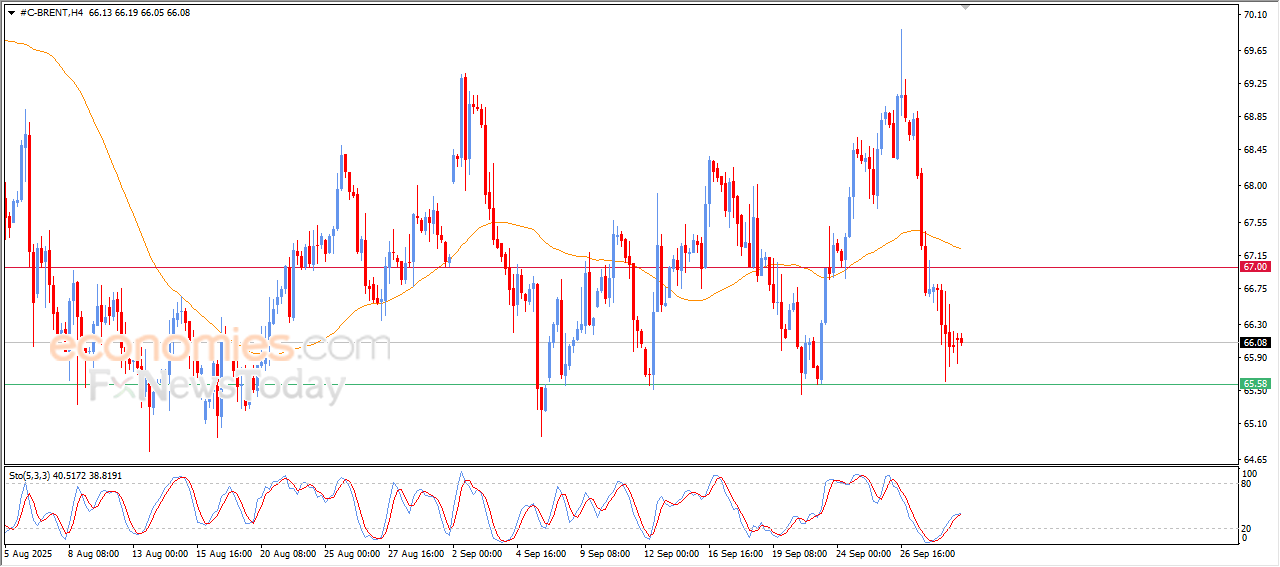

Brent crude oil shows more negative signs- Analysis-01-10-2025

AI Summary

- Brent crude oil is showing negative signs with fluctuated trading and clear oversold conditions, reducing chances for price recovery in the near-term basis

- BestTradingSignal.com offers high-accuracy trading signals for US stocks, crypto, forex, and VIP signals for gold, oil, forex, bitcoin, ethereum, and indices

- VIP Trading Signals Performance for September 22-26, 2025 can be viewed on the website, with subscription packages available for different markets.

The (Brent) price witnessed fluctuated trading on its last intraday levels, where it succeeded in offloading its clear oversold conditions on the relative strength indicators, these indicators began to show negative overlapping signs that intensifies the negative pressure around the price, amid the continuation of its trading below EMA50, reducing the chances for the price recovery on the near-term basis, under the dominance of steep bearish sub-wave on the short-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025:

