Will the German DAX Index reach the 20,000-point milestone for the first time in history?

Amid a positive atmosphere dominating the majority of European stock markets, the German DAX Index continues to record new all-time highs, approaching the 20,000-point barrier for the first time in history.

On Tuesday, October 15, 2024, the index reached its highest level ever, boosting its gains amidst growing optimism about the stability of the European economy and positive expectations for the performance of major German companies.

This positive momentum reflects the markets' response to recent economic developments and investors' focus on capitalizing on the available investment opportunities under the current monetary policies of the European Central Bank.

Lowering European Interest Rates

Investors in Europe are preparing for the third cut in European interest rates in 2024, which is expected in the upcoming meeting of the European Central Bank's monetary policy committee later this week.

This potential cut comes as part of the European Central Bank's efforts to continue supporting the eurozone economy in the face of economic challenges.

There is no doubt that lowering interest rates by the European Central Bank usually has a positive impact on European stock markets.

A rate cut reduces borrowing costs for companies, boosting growth prospects and increasing profits, which encourages investors to buy stocks.

In addition, lowering interest rates supports liquidity in financial markets, increasing investors' risk appetite.

Furthermore, this may lead to a weakening of the euro, enhancing exports and increasing the attractiveness of European stocks to global investors.

European Central Bank

In the September meeting, the European Central Bank continued to lower interest rates by 25 basis points on deposit rates, bringing them down to 3.5%. This step followed a similar move in the June meeting, with a pause in July.

ECB President Christine Lagarde confirmed that future decisions would depend on economic data, adopting a "meeting by meeting" approach, which has eased expectations of another cut in October.

However, the recent weak growth data from Europe and easing inflationary pressures have emphasized the need for further monetary easing.

The eurozone interest rate market estimates a 100% probability that the ECB will cut interest rates by 25 basis points at this week's meeting.

The ECB is expected to lower rates by another 25 basis points in its December meeting, which is likely to see the deposit rate close at 3% by the end of the year.

20,000 Point Barrier

If the ECB's comments this week are more pessimistic than currently expected, it is likely that the chances of the ECB continuing its long cycle of monetary easing will increase.

This trend could attract more investment liquidity, allowing investors to seize opportunities in European markets.

As a result, the German DAX Index is expected to continue breaking its record highs, with the possibility of trading above the 20,000-point barrier for the first time in history before the end of this year.

About the DAX Index

The German DAX Index, also known as "DAX," is the main stock market index in Germany and includes 40 of the largest companies listed on the Frankfurt Stock Exchange.

DAX is a key measure of economic performance in Germany and Europe in general, representing more than 80% of the market value of German companies.

The DAX Index was established in 1988, and its value is calculated based on the market capitalization of its constituent companies, with continuous adjustments to weights based on company performance.

The index covers a wide range of sectors, including automobiles, chemicals, and technology, reflecting the strong diversity of the German economy.

How Important is DAX?

The DAX Index (DAX) is important for several reasons:

- A Measure of the German Economy: Since it includes the largest German companies across various sectors such as industry, technology, and automobiles, DAX directly reflects the health of the German economy, "the largest economy in the eurozone."

- A Global Index: DAX is not just a local index; it is a global index closely monitored by investors around the world. Any significant change in DAX can affect global financial markets.

- An Investment Tool: Investors use the DAX Index as an investment tool, as they can buy exchange-traded funds (ETFs) that track DAX performance or invest directly in the companies that make up the index.

What Are the Components of DAX?

The DAX Index (DAX) consists of 40 large German companies, representing various sectors such as:

- Automobiles: Volkswagen, Daimler, BMW.

- Technology: SAP, Berlin.

- Energy: BP.

- Industry: Siemens.

- Finance: Deutsche Bank.

Top Companies Currently Listed in the DAX Index

- Volkswagen - One of the largest car manufacturers in the world.

- Daimler - Produces Mercedes Benz cars.

- Siemens - A giant in technology and engineering.

- SAP - A leader in enterprise resource planning software.

- Deutsche Bank - One of the largest banks in Germany.

- Bayer - A multinational company in pharmaceuticals and chemicals.

- Commerzbank - A prominent bank offering a variety of financial services.

Factors That Affect the DAX Index

The DAX Index is an important indicator of the health of the German economy and is influenced by several factors, including:

- 1. Economic Performance: Growth in Germany and the eurozone has a significant impact on the DAX Index.

- 2. Monetary Policy: Decisions by the European Central Bank on interest rates and quantitative easing affect liquidity flows.

- 3. Geopolitical Tensions: Political and economic events globally, especially in Europe, can lead to market fluctuations.

- 4. Euro Exchange Rate: Fluctuations in the euro against other currencies, especially the US dollar, can affect European export companies.

- 5. Corporate Earnings: Corporate earnings reports and future expectations directly impact stock prices and, therefore, the index.

Key Price Levels for the DAX Index

• November 1974: The DAX Index recorded its all-time low at 372 points.

• October 2024: The DAX Index recorded its all-time high at 19,634 points.

Best Performance of the DAX Index in History

• In 1985: The DAX Index recorded its best annual performance ever with a 66% increase.

Worst Performance of the DAX Index in History

• In 1999: The DAX Index recorded its worst annual performance ever with a 44% drop.

Key Predictions for the DAX Index in 2024

- Deutsche Bank: The bank predicts that the DAX Index will reach 20,250 points by the end of 2024 and 21,000 points in 2025.

- JP Morgan: The group expects the DAX Index to reach 20,500 points by the end of 2024.

- Goldman Sachs: The bank expects the DAX Index to reach 20,200 points by the end of 2024.

Factors Influencing DAX Index Forecasts

Several factors can influence DAX forecasts. Below is an overview of the most important factors:

Macroeconomics:

• Economic Growth: Strong growth in the European economy in general and the German economy boosts the performance of companies listed on the DAX Index, pushing the index higher.

• Labor Market: Lower unemployment rates and increased job opportunities can contribute to higher consumption and economic growth, benefiting DAX-listed companies.

• Inflation: Moderate inflation can be positive as it reflects economic growth, while high inflation can lead to higher interest rates, increasing borrowing costs and putting pressure on corporate profits.

European Central Bank Monetary Policies:

• Interest Rates: Rising interest rates increase borrowing costs for companies and individuals, which can slow down economic growth and pressure corporate earnings. Conversely, lowering interest rates stimulates spending and investment.

• Quantitative Easing Programs: Quantitative easing measures, which involve the European Central Bank purchasing financial assets, can increase liquidity in markets and boost stock prices.

Government Fiscal Policies:

• Government Spending: Increased government spending on infrastructure and services ("expansionary policy") can strengthen the economy and lead to an increase in the DAX Index.

• Tax Policies: Lowering corporate taxes boosts profits and attracts investments, while raising taxes can have the opposite effect on the performance of DAX-listed companies.

Geopolitical Situations:

• International Tensions: Trade disputes, such as those between Europe and the United States, can lead to significant market fluctuations. Economic sanctions and geopolitical crises can also affect investor confidence.

• Policy Stability: Political stability and clear expectations for government policies enhance investor confidence and support the market.

Performance of Major Companies:

• Earnings and Financial Reports: The performance of companies listed on the DAX Index directly affects the index. Strong earnings reports and revenue growth boost stock values and the index as a whole.

• Future Expectations: Positive expectations for future company performance boost investor confidence.

Market and Investor Trends:

• Psychological Factors: Investor confidence and expectations play a major role in market movement. Good and bad news can lead to significant fluctuations.

• Technical Trading: Technical analysis and market trends, such as support and resistance levels, can influence daily trading decisions.

Innovation and Technology:

• Technological Innovation: Leading technological sectors, such as major tech companies listed in DAX, can drive the index higher due to innovation and rapid growth.

• Investment in R&D: Increased investment in research and development boosts the growth of technology companies listed on the DAX Index.

Unexpected Events:

• Natural Disasters and Pandemics: Unexpected events like natural disasters or pandemics can cause significant market fluctuations, especially in the German financial markets as the largest in the eurozone.

• Global Economic Events: Economic crises in other parts of the world can affect German markets in Frankfurt due to global economic interdependence.

Common Questions About the DAX Index

Is the Current DAX Level Suitable for Investment?

The DAX Index is trading near its all-time highs above 19,500 points, coming close to reaching the 20,000-point barrier and the 20,500 target predicted by major institutions and global banks. We believe that investing in the DAX Index at these levels does not involve high risk.

That risk decreases significantly if the European Central Bank shows determination to implement multiple rate cuts this year while controlling inflation and high prices.

How to Invest in the DAX?

There are several ways to invest in the DAX:

- 1. Investing through Exchange-Traded Funds (ETFs): ETFs are financial instruments that track the performance of a specific index, and in this case, they track the DAX Index.

- 2. Investing in Individual Stocks of DAX-Listed Companies: Instead of investing in a fund that tracks the entire index, you can purchase individual stocks of the companies that make up the DAX Index.

- 3. Investing in Mutual Funds: Some mutual funds "managed by financial professionals" primarily invest in the stocks that make up the DAX Index.

- 4. Futures and Options: For more experienced investors, futures and options can be used to invest in the DAX Index.

Will the DAX Index Reach 20,000 Points?

In light of recent economic developments in the United States, it is not entirely unlikely that the DAX Index will continue its upward movement toward 20,000 points this year, with the potential to surpass this level strongly in the coming years.

Will the DAX Index Rise in 2024?

Yes, the DAX Index is expected to continue rising this year. Most forecasts from major institutions, banks, and experts suggest a bullish market for the index as it approaches the 20,000-point barrier, followed by 21,000 points.

Will the DAX Index Crash in 2024?

It is unlikely that the DAX Index will crash this year, especially since it includes only high-quality companies with strong ties to the performance of the U.S. economy. If the performance of these companies weakens, they are immediately replaced in the index by stronger ones.

Best DAX Trading Platforms for 2024

- Pepperstone, the best DAX trading broker. Trusted for beginners. Established 2010. Minimum deposit: $0. Deposit and withdrawal options available through Mashreq Bank.

- XM, the best platform for trading the German stock market index. Established 2009. Minimum deposit: $5.

- Plus500, the best licensed brokerage firm for trading the German DAX stock index. Established 2008. Minimum deposit: $100.

Compare the Best DAX Trading Brokers (DAX Index)

| Broker | Trade | Analyst Forecast for DAX Prices in 2025 | Special Features | Regulation | Account Types | Leverage for DAX | Spread for DAX | Minimum Deposit | Islamic Account for DAX | Trust Rating |

|---|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | Trade | 21,000 | Fast execution, tight spreads on DAX | ASIC, FCA, DFSA, SCB | Standard, Razor | Up to 1:500 | From 0.1% | $0 | Yes | 9.5/10 |

| XM | Trade | 21,000 | Loyalty program, negative balance protection | IFSC, CySEC, ASIC | Micro, Standard, Zero, Ultra | Up to 1:888 | From 0.2% | $5 | Yes | 9/10 |

| Plus500 | Trade | 21,000 | Commission-free trading, easy-to-use platform | FCA, CySEC, ASIC, FMA | Retail, Professional | Up to 1:30 | From 0.3% | $100 | No | 8.5/10 |

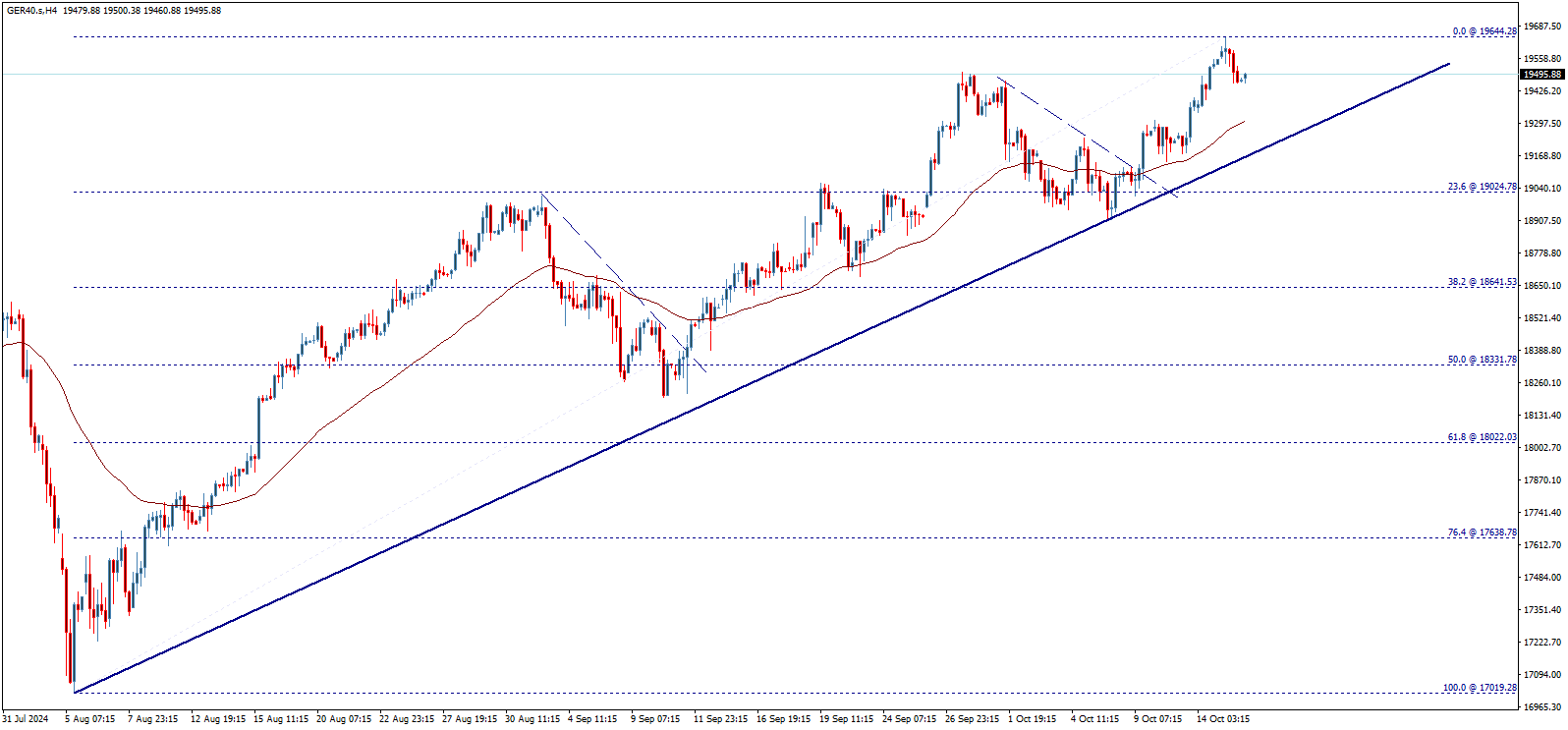

Technical Analysis of the German DAX Index (DAX Index)

By studying the weekly chart of the German index, we find that the index started a long-term upward wave at the beginning of 2009. Since the end of the first quarter of 2020, the index has embarked on a strong upward wave, continuously recording new historical levels, reaching the current areas around 19,490.00.

The index moved within an upward channel that helped achieve strong increases. This channel has additional positive targets that extend to areas of 21,340.00 in the short and medium term, supported by the 50-moving average that continues to carry the index from below and reinforces expectations for continued upward momentum.

On the daily time frame, we find that the index is moving within a secondary upward channel, with its next target located at 20,125.00. The index may need to make a downward correction from these areas to test the support of the mentioned channel around 17,380.00 before resuming its rise.

The intraday trades show signals indicating a temporary downward correction before resuming the rise. The index may head towards testing areas of 19,025.00 and relying on them before continuing the expected main upward trend.

The Stochastic indicator shows negative signals on various time frames, enhancing the chances of some downward correction in the upcoming period before resuming the upward momentum.

In general, the expected main trend remains upward, and the following targets start at 20,125.00 and extend to 21,340.00 after surpassing the previous level. It is important to note that breaking the 19,000.00 barrier may force the index to conduct additional downward corrections and head towards testing areas of 18,330.00, which could extend to 17,265.00 before any new attempt to resume the primary upward trend.

Brent oil price forecast update 16-10-2024

Brent oil price shows negative trades after the temporary rise that it witnessed in the previous sessions, to support the continuation of the expected bearish trend for today, which its targets begin by breaking 73.90$ to open the way to rally towards 72.06$ as a next main station.

Stochastic overlaps negatively to support the expectations to decline for the rest of the day, reminding you that the continuation of the bearish wave conditions holding below 75.36$ and 75.60$ levels.

The expected trading range for today is between 73.20$ support and 76.20$ resistance.

Trend forecast: Bearish

Crude oil price forecast update 16-10-2024

Crude oil price attempts to break 70.58$ level now, to keep the chances valid to continue the expected negative scenario for today, reminding you that we are waiting to visit 68.65$ as a next main target, affected by the double top pattern that appears on the chart, reminding you that the continuation of the bearish wave depends on the price stability below 72.15$.

The expected trading range for today is between 69.20$ support and 72.20$ resistance

Trend forecast: Bearish

Silver price forecast update 16-10-2024

Silver price surpassed 31.70$ level to confirm the continuation of the bullish trend domination for the rest of the day, reminding you that our next target is located at 32.50$, to continue suggesting the bullish trend in the upcoming sessions, supported by moving above the EMA50, reminding you that the continuation of the bullish trend requires holding above 31.00$.

The expected trading range for today is between 31.30$ support and 32.10$ resistance.

Trend forecast: Bullish