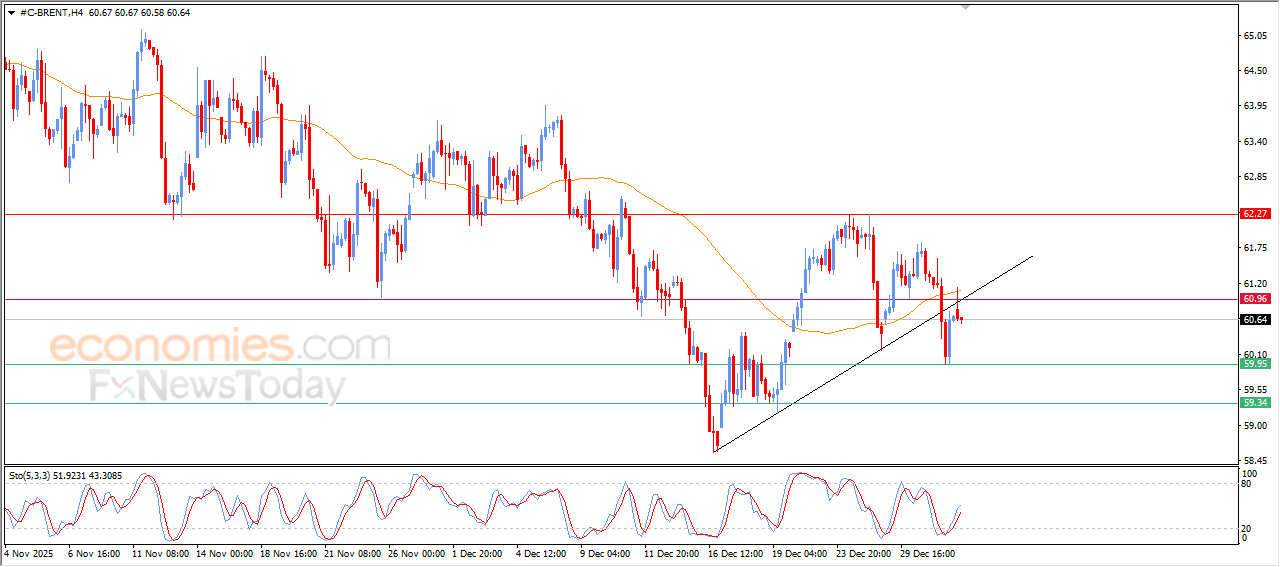

Brent crude oil surrenders to the negative pressure- Analysis- 05-01-2026

The (Brent) price declined in its last trading on the intraday levels, reaching the resistance of its EMA50, which put it under negative pressure that intensified by retesting the previously broken bullish corrective trend line on the short-term basis, especially with offloading its oversold conditions on the relative strength indicators, opening the way for recording more of the losses in the upcoming period.

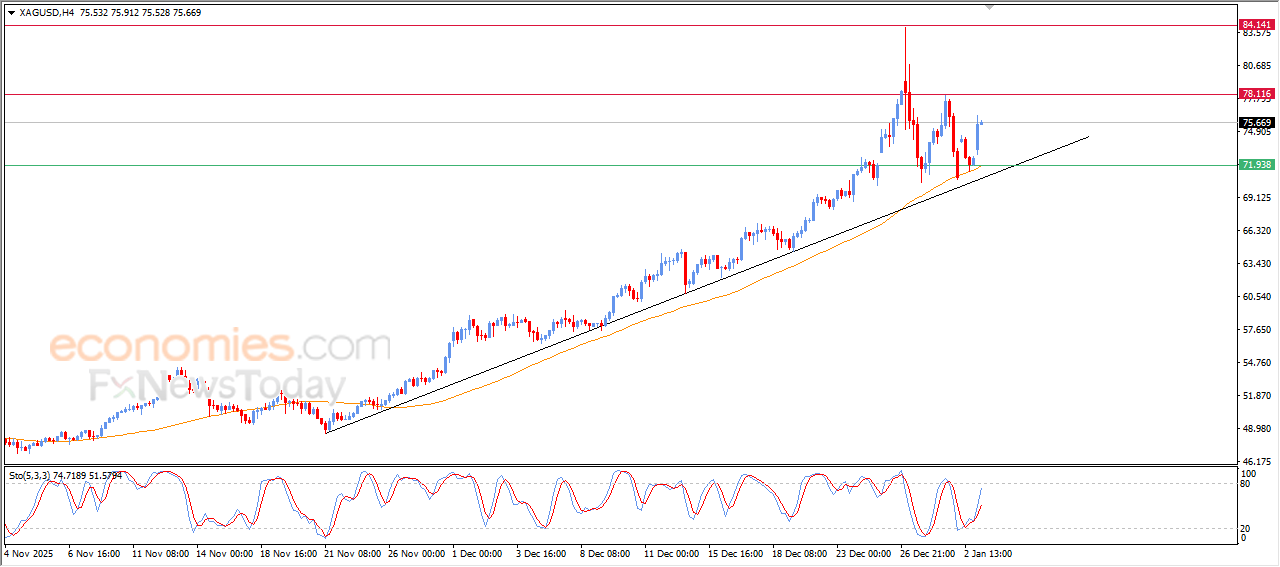

Silver price is amid bullish expectations- Analysis-05-01-2026

Silver price rose in its last intraday trading, due to its leaning on EMA50’s support, gaining bullish momentum that helped it to achieve these gains, especially with its moves alongside main bullish trend line on short-term basis, besides the emergence of bullish momentum from the relative strength indicators, after reaching oversold levels, which increases the chances of extending the gains on the intraday basis.

The USDCHF price is breaching strong resistance- Analysis-05-01-2026

The (USDCHF) price extended its gains on its last intraday levels, breaching the key resistance at 0.7925, amid the dominance of bullish corrective wave on the short-term basis, with its trading alongside supportive trend line for this trend, taking advantage of the dynamic support that is represented by its trading above EMA50, reinforcing the chances of expanding the gains on the near-term basis, especially with the emergence of the positive signals on the relative strength indicators, after offloading its overbought conditions, pushing it to rise.

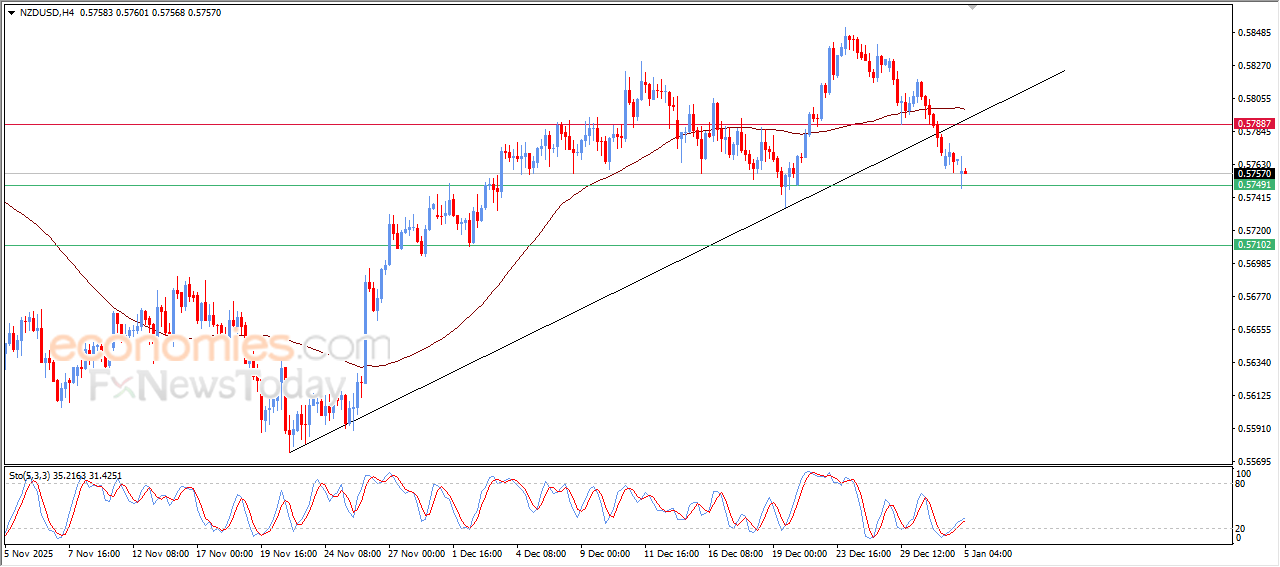

NZDUSD is reaching our expected target-Analysis-05-01-2026

The (NZDUSD) price settles on a decline in its last intraday trading, fluctuating due to its leaning in the key support of 0.5750, this support was our potential target in our previous analysis, with the effect of breaking main bullish trend lune on short-term basis, with the continuation of the negative pressure due to its trading below EMA50, on the other hand, we notice the emergence of the positive signals on the relative strength indicators, after reaching oversold levels, to help the pair to settle on the intraday basis due to its attempt to offload this oversold conditions.