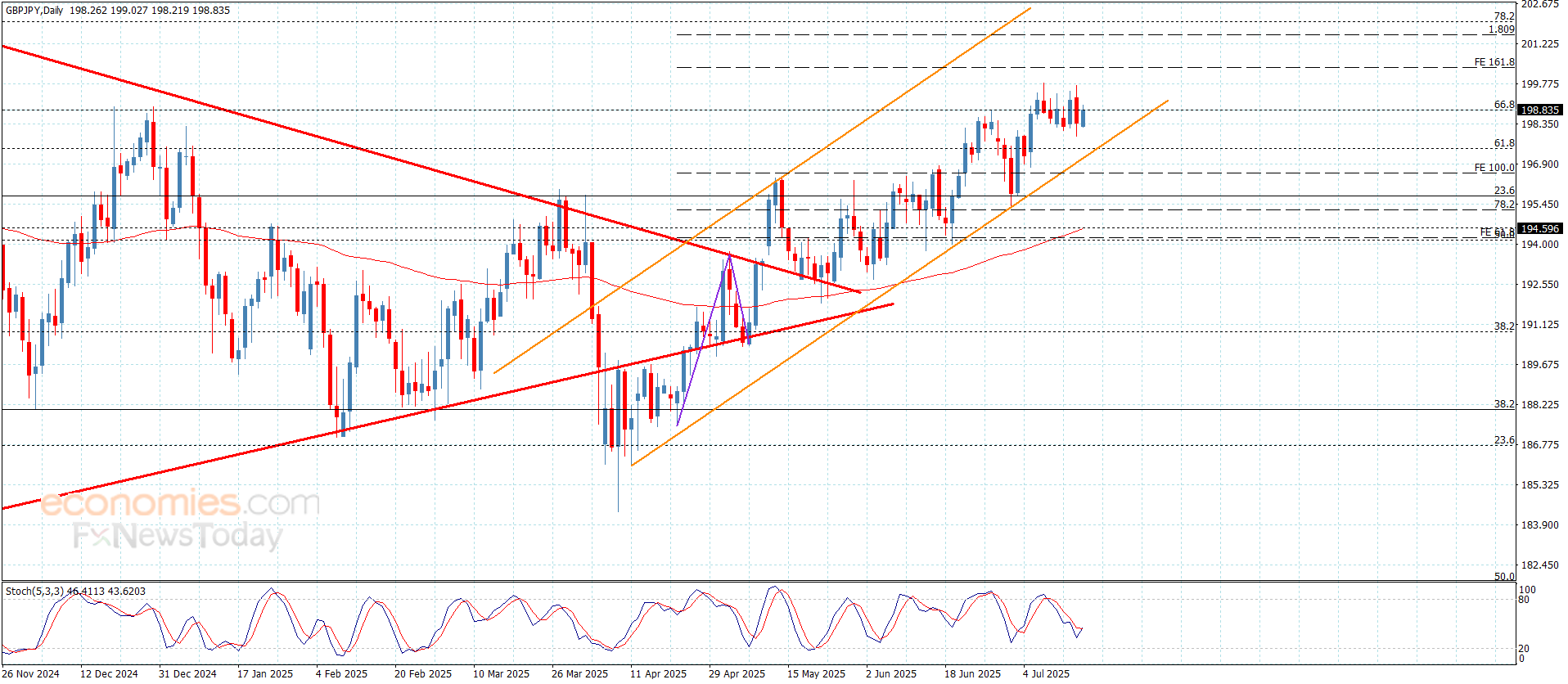

The GBPJPY returns to the sideways fluctuation– Forecast today – 17-7-2025

AI Summary

- GBPJPY pair lost positive momentum, forming intraday bearish wave

- Recommend waiting for confirmation of breaching obstacle to renew bullish attempts

- Expected trading range for today is between 198.00 and 200.35, trend forecast is bullish

The GBPJPY pair lost the positive momentum by stochastic fluctuation near 50 level, which forces it to delay the bullish rally and forming intraday bearish wave, to test the extra support near 197.90 then begin this morning trading with a new positive action, due to its fluctuation near the barrier at 198.80.

We recommend waiting for confirming breaching the current obstacle to confirm its readiness to renew the bullish attempts, which might target 200.35 level, while the failure to breach might help renewing the bearish correctional attempts, forcing it to suffer some losses by reaching 197.45, then attempting to press on the bullish channel’s support at 197.15.

The expected trading range for today is between 198.00 and 200.35

Trend forecast: Bullish

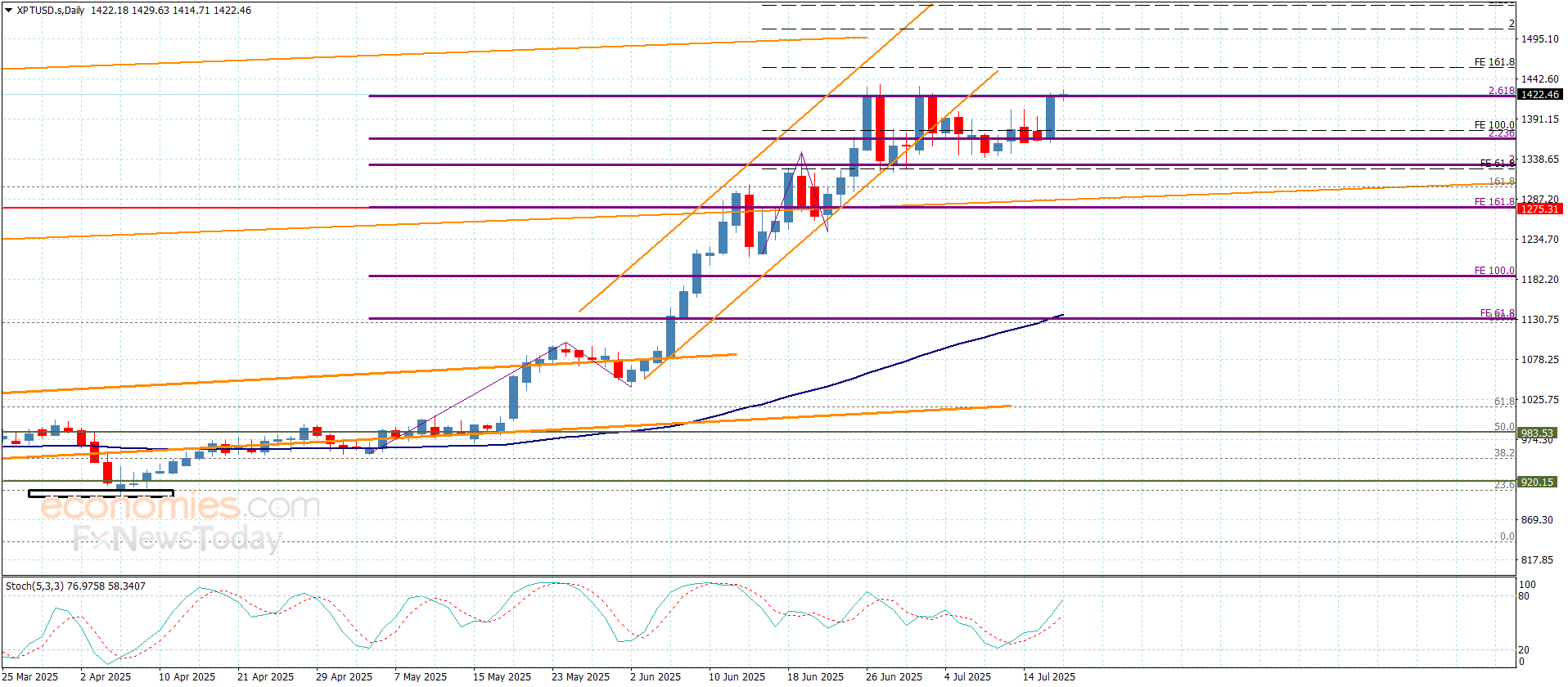

Platinum price achieves the target– Forecast today – 17-7-2025

Platinum price succeeded in renewing the bullish attempts, taking advantage of the stability above the extra support level near $1366.00, reaching the target at $1420.00 and facing 2.618%Fibonacci extended level.

The price might be forced to form some sideways trading until confirming breaching the $1420.00 level, to reinforce the chances for targeting new positive stations that might extend to $1457.00 reaching the next main target at $1507.00.

The expected trading range for today is between $1400.00 and $1457.00

Trend forecast: Bullish

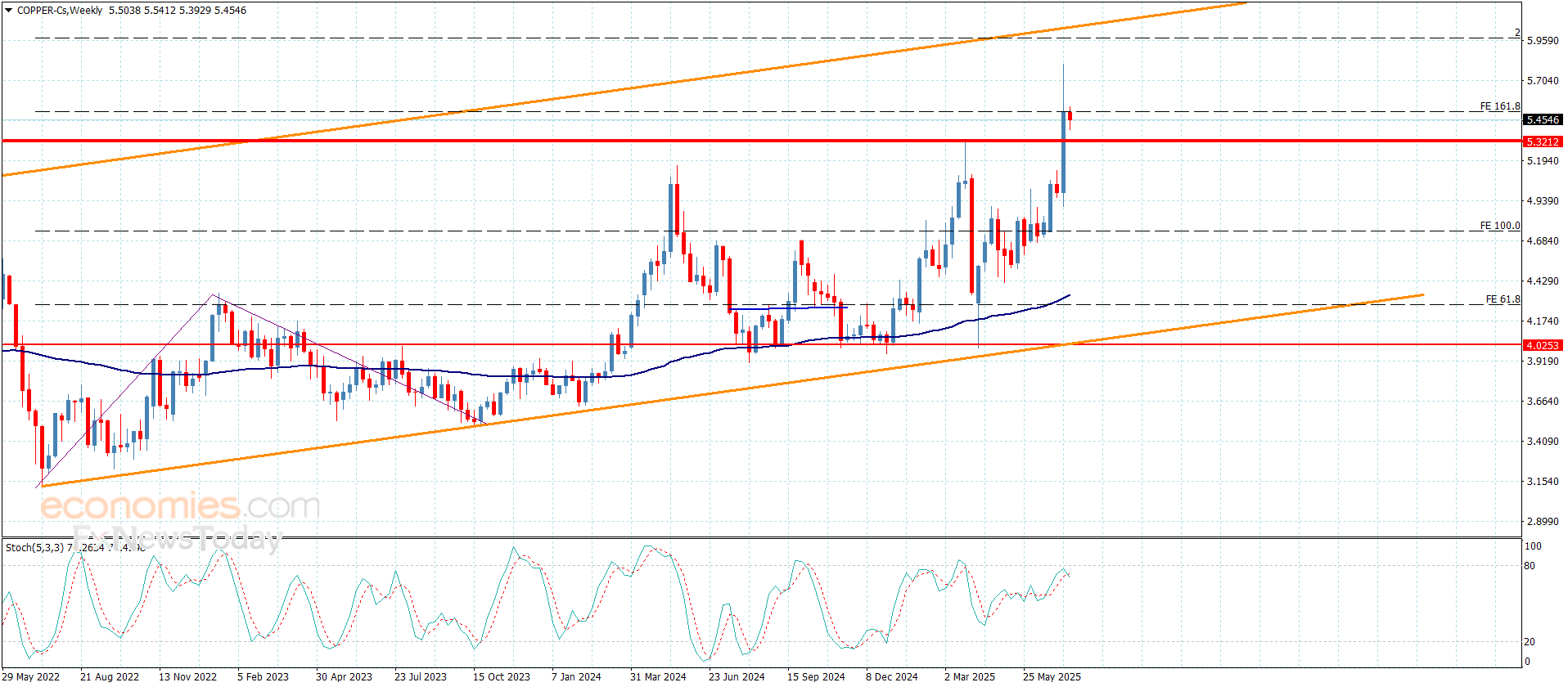

Copper price is without any change– Forecast today – 17-7-2025

No news for copper price, it remains confined between $5.3200 support and $5.5100 level which represents an extra barrier against the bullish attempts, and the contradiction between the main indicators confirming delaying the bullish attempts, to recommend neutrality and wait for surpassing these levels to detect the expected targets in the near trading.

