The GBPCHF builds minor bearish channel– Forecast today – 12-9-2025

AI Summary

- GBPCHF formed a minor bearish channel, fluctuating below resistance at 1.0810

- Negative momentum from stochastic expected to push price to 1.0765, with potential to reach 1.0730

- Expected trading range for today is between 1.0765 and 1.0800, trend forecast is bearish

The GBPCHF formed a minor bearish channel in its last trading, fluctuating below the resistance at 1.0810, affected by the negativity of the moving average 55, which settles above the resistance to increase its stability against the current trading.

The beginning of providing negative momentum by stochastic will push the price to form strong bearish waves to expect reaching 1.0765, then attempts to renew the pressure on the barrier at 1.0730.

The expected trading range for today is between 1.0765 and 1.0800

Trend forecast: Bearish

Natural gas price begins to decline– Forecast today – 12-9-2025

Natural gas prices took advantage of the negative pressures that come from providing negative momentum by the main indicators, reaching below $3.050 yesterday, to begin recording some negative targets by reaching $2.920.

The continuation of the negative pressure on the price will increase the chances of attacking $2.820 level, confirming the importance of breaking it to open the way for resuming the negative attack by target the previously achieved bottom at $2.640

The expected trading range for today is between $2.820 and $3.000

Trend forecast: Bearish

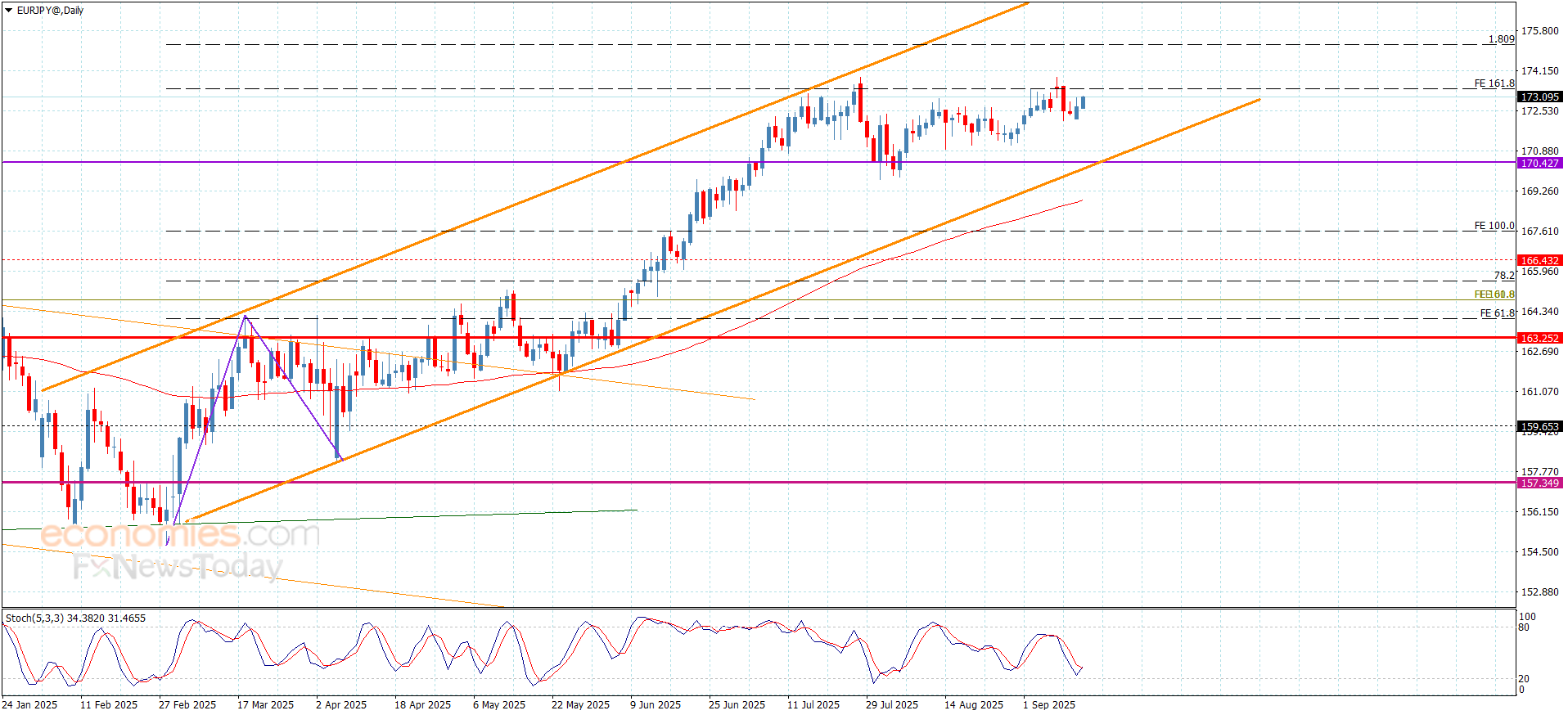

The EURJPY faces stochastic negativity– Forecast today – 12-9-2025

The EURJPY pair succeeded in facing stochastic negativity by its stability above 172.00 level yesterday, to form some of the bullish waves to approach from the barrier at 173.50, forming an obstacle against the attempts of resuming the bullish attack.

To confirm the attempts of resuming the bullish attack, we recommend waiting for breaching the barrier and providing positive close above it, to increase the chances for recording extra gains that might extend to 174.25 reaching 1.809%Fibonacci extension level at 175.20, while the price failure to breach this level will force it to provide more of the sideways trading, and there is a new chance to decline towards 171.60.

The expected trading range for today is between 172.60 and 174.25

Trend forecast: Bullish

The GBPJPY moves slowly– Forecast today – 12-9-2025

The GBPJPY pair provided slow trading in the last period, affected by the contradiction between the main indicators’ positivity and its negative stability below 200.40 barrier, the negative stability supports activating the bearish correctional track in the near period trading, attempting to target some of the negative stations by its decline to 198.60 reaching the extra support at 197.85.

The price success in breaching the current barrier and holding above it, will confirm its readiness to resume the main bullish attack, to expect its rally towards 201.55, then attempts to reach 161.8%Fibonacci extension level at 202.45.

The expected trading range for today is between 198.60 and 200.40

Trend forecast: Bearish