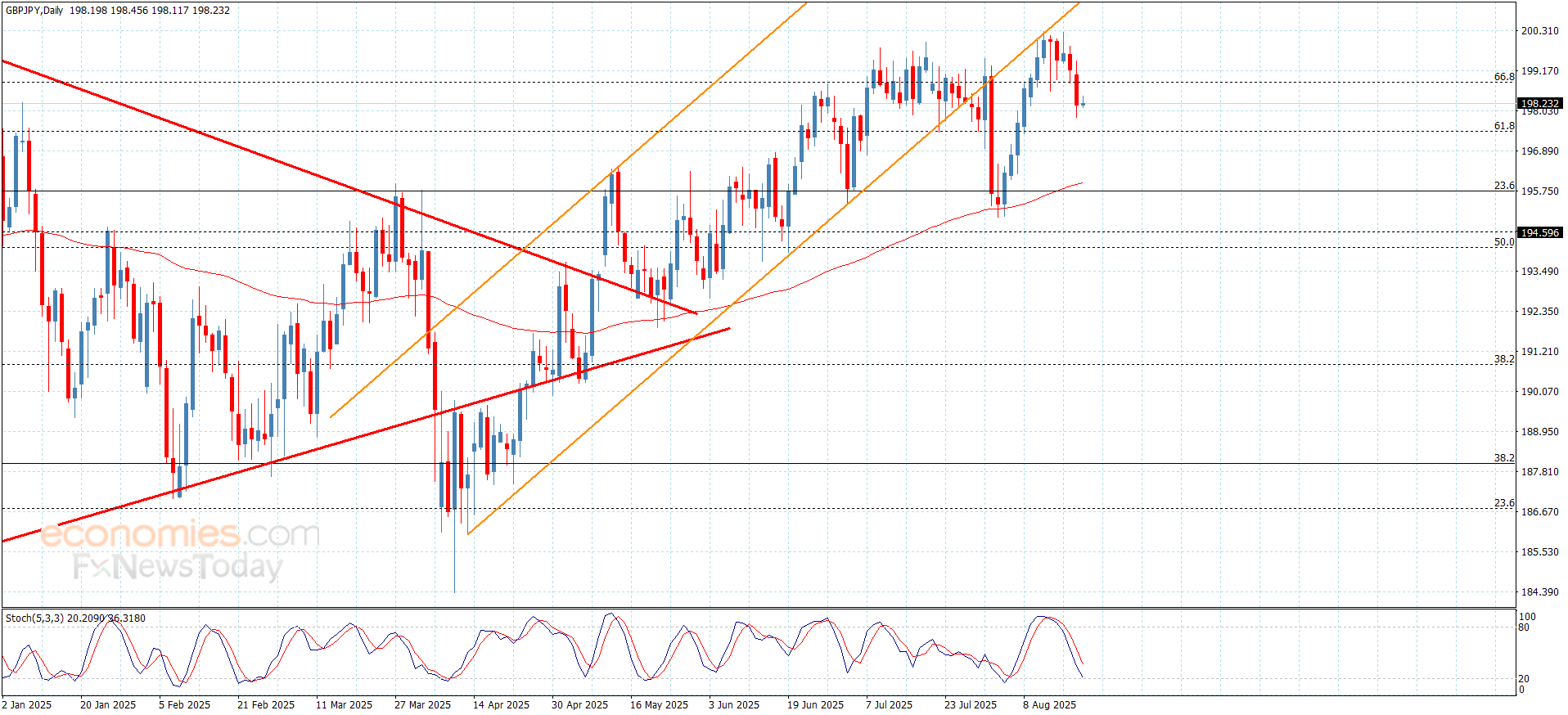

The GBPJPY hits the second target– Forecast today – 21-8-2025

AI Summary

- GBPJPY pair confirms bearish correctional bias domination by hitting second target at 197.85 level

- Additional barrier at 198.80 level and negative momentum from stochastic indicator support continuation of negativity, with potential to reach 196.50

- Expected trading range for the day is between 197.40 and 198.80, with trend forecasted as bearish

The GBPJPY pair confirmed its surrender to the bearish correctional bias domination by breaking 198.80 level, forming more of the bearish waves and achieving the second target by hitting 197.85 level.

Forming extra barrier at 198.80 level and stochastic attempt to provide negative momentum by its approach from 20 level, these factors supports the continuation of the negativity, to expect to attack 197.40, and breaking it will extend the losses towards 196.50 reaching the moving average 55 near 196.00.

The expected trading range for today is between 197.40 and 198.80

Trend forecast: Bearish

Platinum price fluctuates within the sideways track– Forecast today – 21-8-2025

Platinum price surpassed some of the negative pressures by stochastic rally to 80 level, keeping its stability above the support of the sideways track that is represented by $1302.00, to rally to the moving average 55, which reinforces the stability of the barrier at $1342.00.

We will remain neutral, to keep waiting for surpassing one of the main levels to confirm the expected trend in the near and medium period, breaching the barrier will open the way for achieving more of the gains by the price rally to $1365.00 and $1382.00, while breaking the support and holding below it will activate bearish correctional track, and $1281.00 level represents the initial negative target for the bearish track.

The expected trading range for today is between $1302.00 and $1342.00

Trend forecast: Neutral

Copper price is waiting the bullish momentum– Forecast today – 21-8-2025

Copper price continued providing sideways trading despite its stability within the main bullish channel’s levels, attempting to surpass stochastic negativity by its repeated stability above the extra support at $4.2600.

The sideways trading continues until gathering positive momentum, reinforcing the chances for achieving the positive targets that might begin at $4.3300 reaching 100%Fibonacci extension level at $4.7400.

The expected trading range for today is between $4.3300 and $4.6300

Trend forecast: Bullish

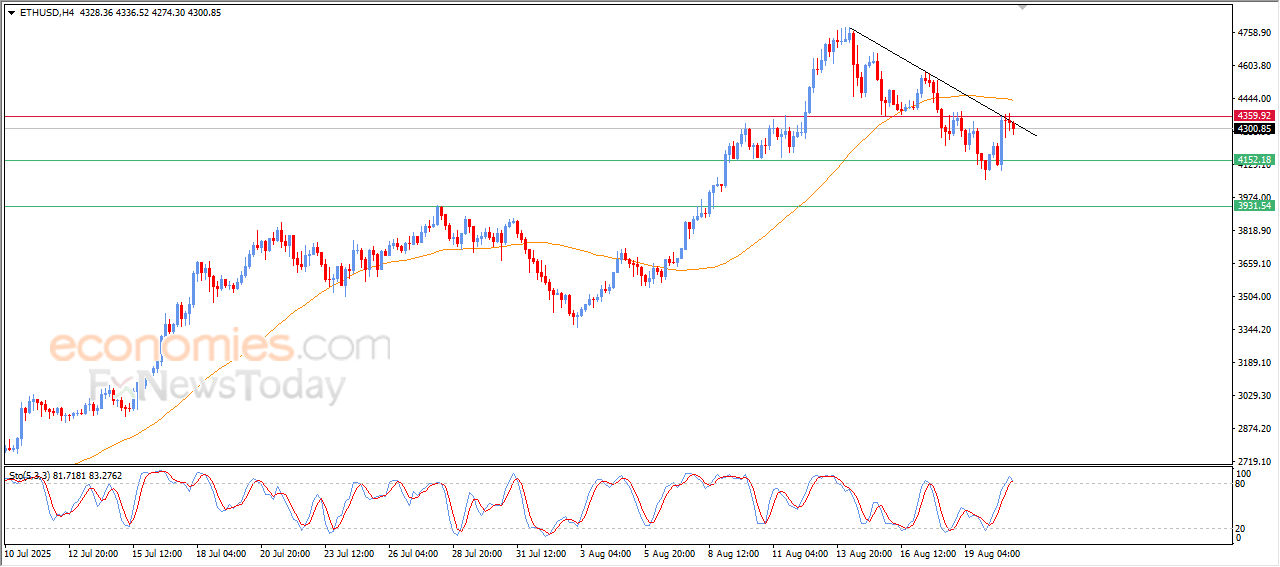

The (ETHUSD) is under negative pressure-Analysis- 21-08-2025

The (ETHUSD) price declined in its last intraday trading, due to the stability of the key resistance level at $4,360, accompanied by testing bearish correctional trend line on the short-term basis, amid the continuation of the negative pressure that comes from its trading below EMA50, intensifying the negative pressure on the price, especially with the emergence of negative overlapping signal on the price especially with the emergence of negative overlapping signal on the (RSI), after reaching overbought levels, which indicates the beginning of forming negative divergence.

VIP Trading Signals Performance by BestTradingSignal.com (August 11–15, 2025)

BestTradingSignal.com – Professional Trading Signals with high accuracy. Subscribe now to tailored packages for the world’s leading markets and receive signals instantly via Telegram from an expert team:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramCheck full VIP signals performance report for the week of August 11–15, 2025: Full Report