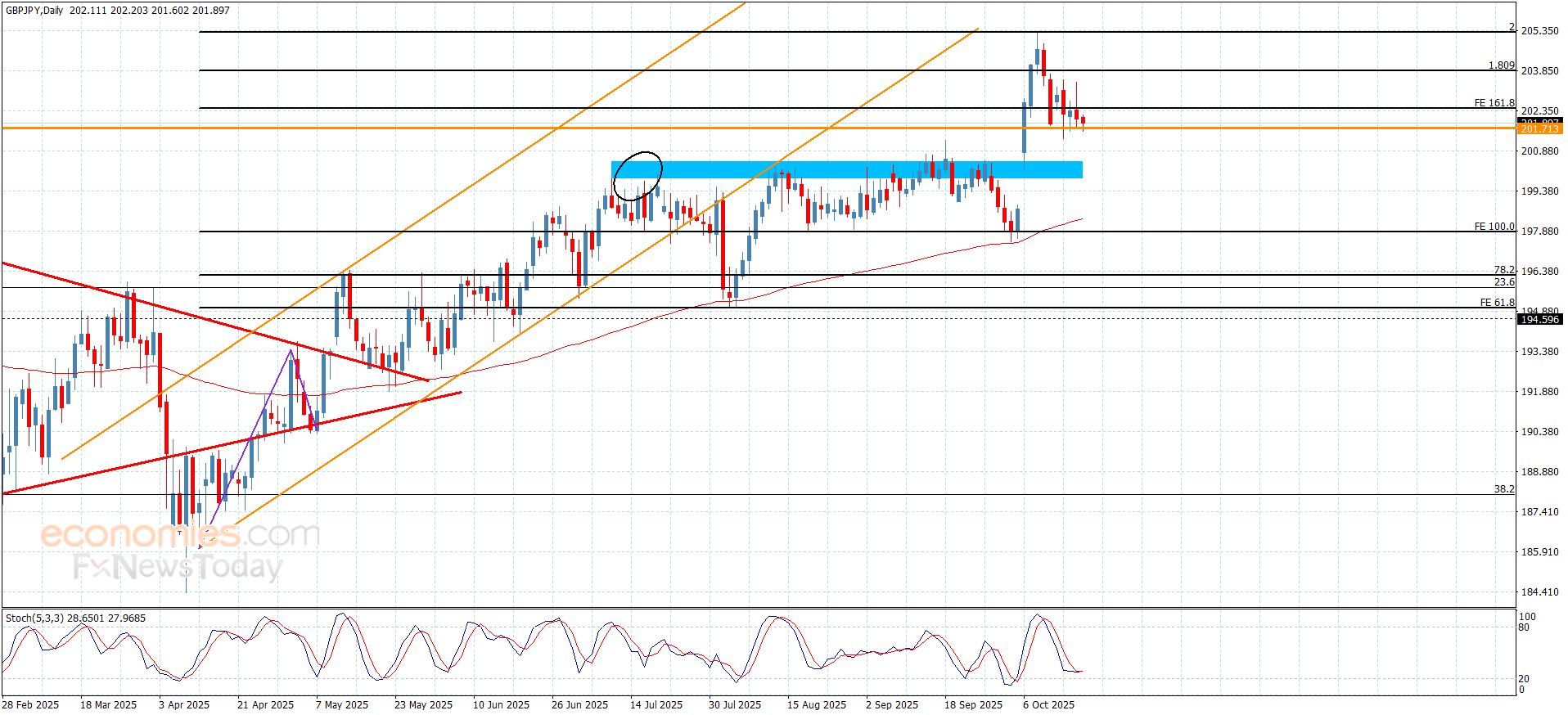

The GBPJPY hovers near the support– Forecast today – 17-10-2025

The GBPJPY pair still needs positive momentum until this moment, which forces it to form sideways fluctuated moves by its stability near 201.70 support level, which represents the key of detecting the expected trend in the near trading, as its stability makes us expect motivating the bullish trend, which might target 202.55 level reaching 203.85 barrier.

While breaking the current support and providing negative close below it will force it to activate the bearish correctional track, which forces it to suffer extra losses by reaching 201.10, reaching the next support at 200.45.

The expected trading range for today is between 201.70 and 203.00

Trend forecast: Bullish

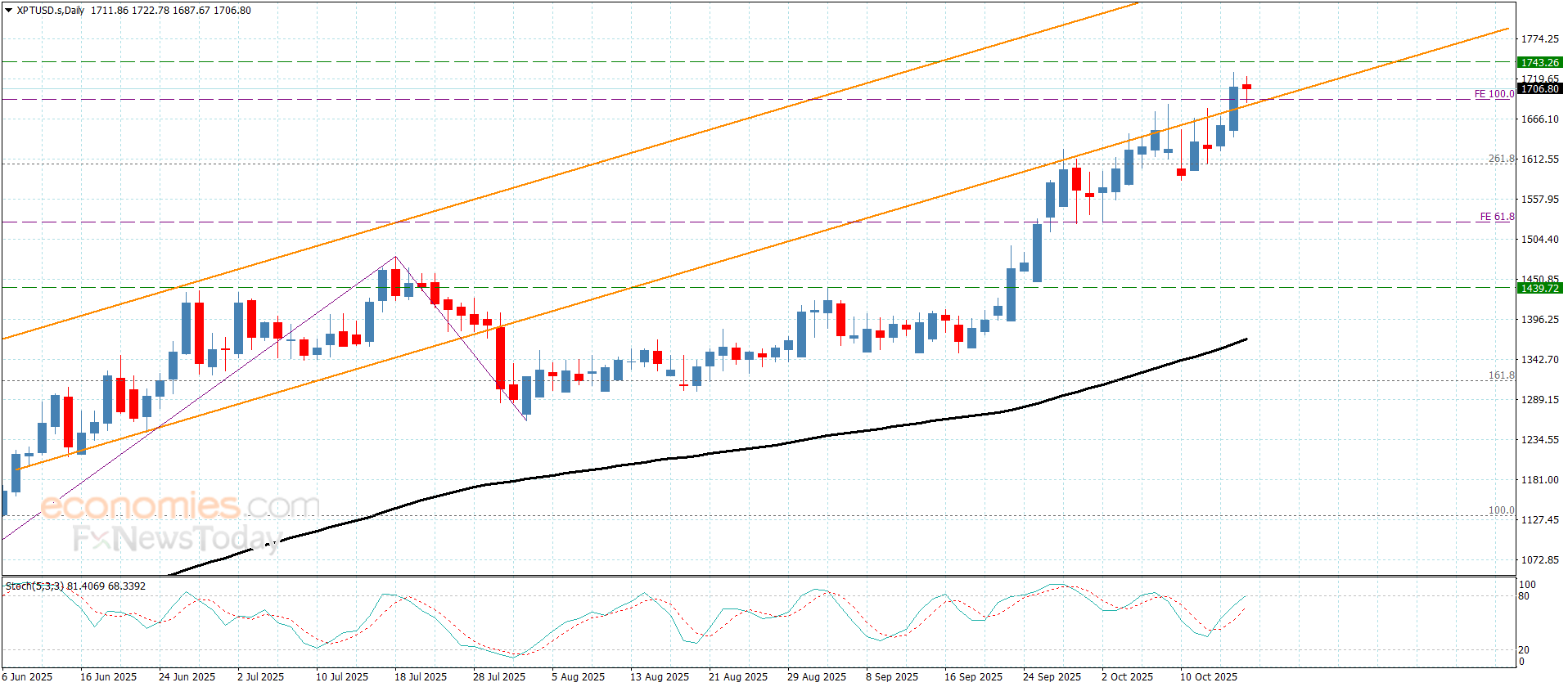

Platinum price renews the positive action– Forecast today – 17-10-2025

Platinum price took advantage of stochastic positivity by its rally yesterday above $1690.00 barrier, to settle within the minor bullish channel’s levels, to record new historical gains by hitting $1728.00 level.

We expect renewing the bullish attack, to target the next barrier near $1745.00, and surpassing it will confirm its readiness to achieve big gains by its rally towards $17800.00 and $1835.00.

The expected trading range for today is between $1675.00 and $1745.00

Trend forecast: Bullish

Copper price is waiting for the positive momentum– Forecast today – 17-10-2025

Copper price remains needs positive momentum, which forces it to delay the previously waited bullish attack, to keep providing sideways trading near $4.9000, note that the stability above $4.7500 support is important, to keep waiting for gathering extra positive momentum to pave the way for surpassing the barrier near $5.0600, then begin recording some gains by its rally towards $5.2000 and $5.3200.

While facing new negative pressures and reaching below the current support might force it to form correctional trading, to suffer intraday losses by reaching $4.6200 followed by the moving average 55 near $4.4000.

The expected trading range for today is between $4.7500 and $5.2000

Trend forecast: Bullish

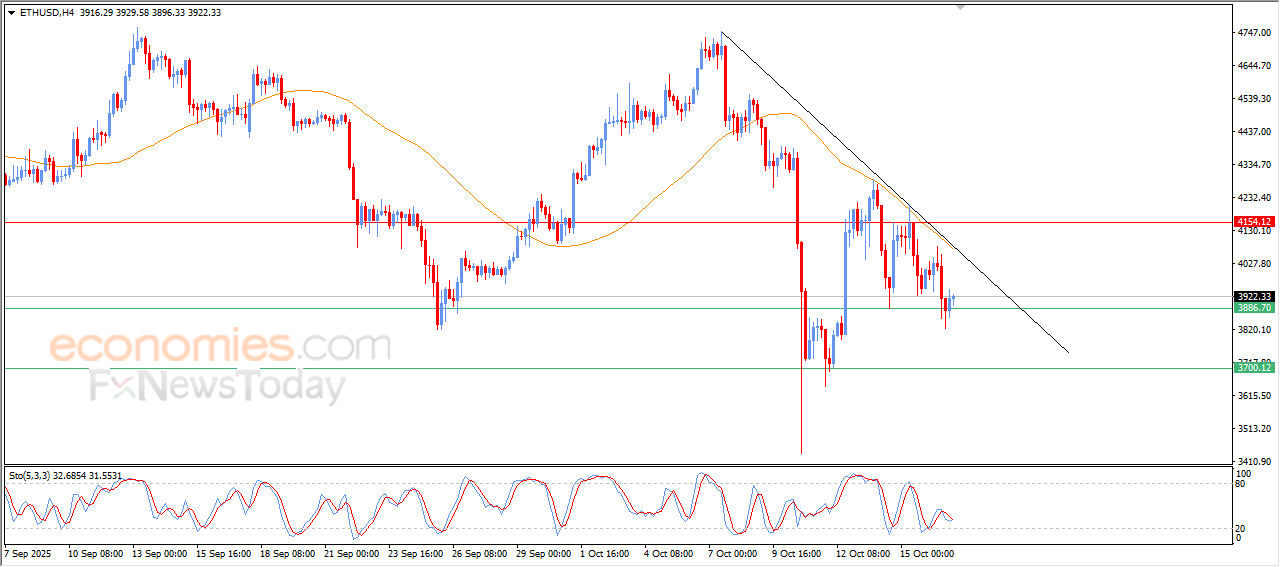

The (ETHUSD) price is rising, affected by key support- Analysis- 17-10-2025

The (ETHUSD) price rose in its last trading on the intraday basis, due to the stability of the support level at $3,885, this support represents our expected target in our previous analysis, gaining positive momentum that helped it to achieve these gains that target recovering some previous losses, amid the continuation of the negative pressure due to its trading below EMA50, and under the dominance of the main bearish trend on the short-term basis and its trading alongside trendline, noticing the negative signals on the relative strength indicators after offloading its oversold conditions in its previous moves, opening the way for recording more of the losses on the near-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (6-10 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 6-10, October 2025: