries impact supply.

- Market Speculation: Investor and speculator activities support upward price trends.

Global Coffee Production

In 2024, global coffee production faces significant challenges, particularly in major producing countries, impacting overall production levels. Brazil has experienced a notable decline in production due to severe weather conditions. Vietnam faces delays in crop harvesting due to fluctuating weather. Projections suggest global production may decrease by 3-5% compared to the previous year.

Global Coffee Inventories

Global coffee inventories are under significant pressure due to production challenges. Reports indicate that inventories may drop to their lowest levels in five years, causing widespread concern among investors and traders. The world could face a deficit of 4-6 million bags by the end of the year.

Global Coffee Demand Growth Projections

Projections by the International Coffee Organization indicate continued growth in global coffee demand over the coming years, with an annual growth rate of 2-3% through 2030. Asian and African markets record the highest growth rates.

Major Coffee Price Projections for 2024

- Rabobank: Expects coffee prices to rise to $300 per contract by year-end.

- Investing Haven: Forecasts coffee prices will reach $290 per contract before year-end.

- World Bank: Projects global coffee prices to average $320 per contract in 2024.

- International Coffee Organization (ICO): Predicts coffee prices will reach approximately $300 per contract by the end of 2024.

Factors Influencing Coffee Price Projections

- Weather Conditions and Agricultural Output: Weather patterns affect production and influence prices.

- Global Inventories: Declining inventories heighten concerns about supply.

- Global Demand: Rising consumption in emerging markets drives prices higher.

- Currency Exchange Rates: Currency fluctuations impact production and export costs.

- Geopolitical and Economic Tensions: Supply chain disruptions result in higher prices.

- Investment Fund Movements: Speculative activity can inflate prices.

- Production Costs: Rising costs of fertilizers, fuel, and labor affect prices.

- Agricultural and Trade Policies: Changes in government policies influence global prices.

Key Coffee Price Milestones

- October 2001: Coffee prices recorded an all-time low of $42.20 per contract.

- April 1977: Coffee prices reached an all-time high of $339.90 per contract.

- November 2024: Coffee recorded the highest closing price ever at $323.05 per contract.

How to Invest in Coffee

- Direct Investment in Coffee Futures: Traded on exchanges like NYMEX, but require deep market understanding.

- Coffee-Linked ETFs: Provide a convenient way to invest without dealing directly with futures.

- Investing in Coffee-Related Companies: Examples include Starbucks, J.M. Smucker Company, and Keurig Dr Pepper.

- Physical Commodities: Buying and storing coffee beans, though this requires substantial resources.

- CFD Trading: Allows trading based on price movements without owning the asset.

- Long-Term Investment: Investing in industries and products related to coffee in general.

Tips for Coffee Investment

- Diversify your portfolio to minimize risks.

- Monitor global markets and weather conditions.

- Utilize technical and fundamental analysis to understand price movements.

Best Coffee Trading Platforms 2024

- Pepperstone - Best overall coffee trading broker for beginners. Founded 2010. Multiple regulated licenses. Minimum deposit: $0. 20% discount on deposit.

- Plus500 - Best licensed broker for investing in coffee. Founded 2008. Multiple regulated licenses. Minimum deposit: $100.

- XM - Top coffee trading platform for educational materials and copy trading. Founded 2009. Multiple regulated licenses. Minimum deposit: $5. Periodic competitions and bonuses.

Summary: Best Coffee Trading Brokers

| Broker | Rating | Best For |

|---|---|---|

| Pepperstone |

4.5/5

|

Best Coffee Trading broker offering advanced Trading tools |

| XM |

4/5

|

Best Coffee Trading platform especially for trader education and training |

| Plus500 |

4/5

|

Best Coffee Trading broker with a user-friendly interface |

Technical Analysis for Coffee Prices

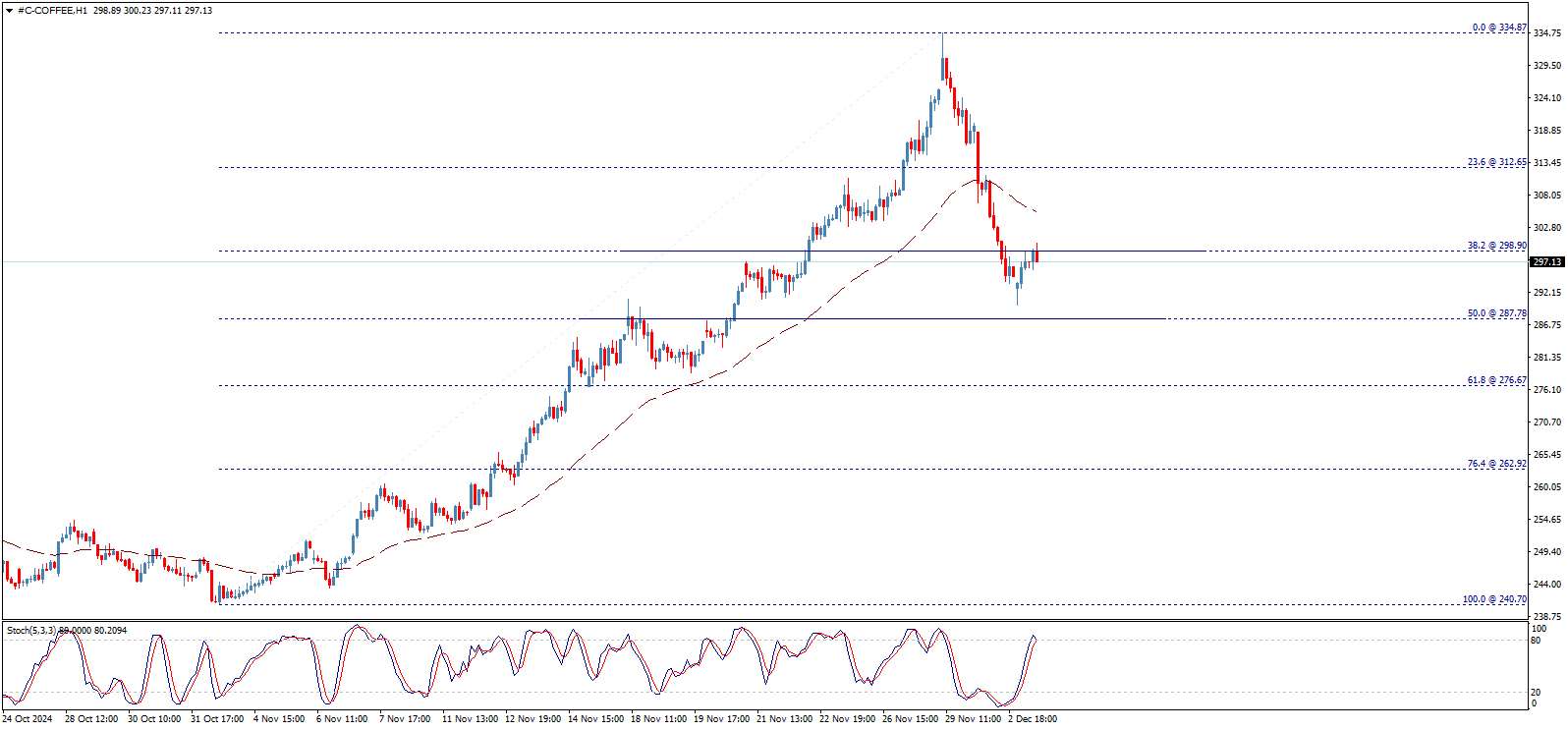

The weekly chart for coffee prices illustrates how the price recently surged significantly, reaching new record levels of 334.87 USD last month. The upward momentum suggests further gains on the medium and long-term horizon, particularly after breaking through the resistance of the long-term ascending channel, as shown in the chart below:

On daily timeframes, the price is retesting the broken resistance of the mentioned channel, which has now turned into crucial support at 289.90 USD. The price needs to stabilize above this level to resume the upward trajectory and target further historic highs, extending to levels of 350.00 USD and 375.00 USD as key next stations.

The stochastic indicator has clearly eliminated its negative momentum during the recent decline, while the 50-period moving average provides positive support to the price. These technical factors contribute to pushing the price to resume the bullish wave and achieve the proposed gains above.

On intraday timeframes, the recent decline appears to be a temporary corrective dip nearing the 50% Fibonacci retracement of the uptrend that started from 240.70 USD. The price needs to breach the 299.00 USD barrier, a significant short-term resistance, to reinforce chances for further upside.

The anticipated positive targets begin at 312.65 USD, extending to 350.00 USD and 375.00 USD.

Conditions for Sustained Uptrend:

- Breaching levels of 299.00 USD and 312.65 USD and maintaining stability above them.

- Accumulating additional positive momentum on shorter timeframes to stimulate further upward movements.

- Maintaining stability above 289.80 USD. Breaking this level could indicate a short-to-medium-term trend reversal towards the downside.

Breaking below 289.80 USD may lead to additional corrective declines toward 262.00 USD before the price attempts recovery and resumes the primary bullish trend.

If levels of 262.00 USD and 250.50 USD are breached, the long-term bullish wave will halt, shifting the trend towards declines and possibly incurring additional losses down to 217.00 USD.

Ethereum price (ETHUSD) forecast update - 04-12-2024

Ethereum price (ETHUSD) continues to rise to surpass 3700.00$ barrier and approach our first waited target at 3740.00$, getting continuous positive support by the EMA50, to support the expectations of achieving more gains in the upcoming period, as our next target reaches 3900.00$.

Therefore, we will continue to suggest the bullish trend on the intraday and short-term basis, unless breaking 3550.00$ and holding below it.

The expected trading range for today is between 3550.00$ support and 3800.00$ resistance.

Trend forecast: Bullish

Bitcoin price (BTCUSD) forecast update - 04-12-2024

Bitcoin price (BTCUSD) shows new positive trades to approach 97000.00$ barrier, reinforcing the expectations of continuing the bullish trend in the upcoming sessions, waiting to visit 97400.00$ followed by 100000.00$ that represents our next main targets, reminding you that the continuation of the bullish wave depends on the price stability above 94640.00$.

The expected trading range for today is between 94400.00$ support and 99000.00$ resistance.

Trend forecast: Bullish

The NZDUSD price forecast update 04-12-2024

The NZDUSD price shows more bearish bias to support the expectations of continuing the domination of the bearish trend on the intraday basis, reminding you that our next station is located at 0.5790$, while breaching 0.5935$ will stop the expected decline and lead the price to achieve more bullish correction on the intraday basis.

The expected trading range for today is between 0.5775 support and 0.5880$ resistance

Trend forecast: Bearish