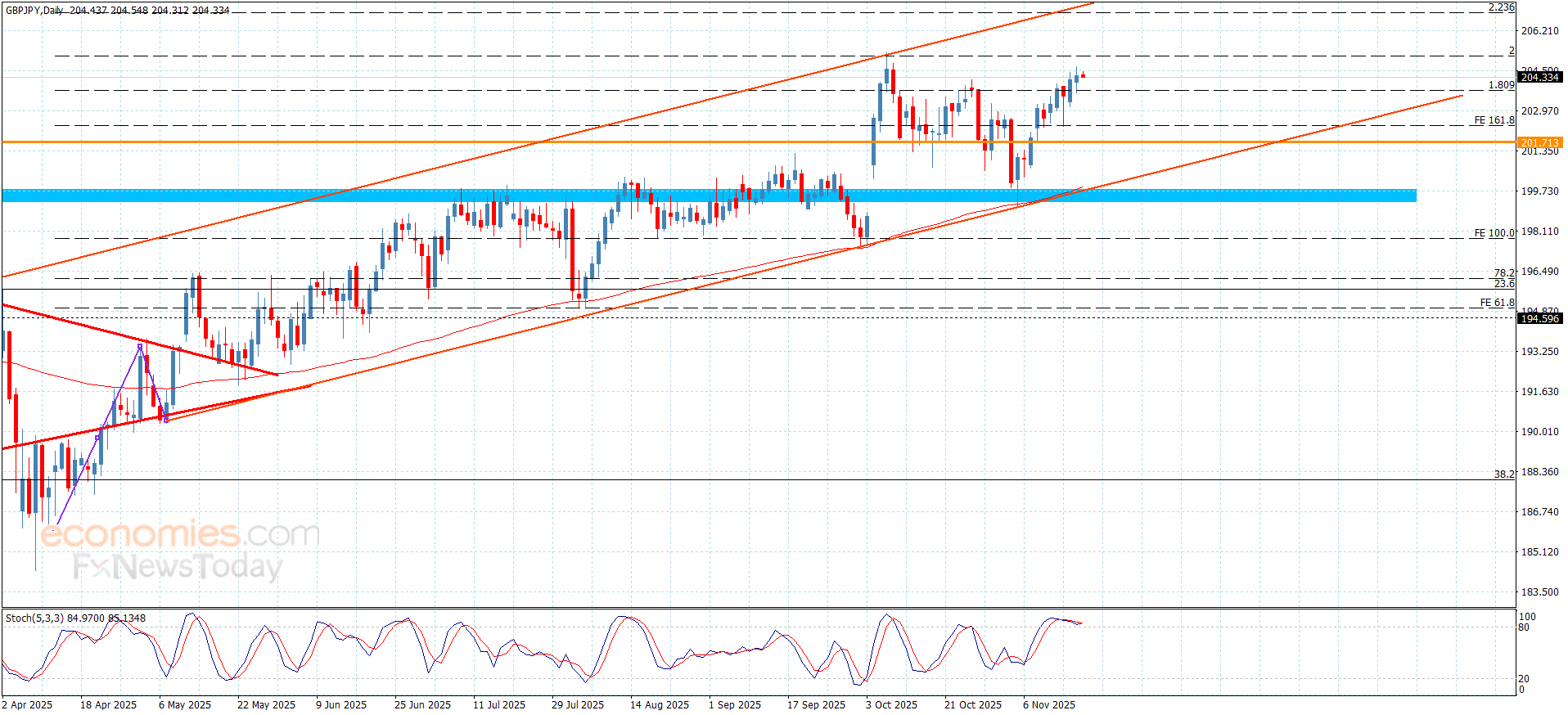

The GBPJPY losses the positive momentum– Forecast today – 19-11-2025

The GBPJPY pair reached the initial extra target at 204.65, which forces it to form sideways trading due to its neediness to the positive momentum, depending on forming extra support at 203.85, increasing the chances of gaining the required extra bullish momentum for recording extra gains that begin at 205.25 and 205.70.

While the failure to settle above 203.85 will push it to provide mixed trading, and there is a chance to begin gathering some gains, to expect reaching 203.10 to test %161.8 Fibonacci extension level near 202.45.

The expected trading range for today is between 203.90 and 202.25

Trend forecast: Bullish

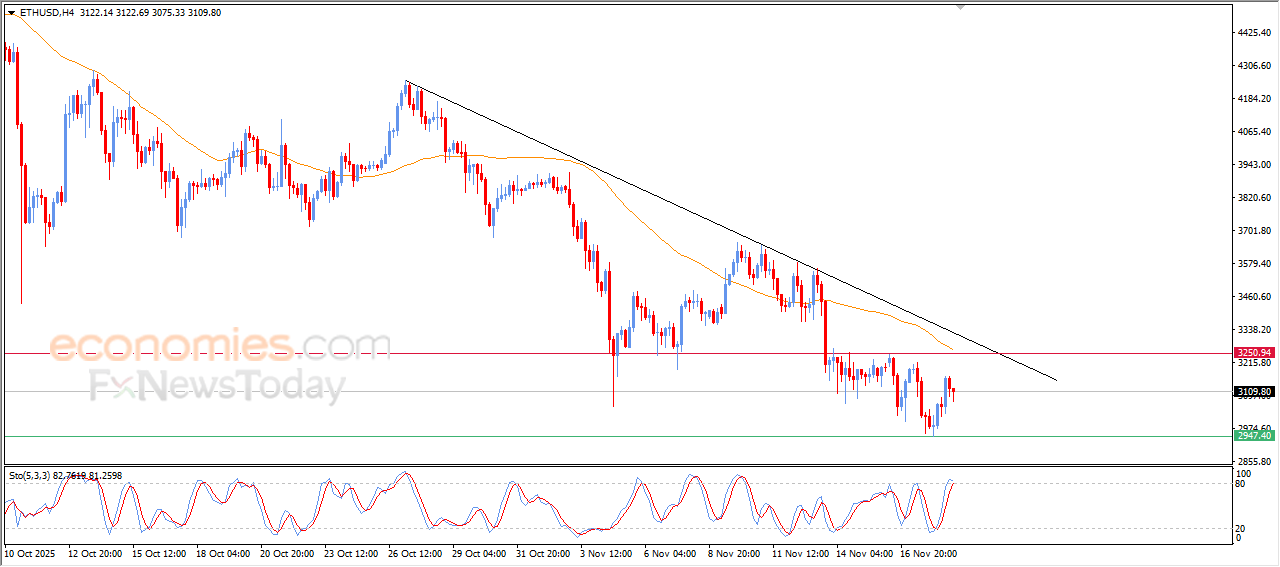

The (ETHUSD) surrenders to the negative pressure- Analysis- 19-11-2025

The (ETHUSD) price declined in its last trading on the intraday levels, with the continuation of the negative pressure due to its trading below EMA50, reinforcing the strength and dominance of the main bearish trend on the short-term basis, especially with its trading alongside supportive trendline for this trend, besides the emergence of negative overlapping signals on the relative strength indicators, after reaching exaggerated overbought levels compared to the price move, indicating the beginning of forming negative divergence.

