The GBPJPY is affected by the contradiction between the indicators– Forecast today – 23-9-2025

AI Summary

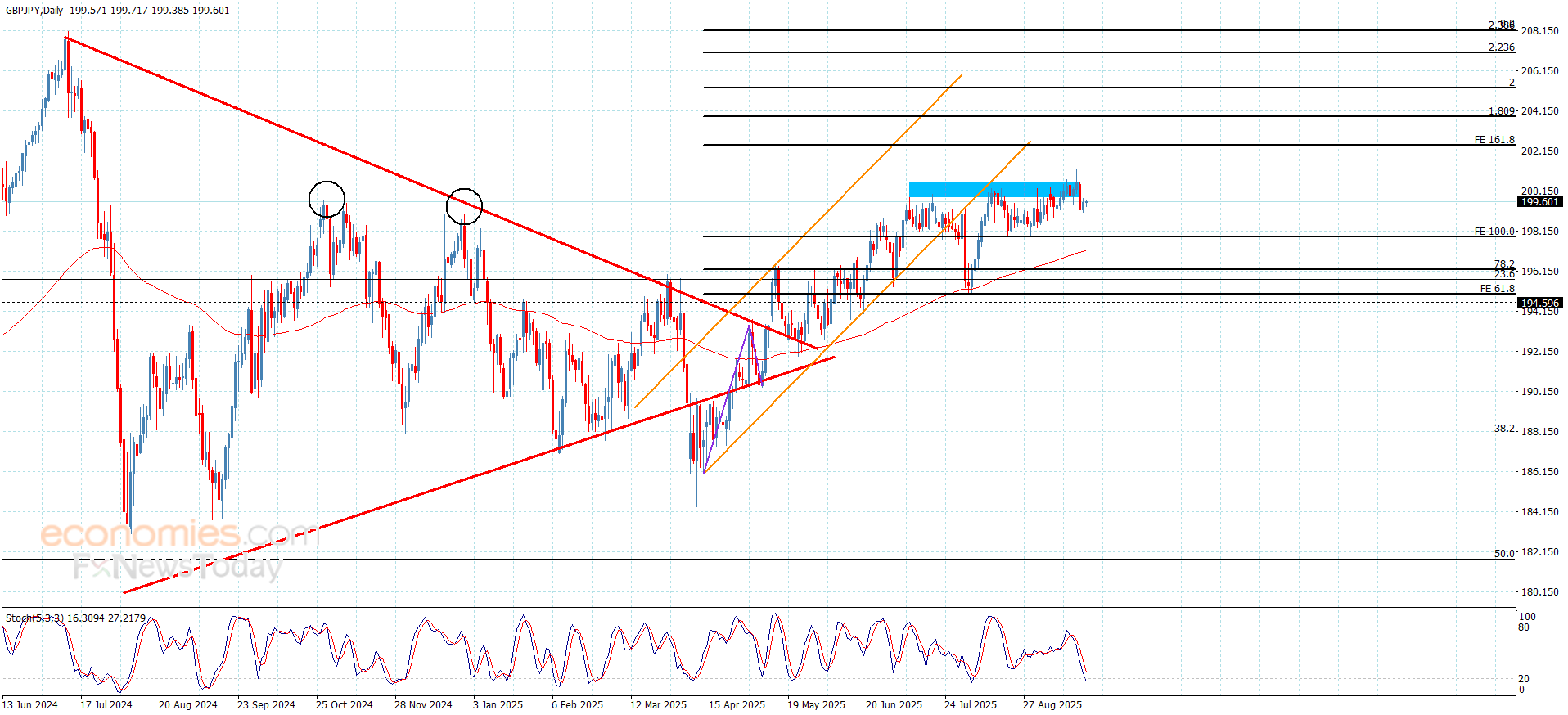

- GBPJPY pair is experiencing stability below 200.45 barrier due to conflicting indicators

- Waiting for negative momentum to form new correctional waves targeting 198.60 level

- Expected trading range for today is between 198.60 and 200.40 with a bearish trend forecast

Despite the stability of the GBPJPY pair in the last period below the barrier at 200.45, but the continuation of the main indicators’ contradiction that pushed it to form sideways trading by its repeated stability near 199.60.

