The GBPJPY is weak– Forecast today – 22-5-2025

The GBPJPY pair continued forming temporary negative trading, announcing its surrender to stochastic negativity, noticing by the above image its approach from the moving average 55, which attempts to form extra support near 192.10 level.

The continuation of forming main support at 191.20 makes us wait for gathering the positive momentum, which allows it to activate the bullish track to target 193.60 level initially, then attempts to press on the barrier at 194.60.

The expected trading range for today is between 192.00 and 193.60

Trend forecast: Fluctuated

Platinum price hits the resistance– Forecast today – 22-5-2025

Platinum price resumed the bullish rally to achieve the suggested target, to achieve the suggested target by hitting $1083.00 facing the resistance of the bullish channel that appears in the above image.

Reminding you that stochastic stability within the overbought level might force the price to provide intraday sideways trading, and the continuation of the current resistance stability might force the price to retest the initial support at $940.00, while breaching the resistance and holding above it will open the way for achieving new gains, forming an initial target at $1100,00 level, reaching the recently achieved top at $1125.00.

The expected trading range for today is between $1055.00 and $1083.00

Trend forecast: Sideways

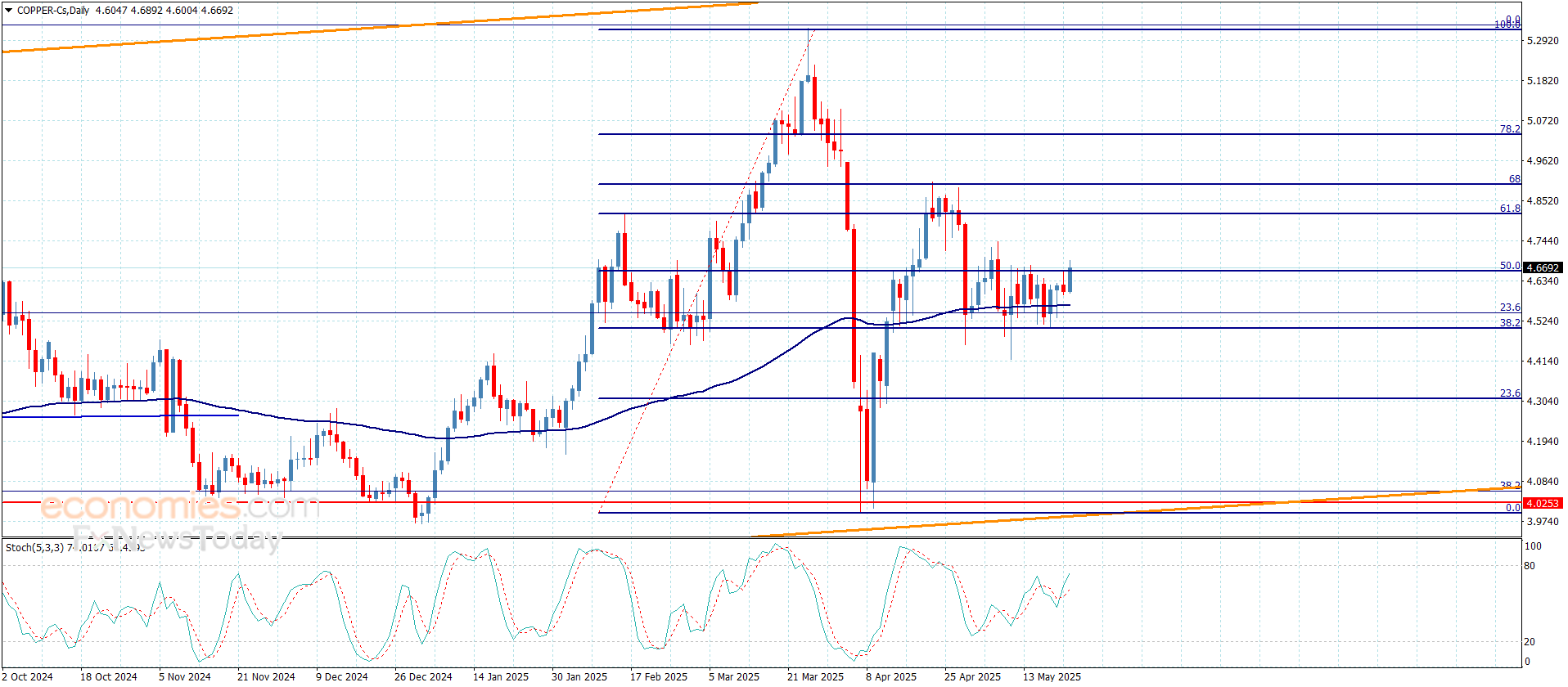

Copper price delays the decline– Forecast today – 22-5-2025

Copper price confirmed delaying the decline in the current period, due to the continuation of providing positive momentum by the main indicators, attempting to surpass the initial barrier at $4.6600, recommend waiting for confirming the breach to reinforce the chances for forming a bullish rally then targeting some of the positive stations that begin at $4.7500 reaching 61.8%Fibonacci correction level at $4.8100.

Activating the negative track requires forming a sharp decline, to settle below $4.5000 level, to confirm targeting several negative stations that begin at $4.4300 and $4.3100.

The expected trading range for today is between $4.5500 and $4.7500

Trend forecast: Bullish

The GBPUSD attempts to recover -Analysis-22-05-2025

The (GBPUSD) price rose in its last intraday trading, amid its readiness to attack the stubborn and critical resistance at 1.3440, supported by its continuous trading above its EMA50, and under the domination of the main bullish trend on the short-term basis and its trading alongside a bias line, the price succeeded to offload its clear overbought conditions on the (RSI), which renews the positive momentum.