The GBPJPY moves slowly– Forecast today – 12-9-2025

AI Summary

- GBPJPY pair showing slow trading, with indicators conflicting and negative stability below 200.40 barrier

- Bearish correctional track expected, with potential decline to 198.60 and extra support at 197.85

- Breaching current barrier and holding above it could signal readiness for main bullish attack towards 201.55 and 202.45 Fibonacci extension level

The GBPJPY pair provided slow trading in the last period, affected by the contradiction between the main indicators’ positivity and its negative stability below 200.40 barrier, the negative stability supports activating the bearish correctional track in the near period trading, attempting to target some of the negative stations by its decline to 198.60 reaching the extra support at 197.85.

The price success in breaching the current barrier and holding above it, will confirm its readiness to resume the main bullish attack, to expect its rally towards 201.55, then attempts to reach 161.8%Fibonacci extension level at 202.45.

The expected trading range for today is between 198.60 and 200.40

Trend forecast: Bearish

Platinum price fluctuates below the barrier– Forecast today – 12-9-2025

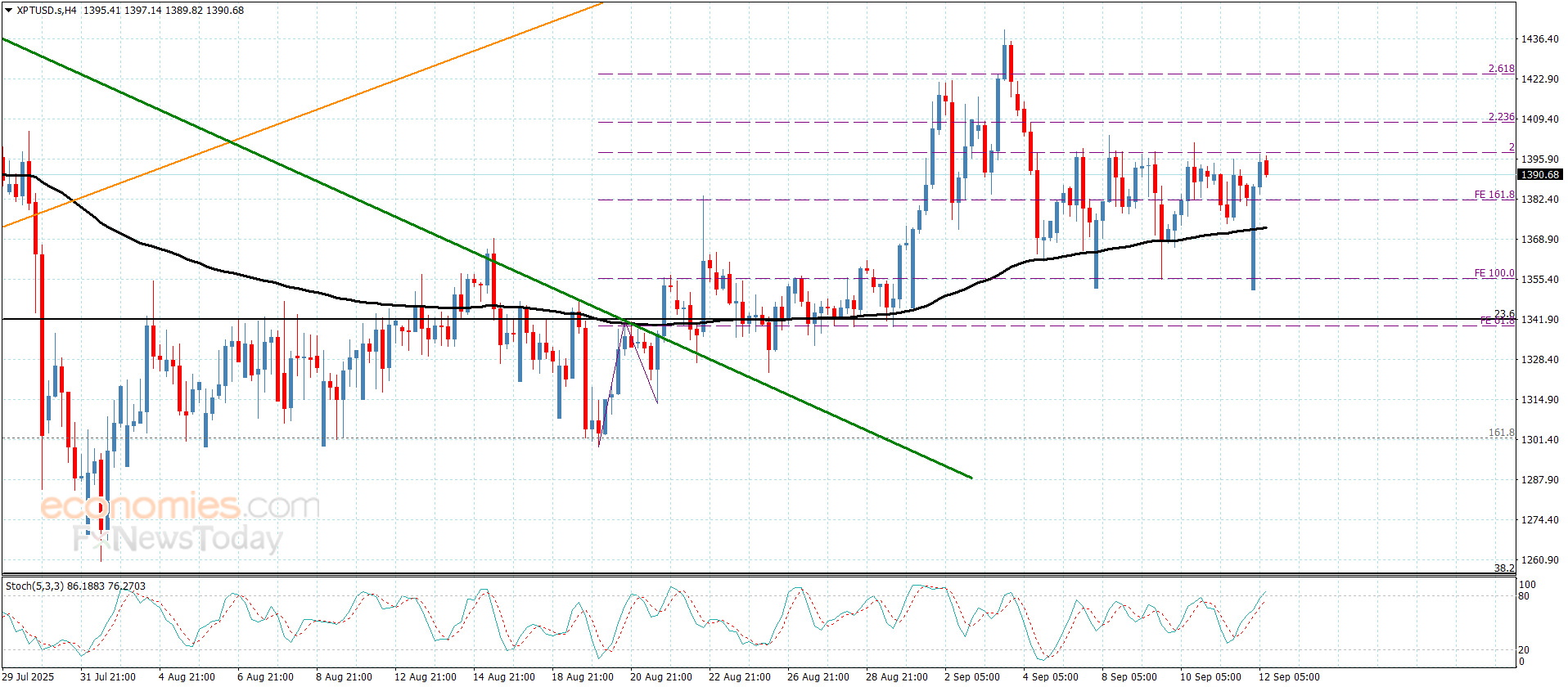

Platinum price ended its last attempts of breaching the barrier at $1400.00 with clear failure, to keep forming mixed trading as appears in the above image.

The main stability within the bullish track depends on the stability of the support at $1340.00, besides providing positive momentum by the main indicators, make us wait for achieving the required breach, to open the way for recording extra gains that might begin at $1412.00 and $1435.00.

The expected trading range for today is between $1375.00 and $ 1412.00

Trend forecast: Bullish

Copper price achieves the initial target– Forecast today – 12-9-2025

Copper price activated with the positive factors, especially with the positive factors of stochastic by its exit from the oversold level, to settle near the initial positive target at $4.6200.

The positive leaning above the moving average 55 reinforces the extra support at $4.2600, which supports the chances for resuming the bullish attack, to keep waiting to hit the next target at $4.7500, then monitor the behavior of the price to confirm the suggested targets in the upcoming trading.

The expected trading range for today is between $4.3800 and $4.7500

Trend forecast: Bullish

The (ETHUSD) is attacking our suggested target- Analysis- 12-09-2025

The (ETHUSD) price rose in its last intraday trading, attacking the critical resistance at $4,500, which represents our suggested target in our previous analysis, supported by its continuous trading above EMA50, with its trading alongside minor bullish trend on the short-term basis that supports the bullish movement, despite the negative signals that come from the (RSI), after reaching overbought levels, to offload some of this conditions despite the price rise, indicating the strength of the trend and its dominance.

VIP Trading Signals Performance by BestTradingSignal.com (September 1–5, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 1–5, 2025: