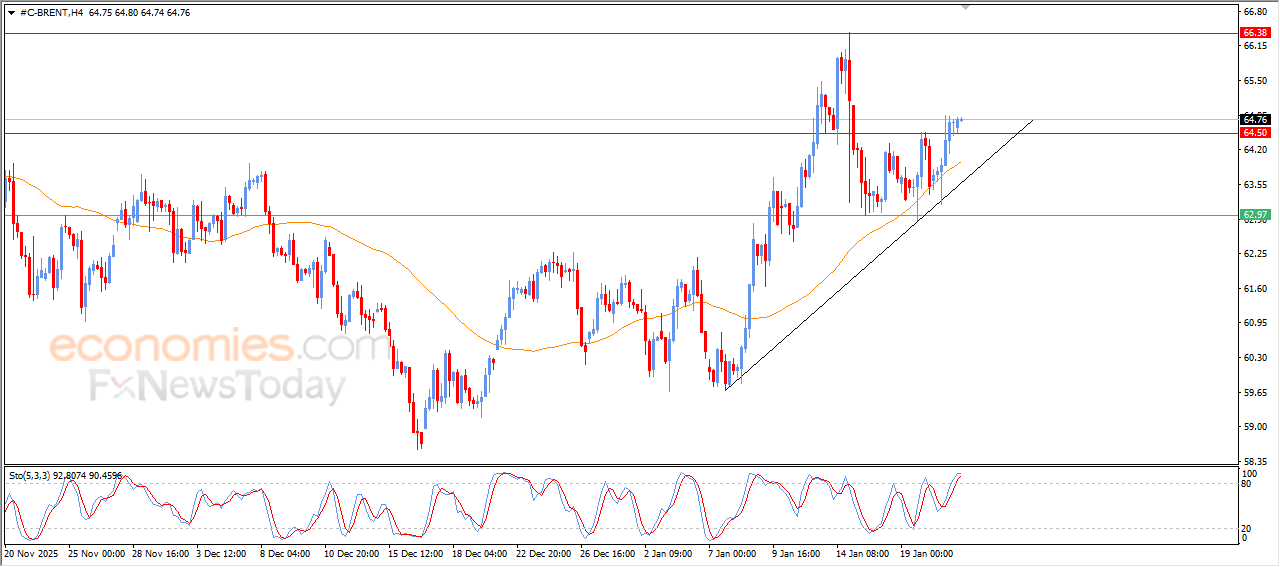

Brent crude oil is breaching significant resistance- Analysis- 22-01-2026

The (Brent) price extended its gains in its last intraday trading, breaching the key resistance at $64.50, affected by its trading alongside minor bullish trend line on short-term basis, with the continuation of the dynamic pressure in its trading above EMA50, reinforcing the chances of extending the gains in the upcoming period, especially with the positive signals on relative strength indicators, despite reaching overbought levels.