We will keep waiting for gathering the extra negative momentum, to ease the mission of forming new correctional waves, to target 198.60 level reaching the extra support at 197.80, while breaching the barrier will turn the bullish track back, to begin recording extra gains by its rally towards 200.90 and 201.55.

The expected trading range for today is between 198.60 and 200.40

Trend forecast: Bearish

Platinum price records some gains– Forecast today – 23-9-2025

Platinum price continued forming bullish waves yesterday, reaching the target at $1425.00, forming 2.618%Fibonacci extension level, then forms some sideways trading as appears in the above image.

The continuation of providing the main indicators for the positive momentum makes us expect breaching the current obstacle, to open the way for recording extra gains that might extend towards $1435.00 reaching $1457.00.

The expected trading range for today is between $1400.00 and $1435.00

Trend forecast: Bullish

Copper price remains slow– Forecast today – 23-9-2025

Copper price provided slow trading despite the presence of the positive factors, such as the main stability within the bullish channel’s levels by forming main support at $4.1100 level, besides the continuation of providing bullish momentum by the main indicators, specifically by forming an extra support by the moving average 55 by its stability near $4.3700.

Therefore, we will keep preferring the bullish scenario, to expect surpassing the barrier at $4.6200, to rally towards the positive stations at $4.7500 and $4.9500.

The expected trading range for today is between $4.5000 and 4.7500

Trend forecast: Bullish

The (ETHUSD) is getting ready to break critical support- Analysis- 23-09-2025

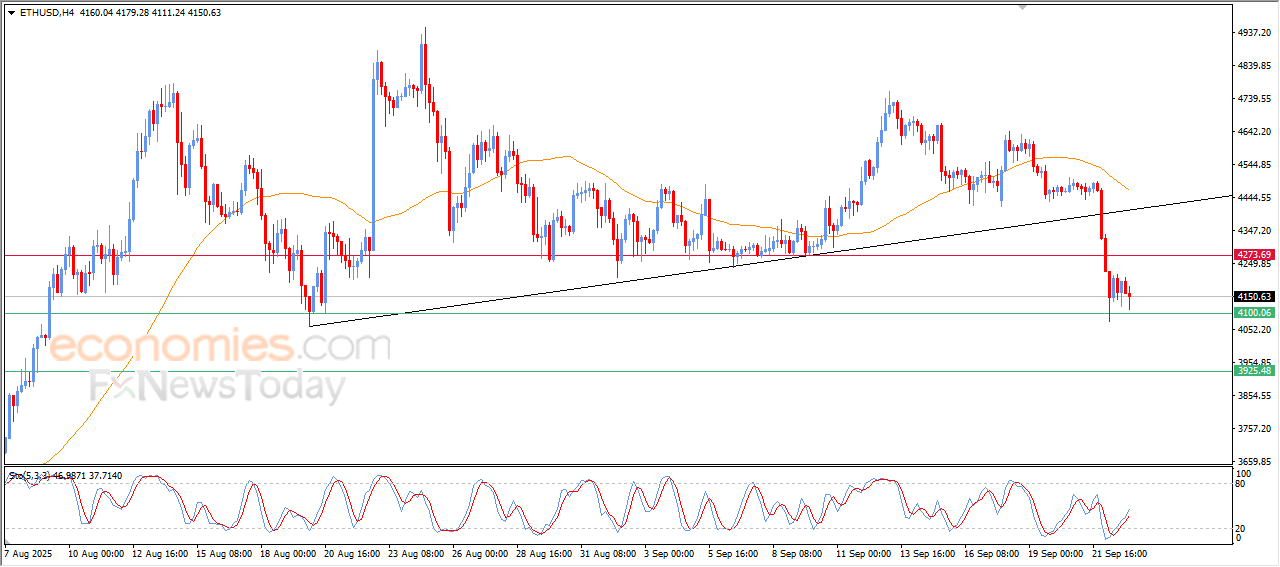

The (ETHUSD) price declined in its last intraday trading, preparing to break the critical support at $4,100, amid the dominance of the bearish correction trend on a short-term basis, affected by breaking main bullish trendline, with the continuation of the negative pressure due to its trading below EMA50, after offloading its clear oversold conditions on the relative strength indicators.

VIP Trading Signals Performance by BestTradingSignal.com (September 15–19, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 15–19, 2025: