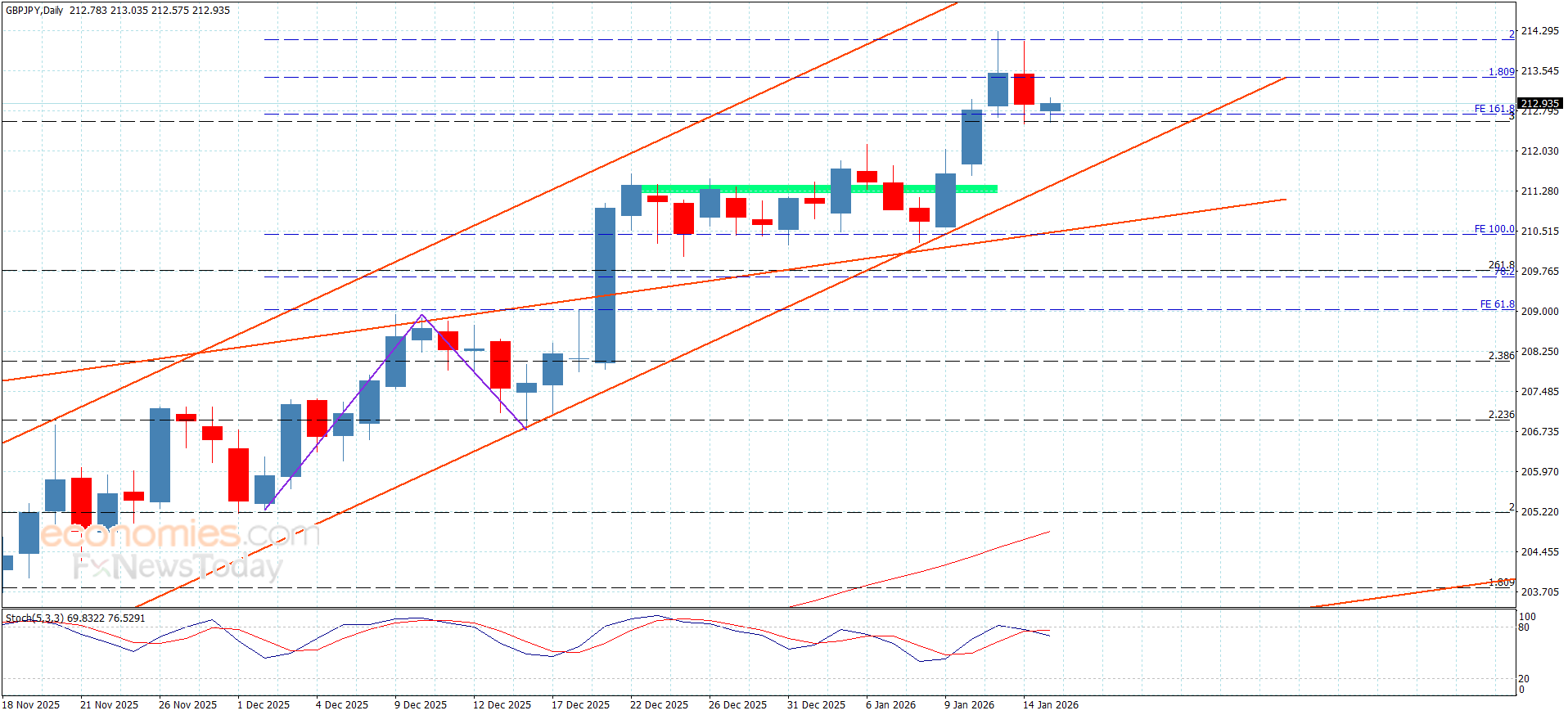

The GBPJPY is retesting extra support– Forecast today – 15-1-2026

The GBPJPY pair surrendered to the stability of 214.20 barrier, which represents %2.00 Fibonacci extension level, forcing it to activate the attempts of gathering the gains, reaching 212.55, to test extra support level again.

Reminding you that the main stability within the bullish channel’s levels and the stability of the current support make us keep the bullish scenario, which might target 213.55 level, and surpassing it might make it approach the previously mentioned barrier, while the stability below 213.55 and facing extra negative pressure will increase the chances of activating the bearish corrective track, to reach 212.20 reaching the bullish channel’s support at 211.40.

