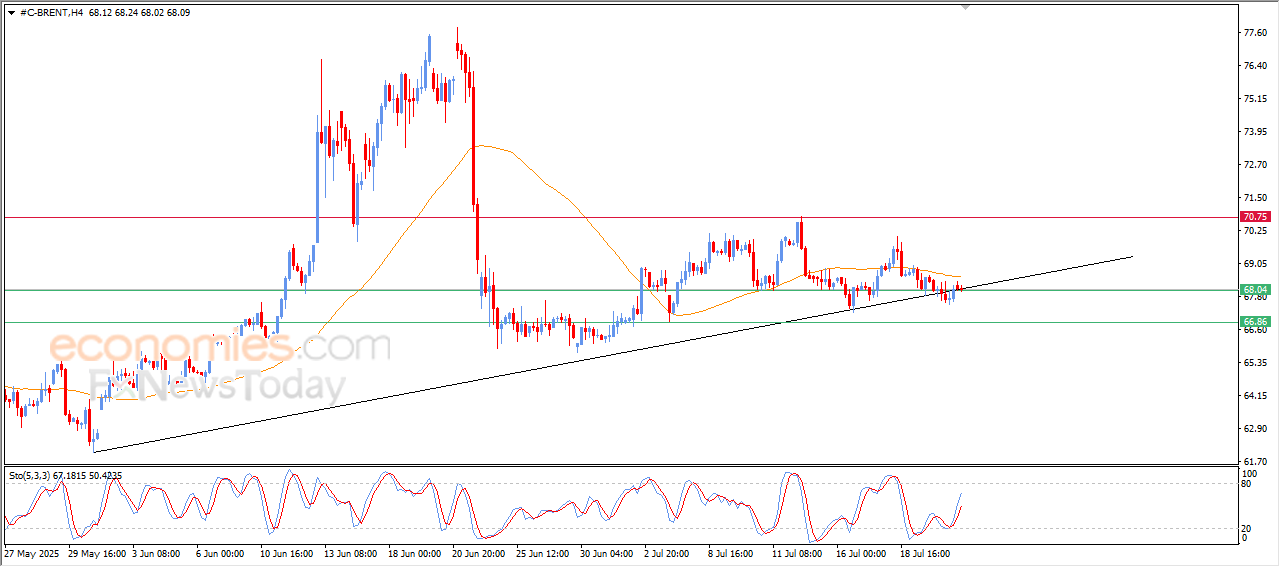

Brent crude oil begins to surrender to the negative pressure- Analysis-23-07-2025

AI Summary

- Brent crude oil price declined slightly after reaching resistance of EMA50 and RSI reaching overbought levels, indicating weakness in bullish momentum

- BestTradingSignal.com offers high-accuracy trading signals for US stocks, crypto, forex, and VIP signals for gold, oil, forex, bitcoin, ethereum, and indices

- Subscriptions available via Telegram with savings and value increasing with longer subscriptions; weekly performance reports also available

The (Brent) price declined slightly in its last intraday trading, after reaching the resistance of its EMA50, accompanied by retesting the main bullish trend line that was broken previously, besides the (RSI) reaching overbought levels, which indicates the weakness of the bullish momentum in the previous trading.

BestTradingSignal.com – Professional Trading Signals

High-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s most important markets – all powered by BestTradingSignal.com .

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramThe longer the subscription, the greater the savings and the more value you get.

Weekly performance report available here: Trading Signal Results – Week of July 14–18, 2025

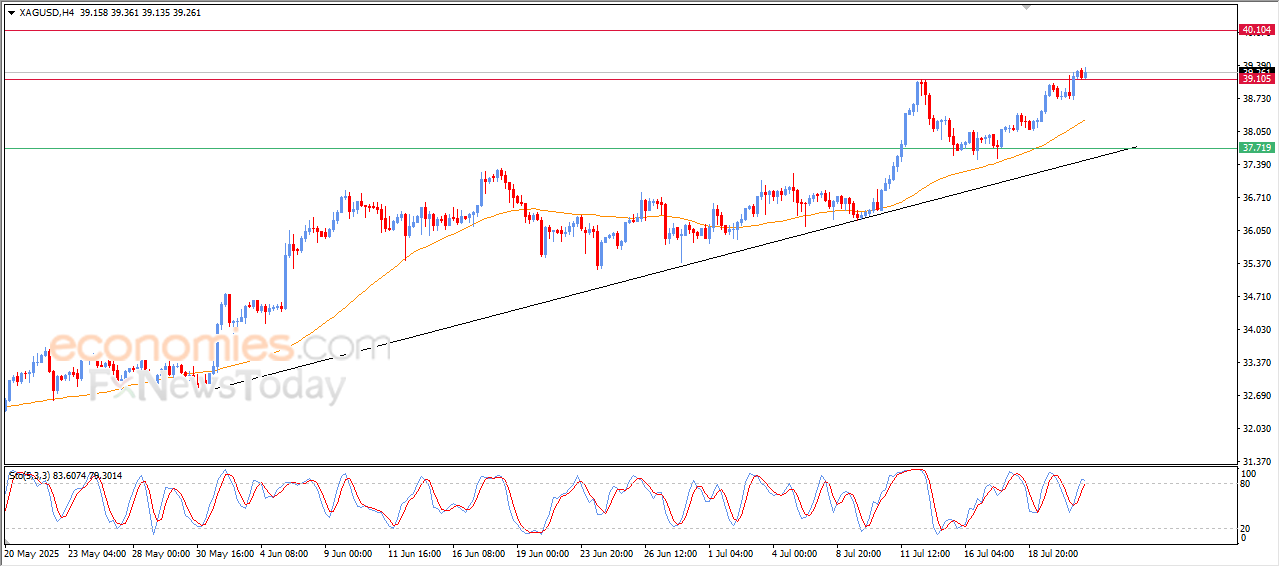

Silver price breaches critical resistance -Analysis-23-07-2025

The (silver) price rose in its last intraday trading, to confirm breaching the critical resistance level at $39.00, supported by its continuous trading above its EMA50, forming a dynamic support that assists the stability of the bullish trend, amid the dominance of the main bullish trend on the short-term basis and its trading alongside a supportive bias line for the trend, with the emergence of the positive signals on the (RSI).

BestTradingSignal.com – Professional Trading Signals

High-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s most important markets – all powered by BestTradingSignal.com .

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramThe longer the subscription, the greater the savings and the more value you get.

Weekly performance report available here: Trading Signal Results – Week of July 14–18, 2025