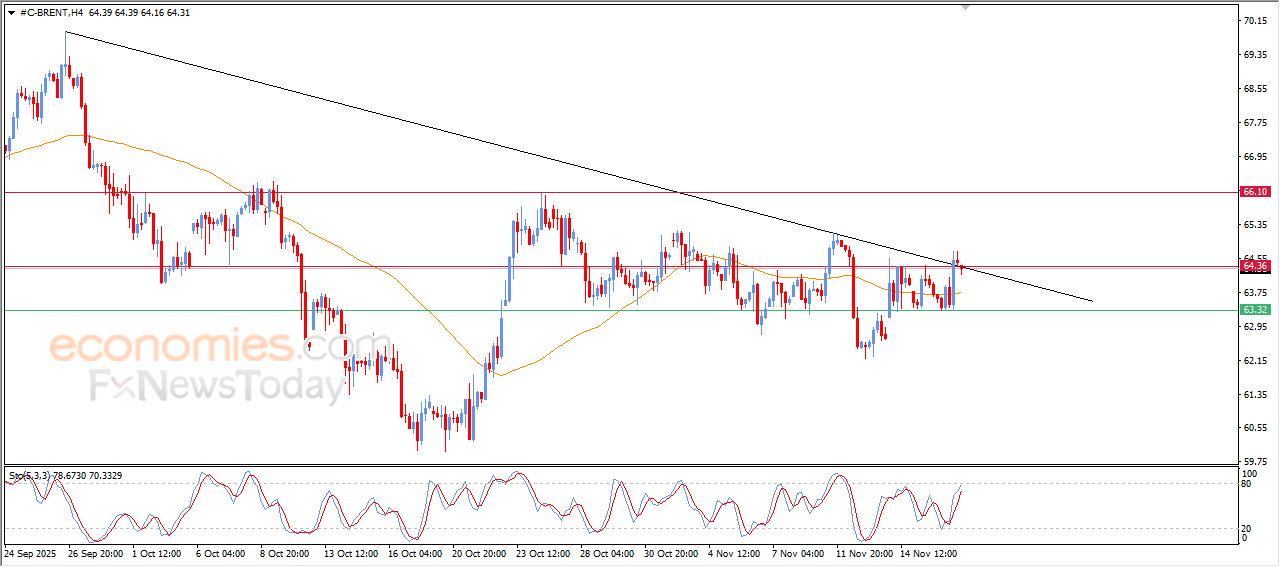

Brent crude oil is attacking minor bearish trend line- Analysis-19-11-2025

The (Brent) price settled in its last intraday trading, amid the dominance of the main bearish trend on the short-term basis and its trading alongside supportive trend line for this trend, with the emergence of the negative signals on the relative strength indicators, after reaching overbought levels, to surpass the support of its EMA50, to reinforce the chances of the price decline on the near-term basis.

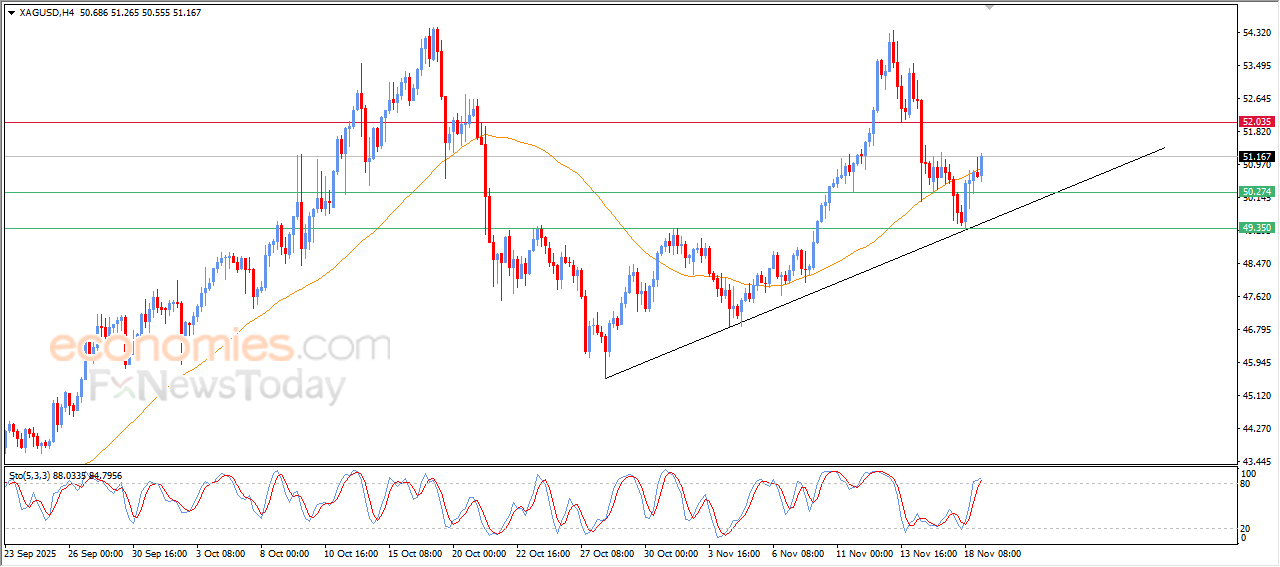

Silver price is resuming the rise- Analysis-19-11-2025

Silver price kept rising in its last intraday trading, surpassing the resistance of its EMA50, getting rid of its negative pressure amid the dominance of the main bullish trend and its trading alongside minor trend line on the short-term basis on the short-term basis, on the other hand, we notice the emergence of negative overlapping signals on the relative strength indicators after reaching overbought levels, which might reduce the upcoming gains of the price.