The expected trading range for today is between 212.4 and 213.55

Trend forecast: Bullish

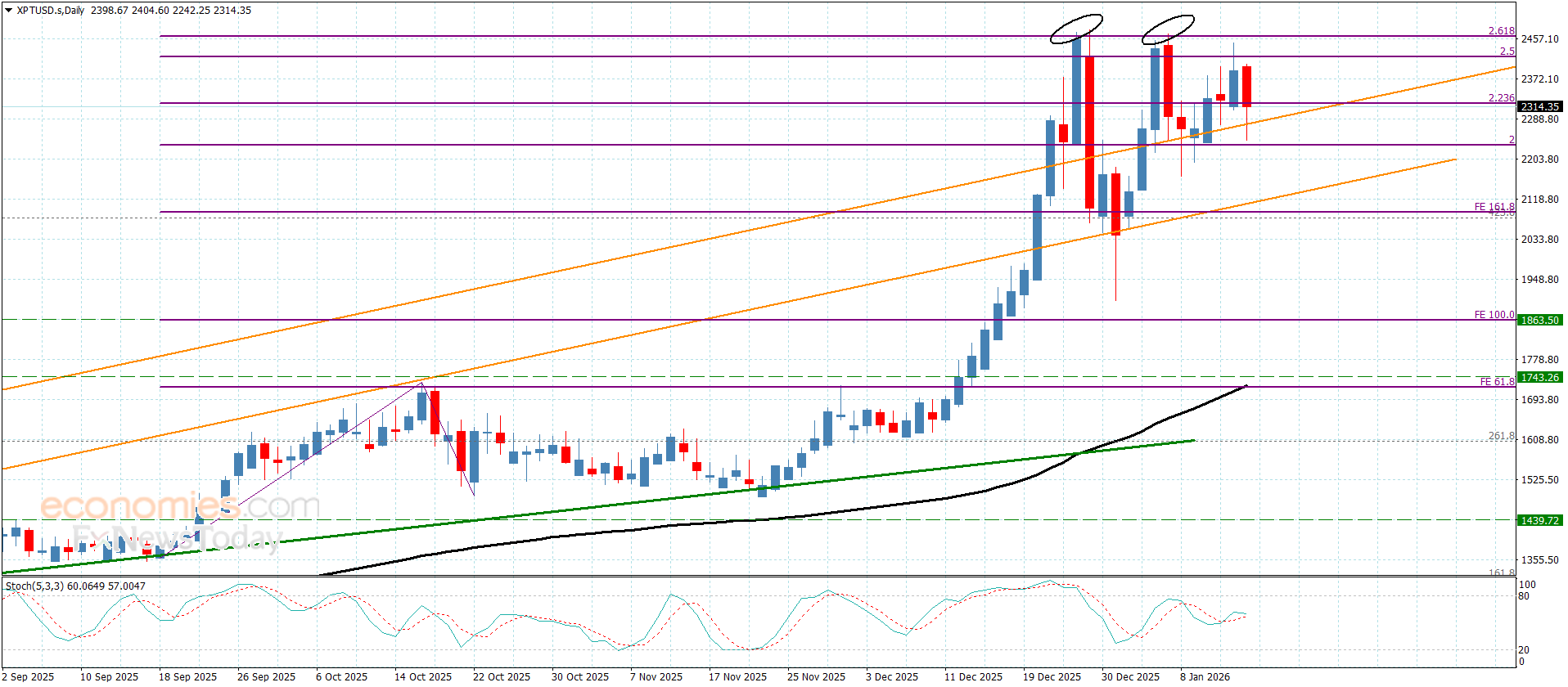

Platinum price repeats testing the support– Forecast today – 15-1-2026

Platinum price affected by the negative data, which forces it to form some bearish corrective waves, attempting to retest extra support at $2330.00, then bounces directly to settle near $2315.00, to confirm the continuation of the bullish scenario.

The contradiction between the main indicators might force the price to provide mixed trading, but the repeated stability above the current support will reinforce the chances of targeting some bullish stations by its rally towards $2385.00 and $2440.00.