Trading success in surpassing the barrier and holding above it will reinforce the dominance of the bullish bias, which might target $5.6700, while breaking the support will force it to form bearish correctional waves, to expect reaching $5.1500 and $4.9800.

The expected trading range for today is between $5.3100 and $5.5100

Trend forecast: Neutral

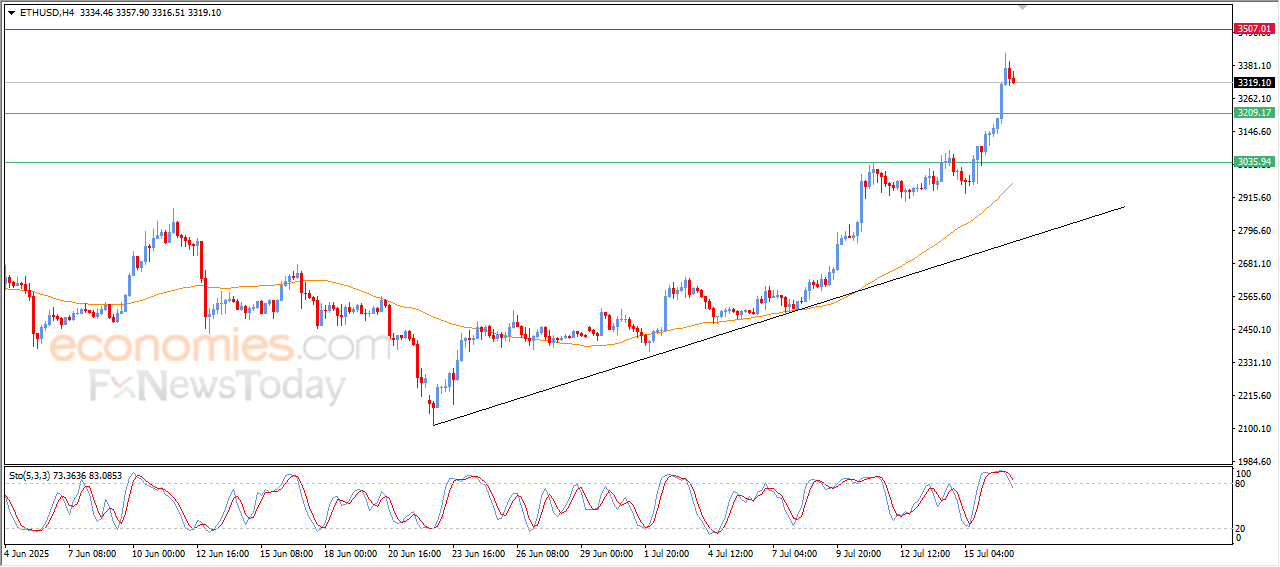

The (ETHUSD) is on a truce to catch breaths-Analysis- 17-07-2025

The (ETHUSD) price declined in its last intraday trading, gathering the gains of its previous rises, attempting to offload some of its clear overbought conditions on the (RSI), especially with the beginning of the negative signals emergence from them, gathering its positive strength that might assist it to recover and begin a new bullish wave, amid the dominance of the main bullish trend on the short-term basis and its trading alongside a bias line.