The GBPJPY without any change– Forecast today – 8-9-2025

AI Summary

- GBPJPY pair remains affected by sideways bias, with bearish correctional suggestion valid

- Price may reach 198.60 with extra support near 197.85, or resume bullish attack to reach 200.90 and 202.45

- Expected trading range for today is between 198.65 and 200.30, with a bearish trend forecasted

The GBPJPY pair remains affected by the dominance of the sideways bias, due to the contradiction between the positivity of the main indicators against the stability of the barrier at 200.40, fluctuating within tight range without recording any of the waited correctional targets.

In general, the bearish correctional suggestion remain valid depending on the stability of the current barrier, to expect reaching 198.60, pressing on the extra support near 197.85, while the price success by breaching the barrier and holding above it will open the way for resuming the bullish attack, to achieve new gains by reaching 200.90, then targeting 161.8% Fibonacci extension level near 202.45.

The expected trading range for today is between 198.65 and 200.30

Trend forecast: Bearish

The (ETHUSD) is showing mixed signals- Analysis- 08-09-2025

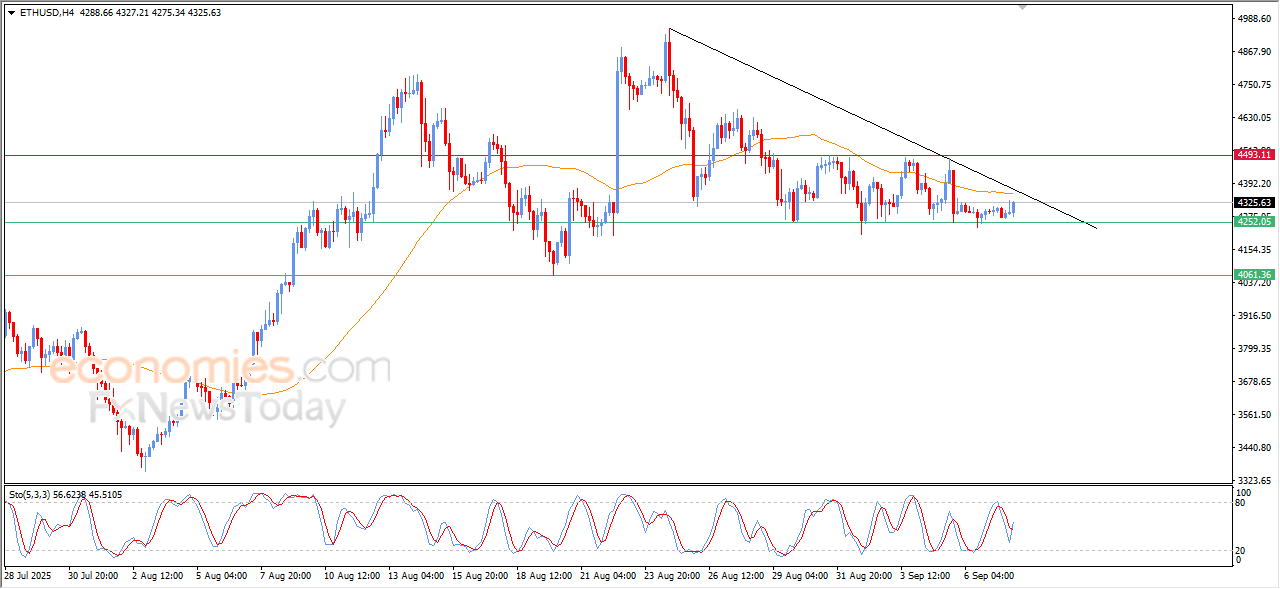

The (ETHUSD) price rose in its last intraday trading, due to the stability of the critical support at $4,250, with the emergence of positive overlapping signals on the (RSI), after reaching oversold levels, this performance comes due to the continuation of the negative pressure that comes from its trading below EMA50, which prevented the price recovery in the previous trading, especially with the dominance of the bearish correctional trend on the short-term basis and its trading alongside a bias line.

VIP Trading Signals Performance by BestTradingSignal.com (September 1–5, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 1–5, 2025:

Brent crude oil attempts to correct the bearish trend- Analysis-08-09-2025

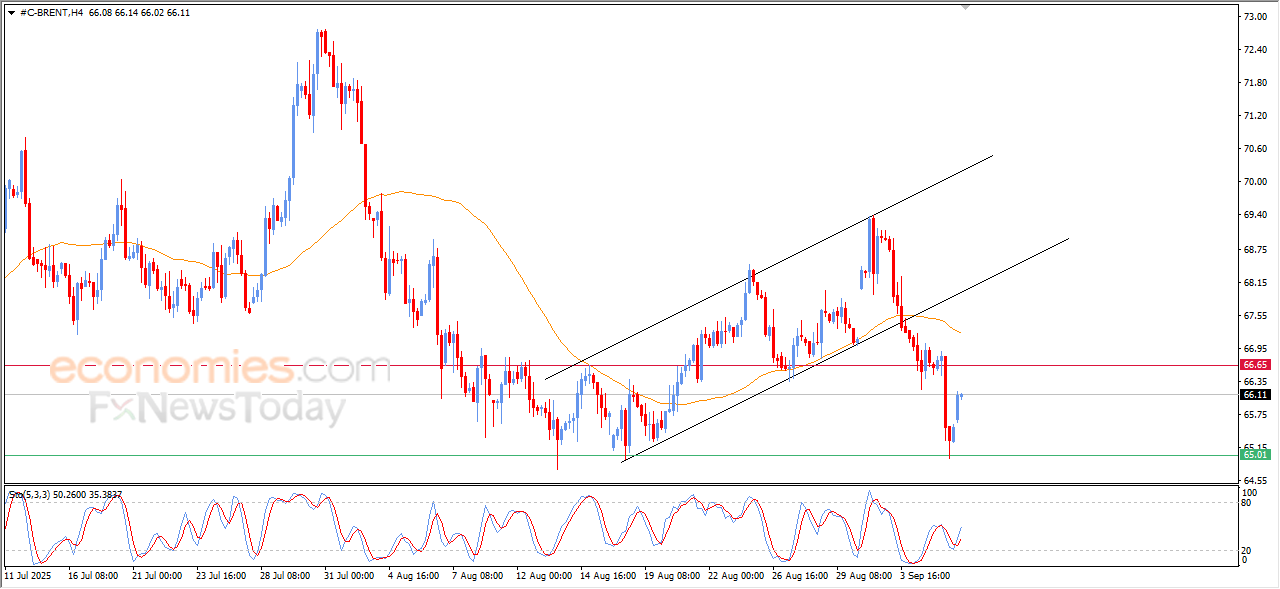

The (Brent) price soars high in its last intraday trading, taking advantage of forming a positive divergence on the (RSI), with the emergence of the positive signals from there, and the price gad previously benefited from the stability of the key support at $65.00, gaining positive momentum that intensified these signals, in attempt to recover some of the previous losses on the short-term basis, with the continuation of the negative pressure that comes from its trading below EMA50, decreasing the chances for the recovery.

VIP Trading Signals Performance by BestTradingSignal.com (September 1–5, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 1–5, 2025:

Silver Price is looking for a rising low- Analysis-08-09-2025

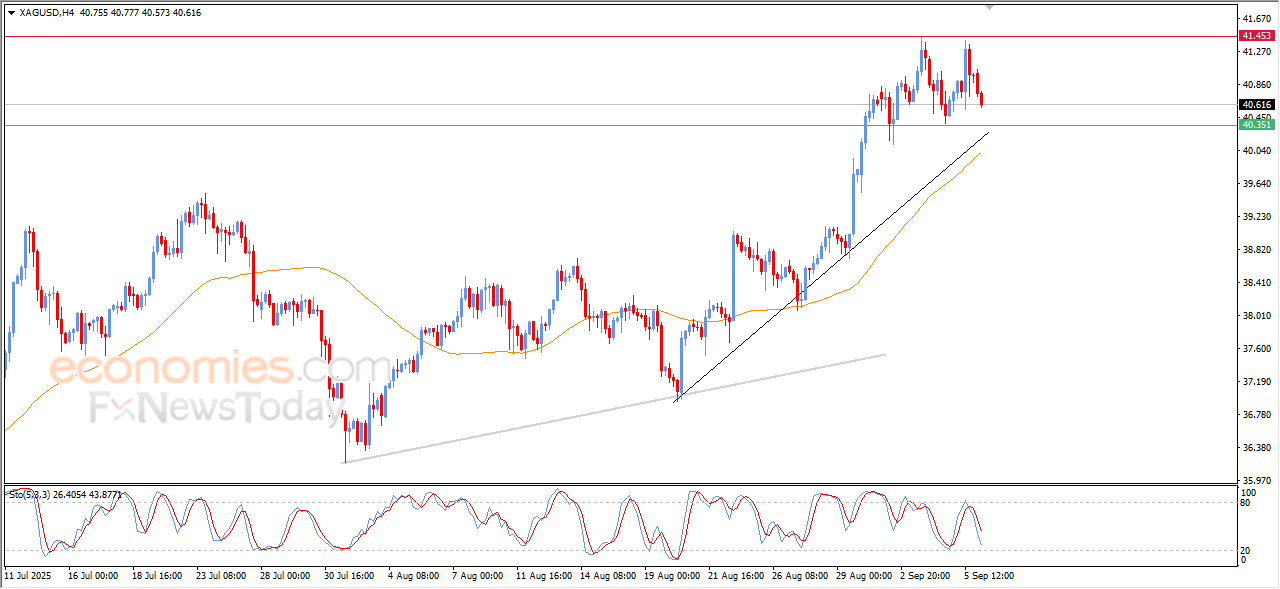

The (silver) price declined in its last intraday trading, amid the emergence of the negative signals on the (RSI), after reaching overbought levels in attempt to look for a rising low to take it as a base for gaining the required bullish momentum to recover and rise again, amid the dominance of the main bullish trend and its trading alongside minor bias line on its trading above EMA50, increasing the chances for the price recover on the near-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (September 1–5, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 1–5, 2025: