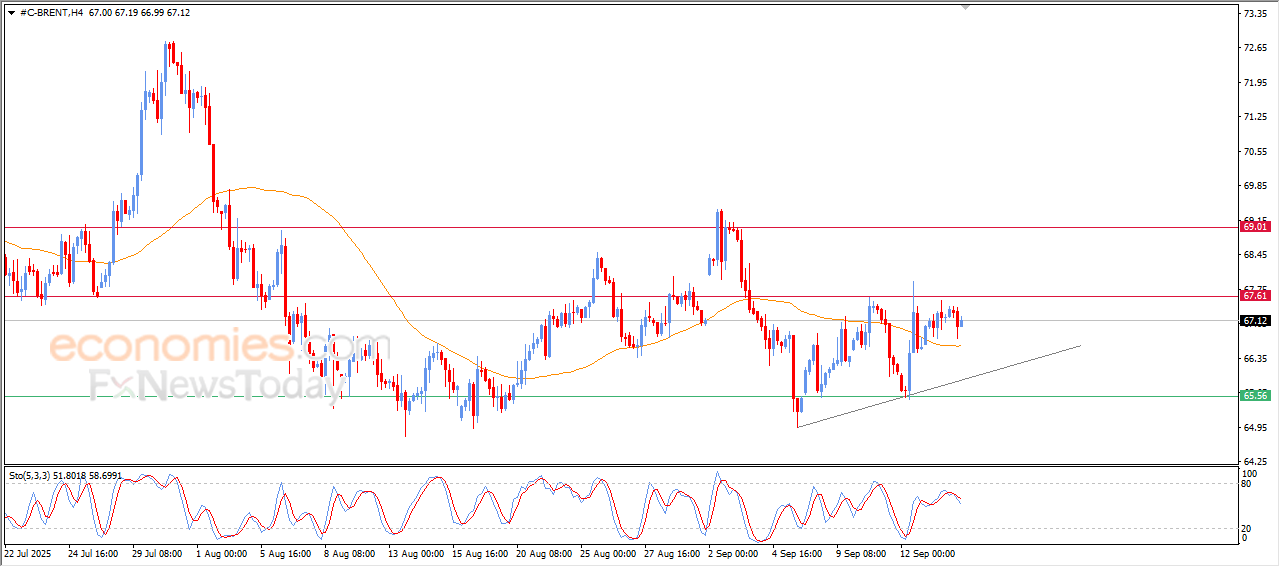

Forecast update for Brent crude oil -16-09-2025

AI Summary

- Brent crude oil prices have recently declined due to a dominant bearish trend on a short-term basis.

- Negative signals have emerged, reducing the chances of a price rise in the near future.

- The price settling below EMA50 confirms a negative outlook for Brent crude oil.

Crude oil prices settled with correctional decline on its last intraday levels, due to the stability of the critical resistance at $67.60, attempting to gain bullish momentum that might help it to offload its clear overbought conditions on the relative strength indicators, with the emergence of the negative signals, amid the dominance of bullish correctional wave on the short-term basis alongside supportive bias line, besides its trading above EMA50, reinforcing the chances for this recovery.

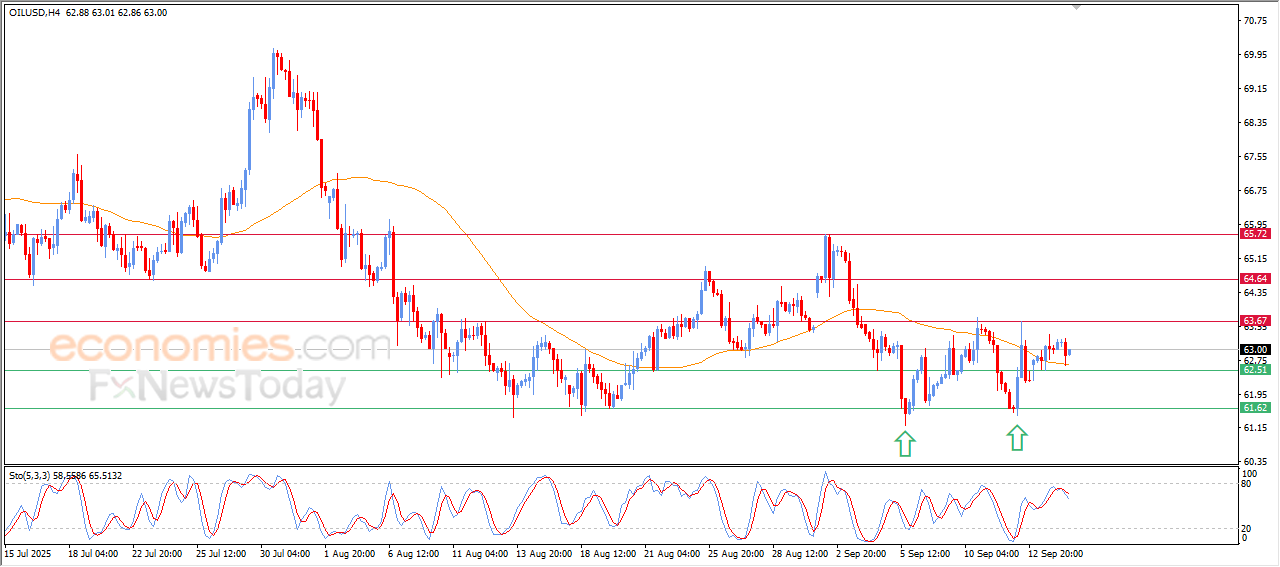

Forecast update for crude oil -16-09-2025

Crude oil prices declined in its last intraday trading, representing healthy sign for the price momentum to recover on the near-term basis, attempting to gain bullish momentum that might help it to attack the critical resistance at $63.65, and attempting to offload some of its clear overbought conditions on the relative strength indicators, especially with the emergence of the negative signals from there, leaning on the support of its EMA50, reinforcing the price ability to rise again.

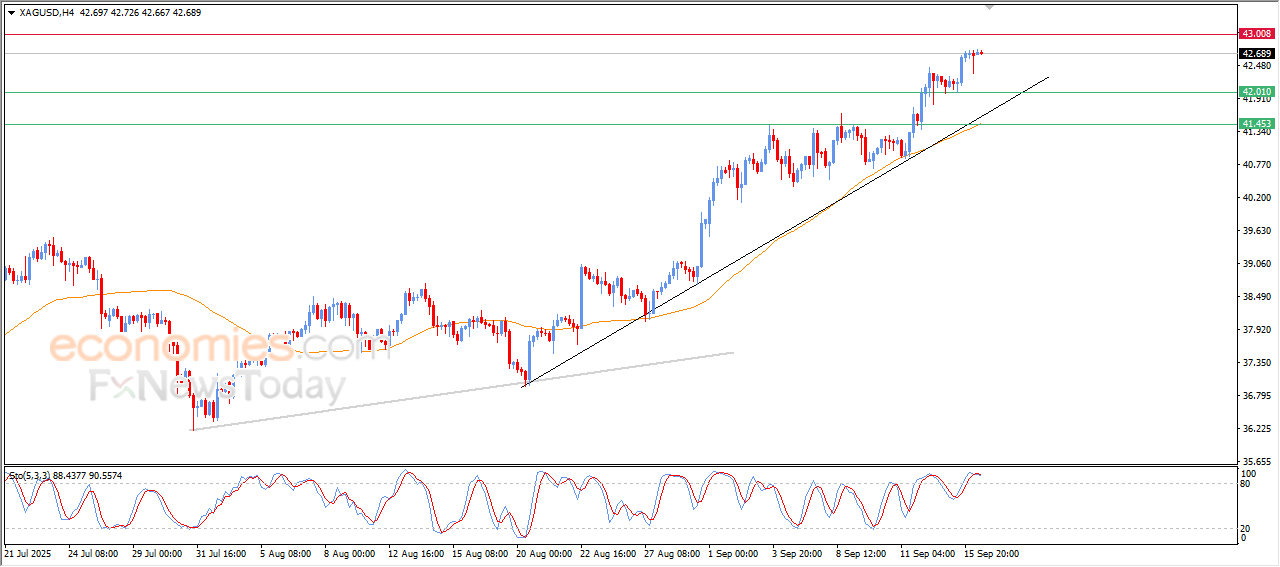

Forecast update for Silver -16-09-2025

The price of (Silver) witnessed fluctuated trading on its last intraday levels, amid its attempts to gain bullish momentum that might help it to recover and rise again, besides its attempt to offload some of its overbought conditioned on the relative strength indicators, especially with the emergence of negative overlapping signals, amid the dominance of the main bullish trend dominance on the short-term basis and its trading alongside supportive bias line, besides its trading above EMA50, reinforcing the chances for the price recovery on the near-term basis.

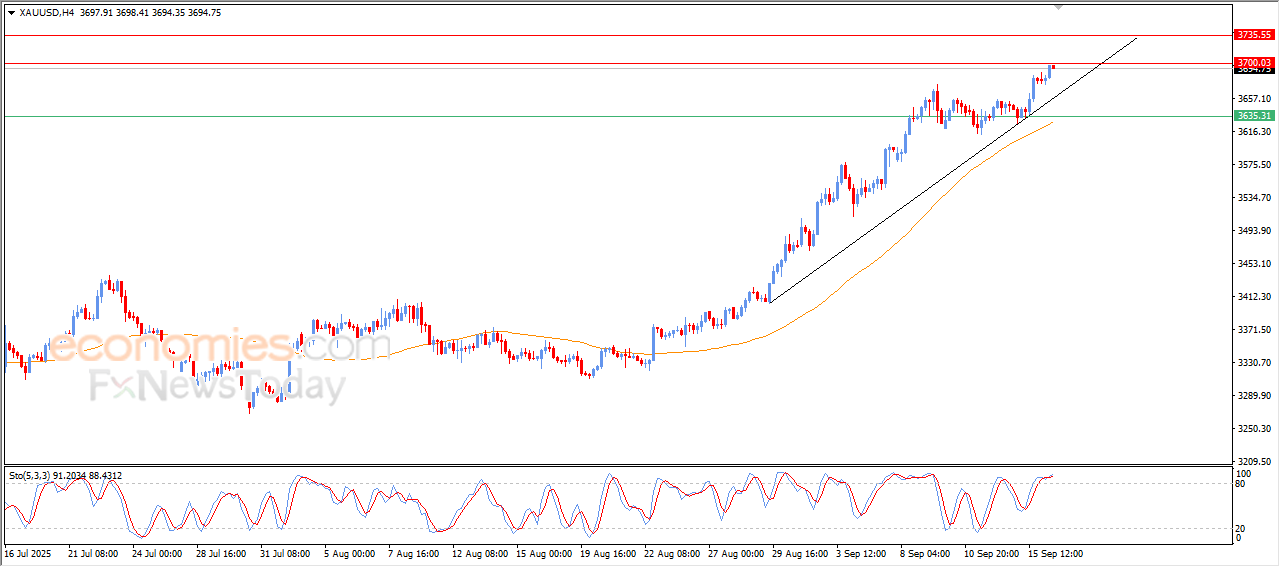

Forecast update for Gold -16-09-2025

The price of (Gold) reached new all-time highs on its last intraday levels, reaching our last suggested target at $3,700 resistance, depending on the continuous support from its trading above EMA50, and under the dominance of the main bullish trend and its trading alongside bias line, that indicates the strength and dominance of this track, besides the emerging of the positive signals from the relative strength indicators, despite reaching overbought levels.