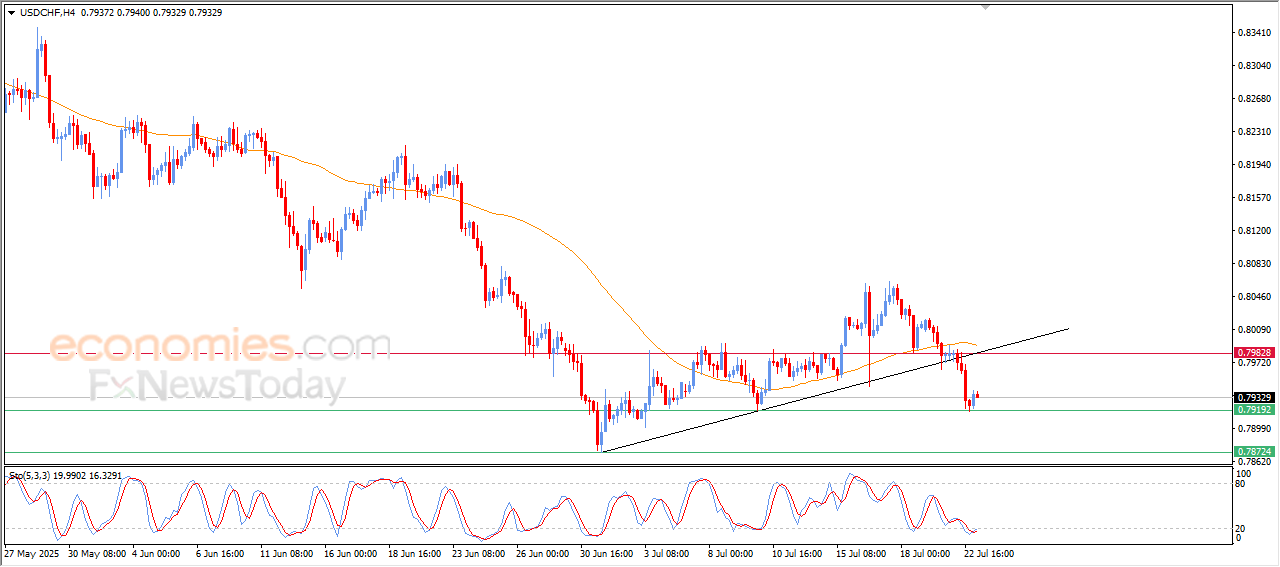

The USDCHF is attempting to recover some of its losses -Analysis-23-07-2025

The (USDCHF) price rose in its last intraday trading, due to the stability of the support level at 0.7920, this support represents our yesterday’s target, which provided some bullish momentum, to attempt to offload some of its clear oversold conditions on the (RSI), especially with the beginning of positive overlapping signals appearance on it. The price is attempting to recover some of its previous losses, amid its affection by breaking bullish correctional trend line on the short-term basis.

BestTradingSignal.com – Professional Trading Signals

High-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s most important markets – all powered by BestTradingSignal.com .

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramThe longer the subscription, the greater the savings and the more value you get.

Weekly performance report available here: Trading Signal Results – Week of July 14–18, 2025

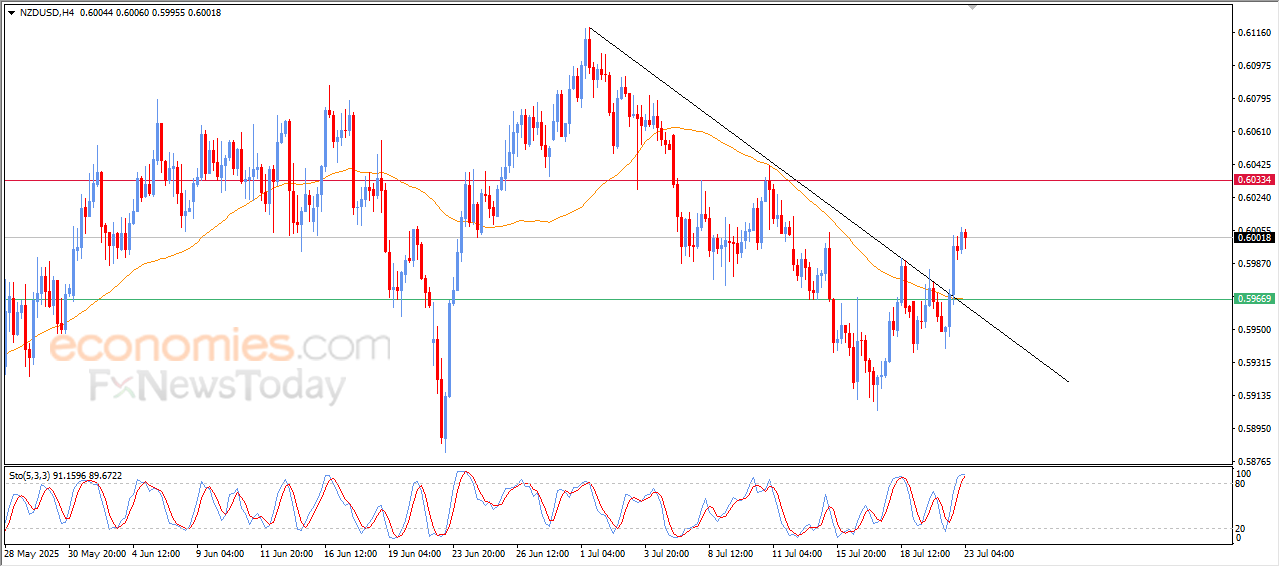

NZDUSD is getting rid of its negative pressure -Analysis-23-07-2025

The (NZDUSD) price rose in its last intraday trading, affected by breaching bearish correctional trend line on the short-term basis, accompanied by surpassing the negative pressure of the EMA50, announcing its full recovery, on the other hand, we notice the beginning of negative overlapping signals on the (RSI) after reaching overbought levels, which might reduce the upcoming gains.

BestTradingSignal.com – Professional Trading Signals

High-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s most important markets – all powered by BestTradingSignal.com .

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramThe longer the subscription, the greater the savings and the more value you get.

Weekly performance report available here: Trading Signal Results – Week of July 14–18, 2025