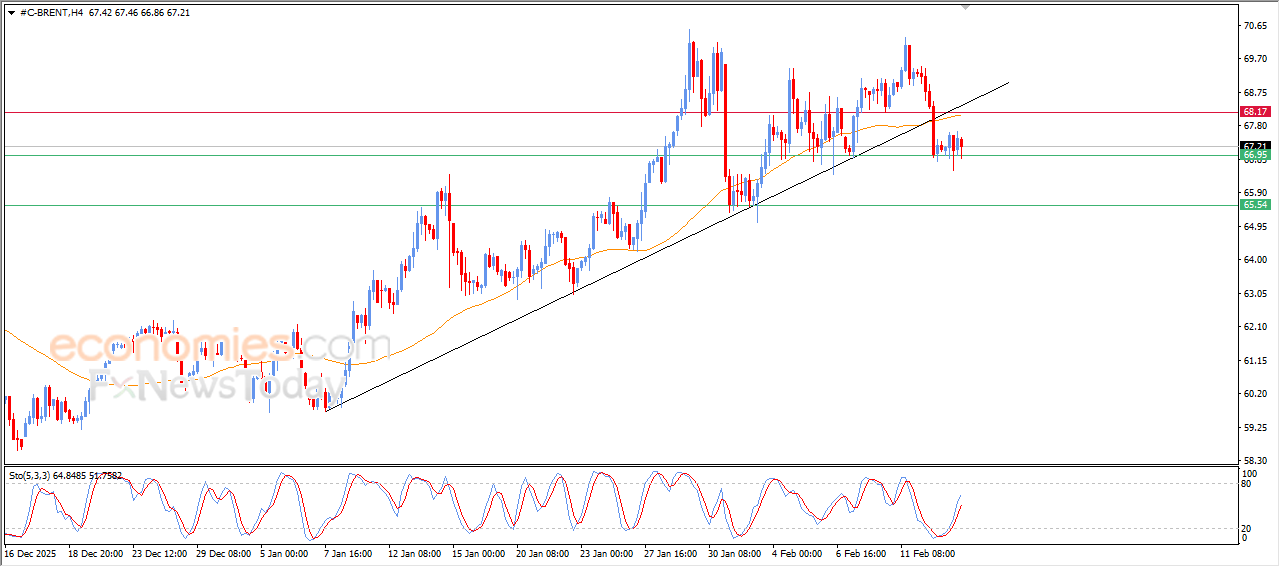

Forecast update for Brent -16-02-2026

Brent prices declined in their last intraday trading, amid fluctuated trading, supported by the stability of the current support at $66.95, taking advantage of the positive signals emergence from relative strength indicators, we notice entering exaggerated overbought levels compared to the price move, in a strong signal for the bullish momentum fading, affected by breaking main bullish trend line on short-term basis, with the continuation of the negative pressure due to its trading below EMA50, which reduces the chances of the price recovery on near term basis.

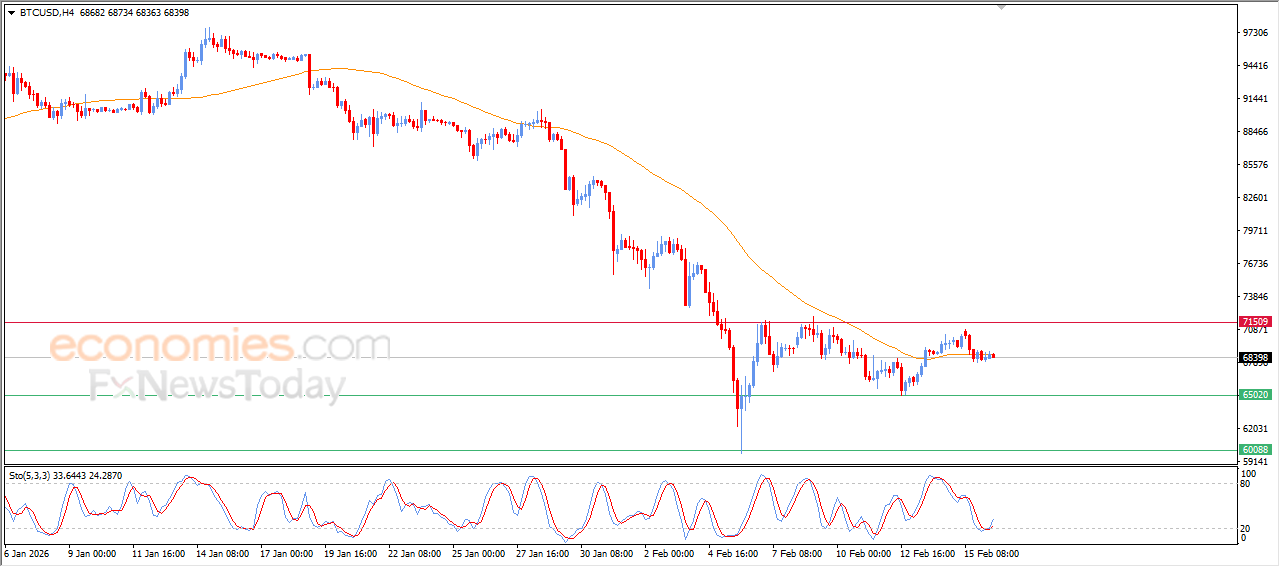

Forecast update for Bitcoin -16-02-2026

BTCUSD price moves in limited range on its last intraday levels, moving around EMA50’s levels, as a clear signals from looking for its upcoming track, affected by forming positive divergence on relative strength indicators, after reaching oversold levels, exaggeratedly compared to the price move with the emergence of positive signals from there, with the dominance of the main bearish trend on short-term basis.

Forecast update for crude oil -13-02-2026

The price of (crude oil) fluctuated in its last intraday levels, benefiting from the positive signals from relative strength indicators, which helped it to settle against the dynamic negative pressure due to its trading below EMA50, affected by breaking main bullish trend line on short-term basis.

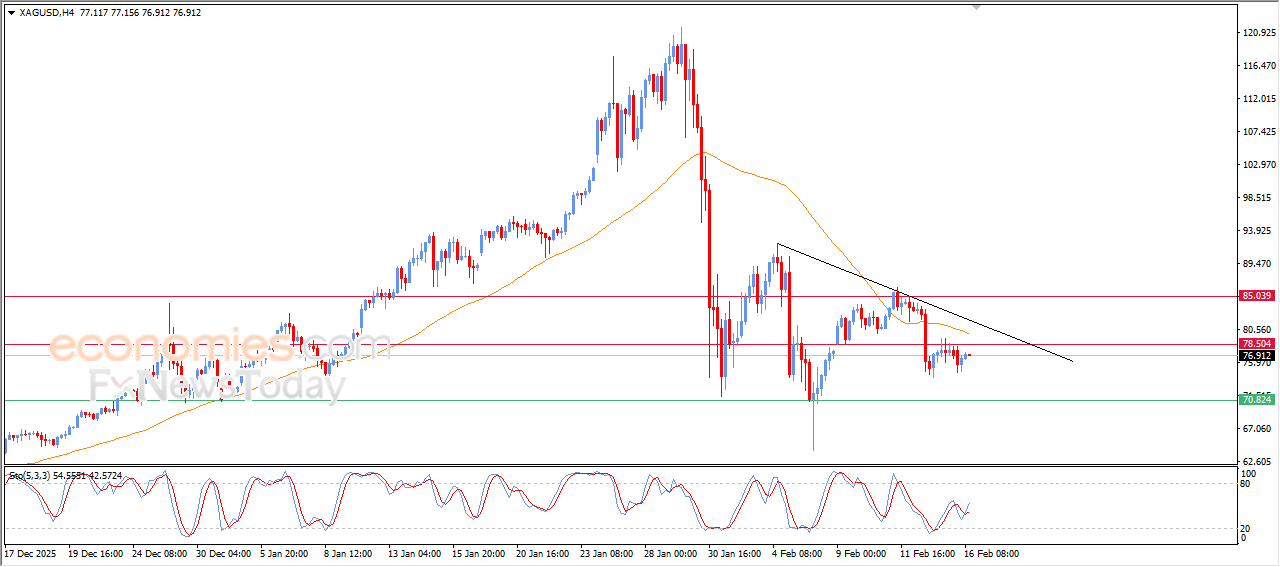

Forecast update for silver -13-02-2026

The price of (silver) rose slightly on its last intraday levels, supported by the positive signals emergence from relative strength indicators, however the price remains stable below $78.50 resistance, and under negative pressure due to its trading below its EMA50, reinforcing the stability and dominance of the bearish correction trend on short-term basis, especially with its trading alongside supportive trend line for this path.