The expected trading range for today is between $2280.00 and $2440.00

Trend forecast: Bullish

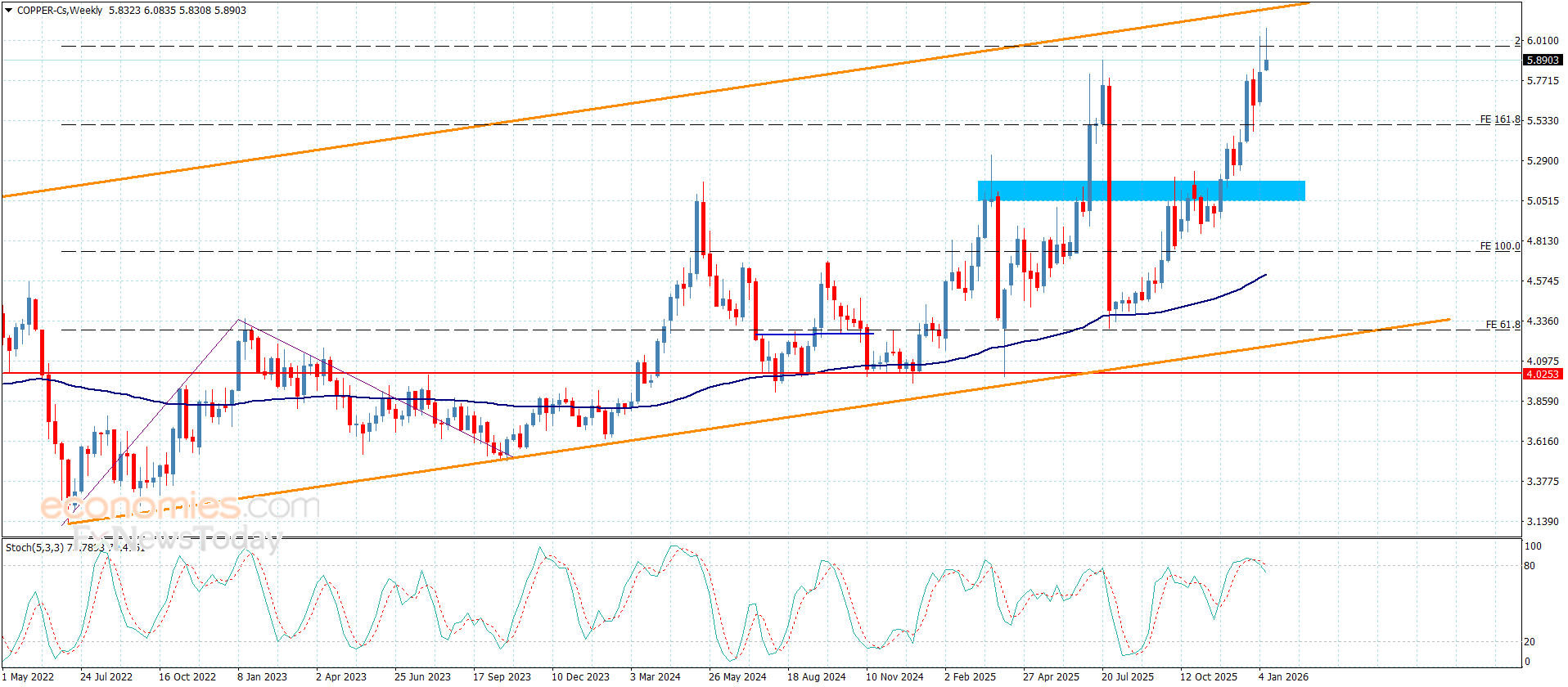

Copper price failed to settle– Forecast today – 15-1-2026

Copper price failed to settle for long time above $5.9700 barrier, affected by stochastic exit from the overbought level, to reach $5.8800 again, which increases the chances of activating temporary negative corrective trading, facing new bearish pressures that will force it to decline towards $5.6000 reaching extra support at $5.5100.

While the price success in surpassing the barrier and holding above it will reinforce it to record new historical gains by its rally towards $6.1200 and $6.2050.

The expected trading range for today is between $5.7500 and $6.000

Trend forecast: Fluctuated within the bullish trend

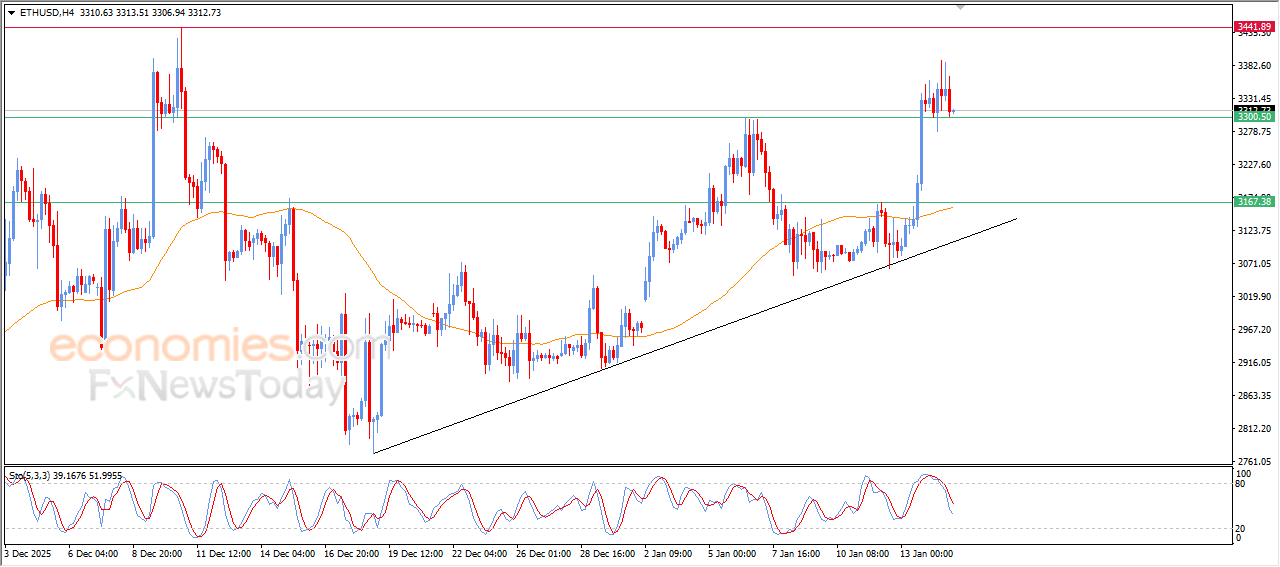

The (ETHUSD) is attempting to gain bullish momentum- Analysis- 15-01-2026

The (ETHUSD) price declined in its last intraday trading, amid the emergence of the negative signals from the relative strength indicators, after reaching overbought levels, to attempt to gain bullish momentum that might help it to recover and rise again, amid the dominance of the bullish trend on the short-term basis, with its trading alongside supportive trend line for this track, taking advantage of its trading above EMA50, reinforcing the chances of a recovery on the near-term basis.