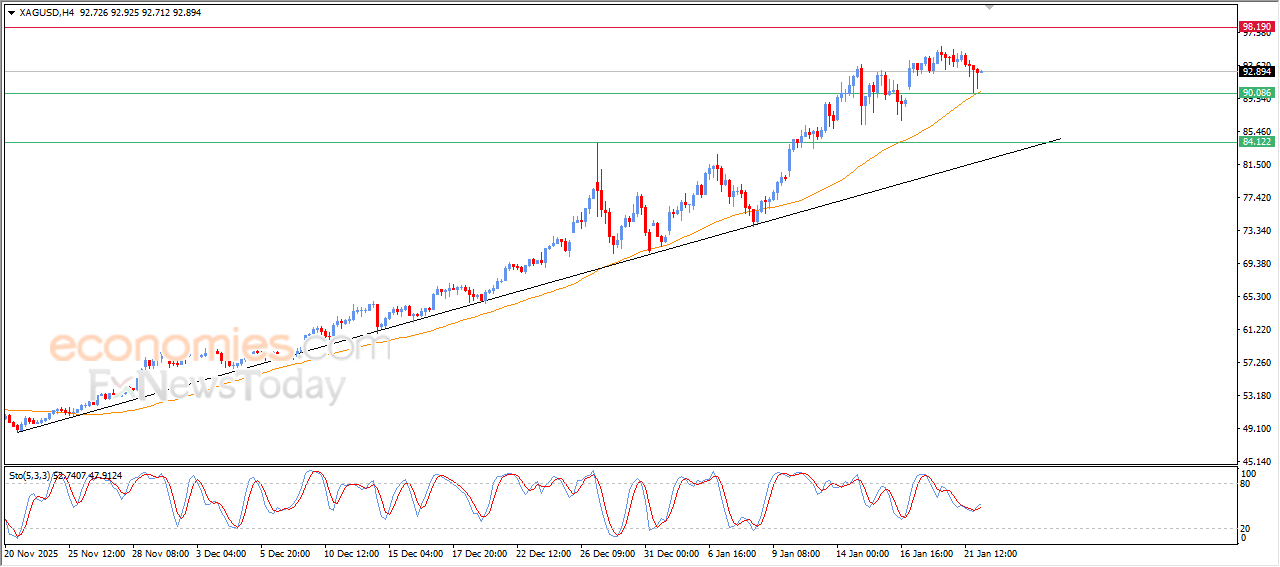

Silver Price is gathering bullish momentum- Analysis-22-01-2026

Silver prices are experiencing fluctuating trading on its last intraday levels, attempting to gain the required bullish momentum to recover and resume the rise again, where they settle on EMA50’s support, pushing it to rebound quickly to the upside, and indicates the strengths of this support to keep the price stability.

This comes amid the dominance of the main bullish trend on short-term basis, with the trading alongside supportive trend line for this trend, accompanied by the emergence of positive signals from relative strength indicators, after offloading its overbought conditions, opening the way for achieving more gains, to prefer targeting new historical levels on near-term basis.

Therefore, our expectations suggest a rise in silver prices in their upcoming intraday trading, conditioned by the stability above $90.00, to target $98.00 resistance.

The expected trading range is between $90.00 support and $98.00 resistance.

Today’s forecast: Bullish

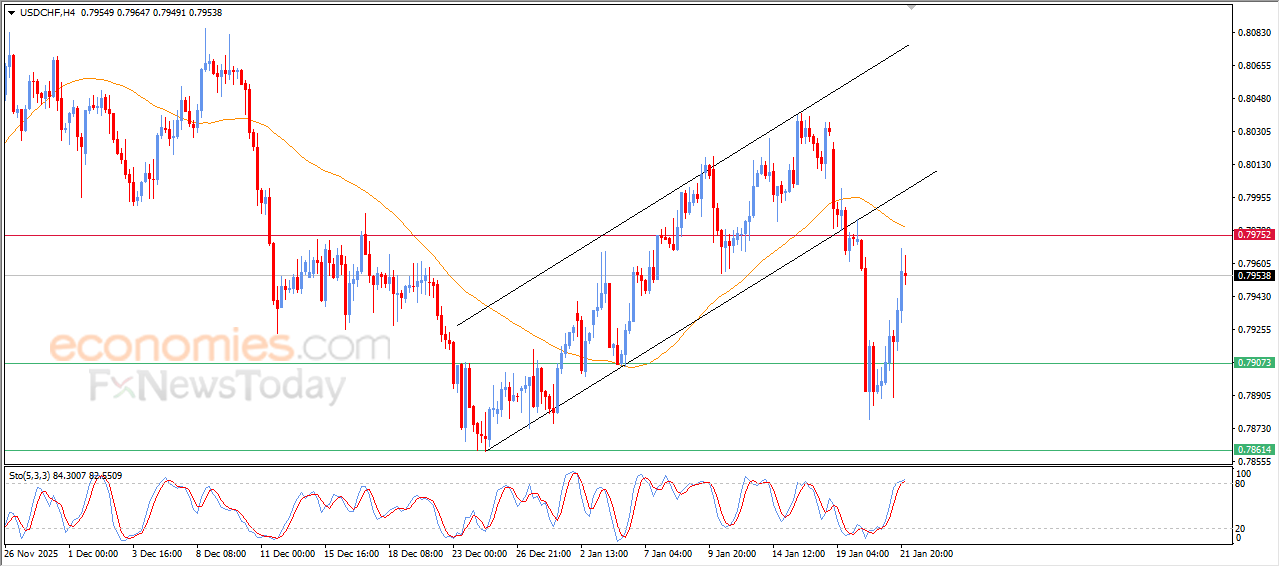

The USDCHF Price shows potential weakness signals- Analysis-22-01-2026

The (USDCHF) price settles on strong gains in its last intraday trading, amid the continuation of negative pressure due to its previous trading on short-term basis, besides the emergence of negative overlapping signals on relative strength indicators, after reaching overbought levels, which indicate a beginning to form negative divergence, indicating a fading to the surrounding bullish momentum.

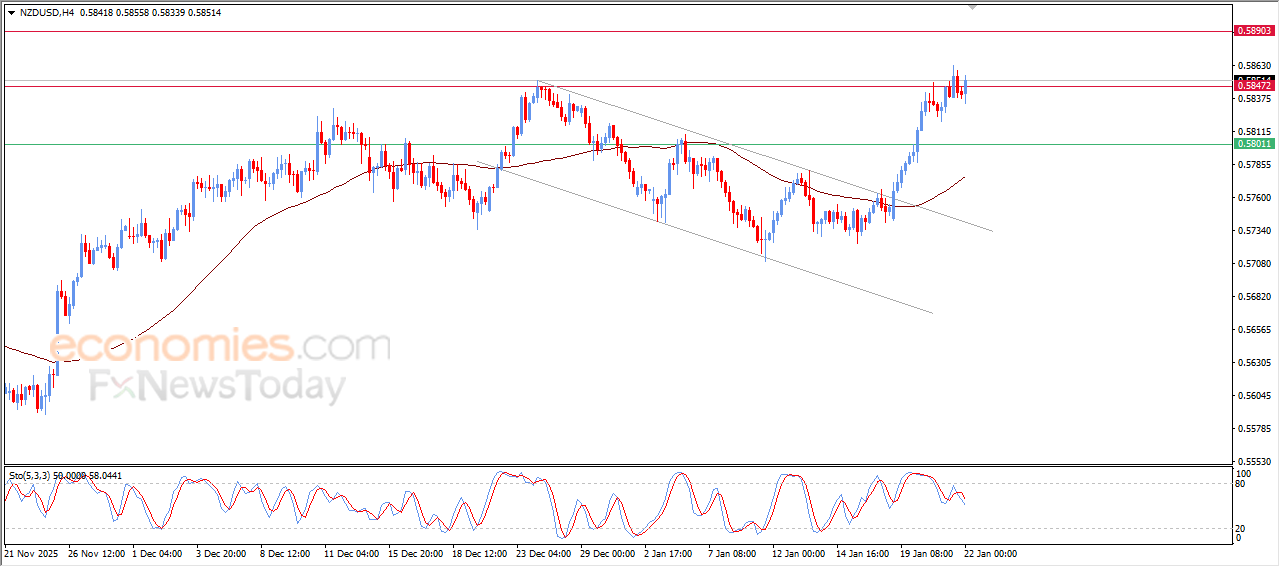

NZDUSD is reaching key resistance-Analysis-22-01-2026

The (NZDUSD) price rose in its last intraday trading, amid the attempts to breach the stubborn key resistance at 0.5845, supported by its continuous trading above EMA50, under the dominance of the main bullish trend on short-term basis, noticing that relative strength indicators reached oversold levels, indicating a likelihood of entering new bullish momentum that might push the price to extend its gains on near-term basis.