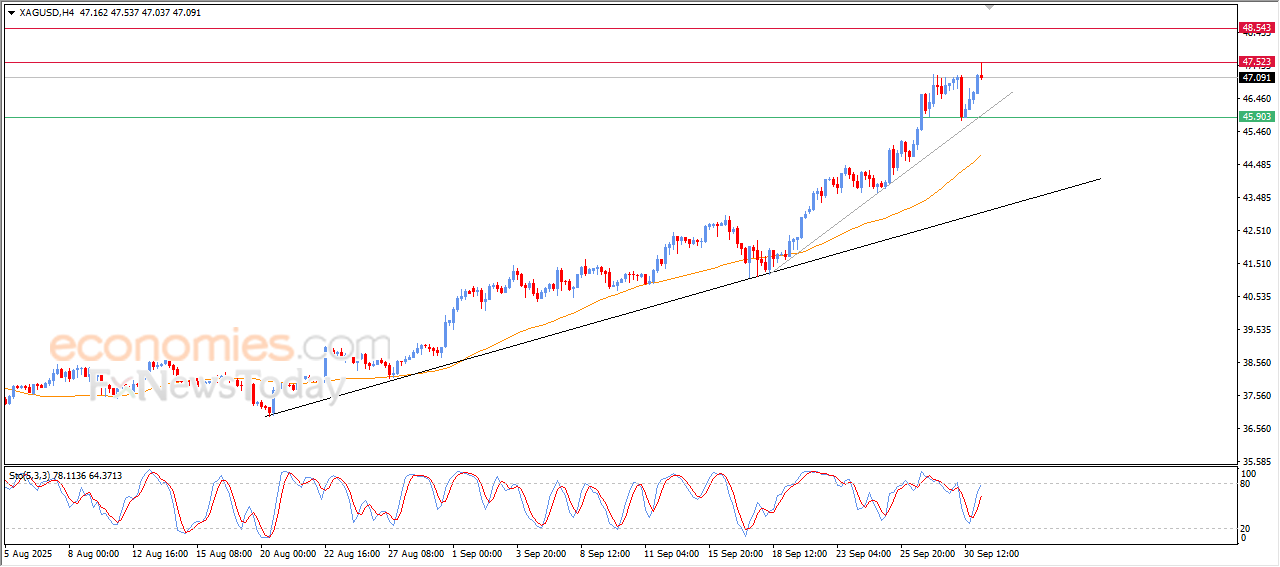

Silver Price reaches our expected target- Analysis-01-10-2025

The (silver) price settled high in its last intraday trading, reaching our last expected target at $47.50 resistance, the stability of this resistance reduced the price’s early gains in a quick attempt to gather the gains and gain the required positive momentum to breach this resistance, amid the continuation of the positive pressure due to its trading above EMA50, and under the dominance of the main bullish trend and its trading alongside main and minor trendlines on the short-term basis, with the emergence of the positive signs from the relative strength indicators after reaching oversold levels.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025:

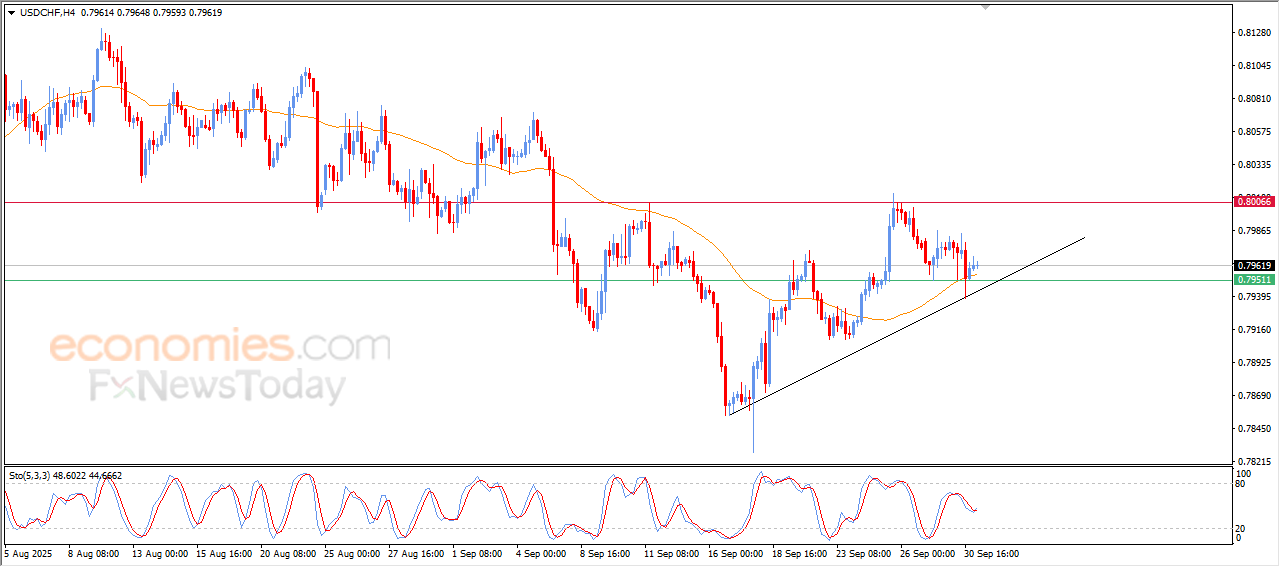

The USDCHF price is getting some support- Analysis-01-10-2025

The (USDCHF) price rose in its last intraday trading, due to its leaning on the support of EMA50, accompanied by its leaning on bullish correctional trend line on the short-term basis, which intensified the positive pressure, especially with the emergence of positive overlapping signals on the relative strength indicators, after its success in offloading its overbought conditions, opening the way for achieving new gains.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025:

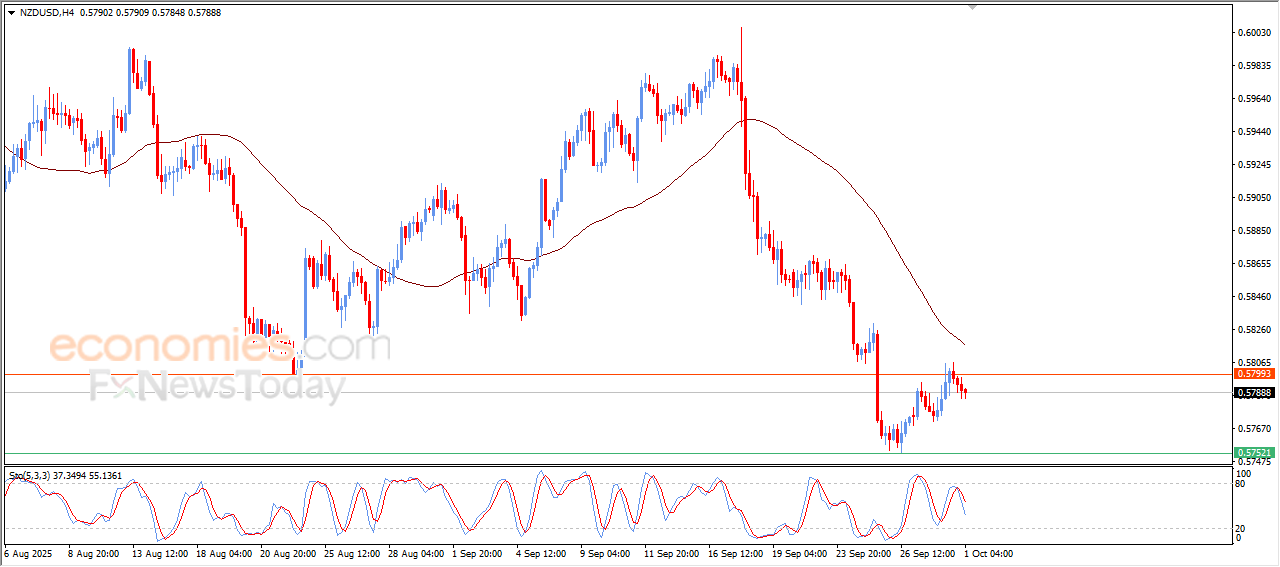

NZDUSD surrenders to the negative pressure-Analysis-01-10-2025

The (NZDUSD) price declined in its last trading on the intraday levels, affected by the stability of the critical resistance at 0.5800, putting it under negative pressure that intensified after forming negative divergence on the relative strength indicators, with the emergence of the negative signals, amid the continuation of its moves below EMA50, which represents a dynamic resistance that prevent the price recovery on the near-term basis, and under the dominance of the main bearish trend on the short-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025: