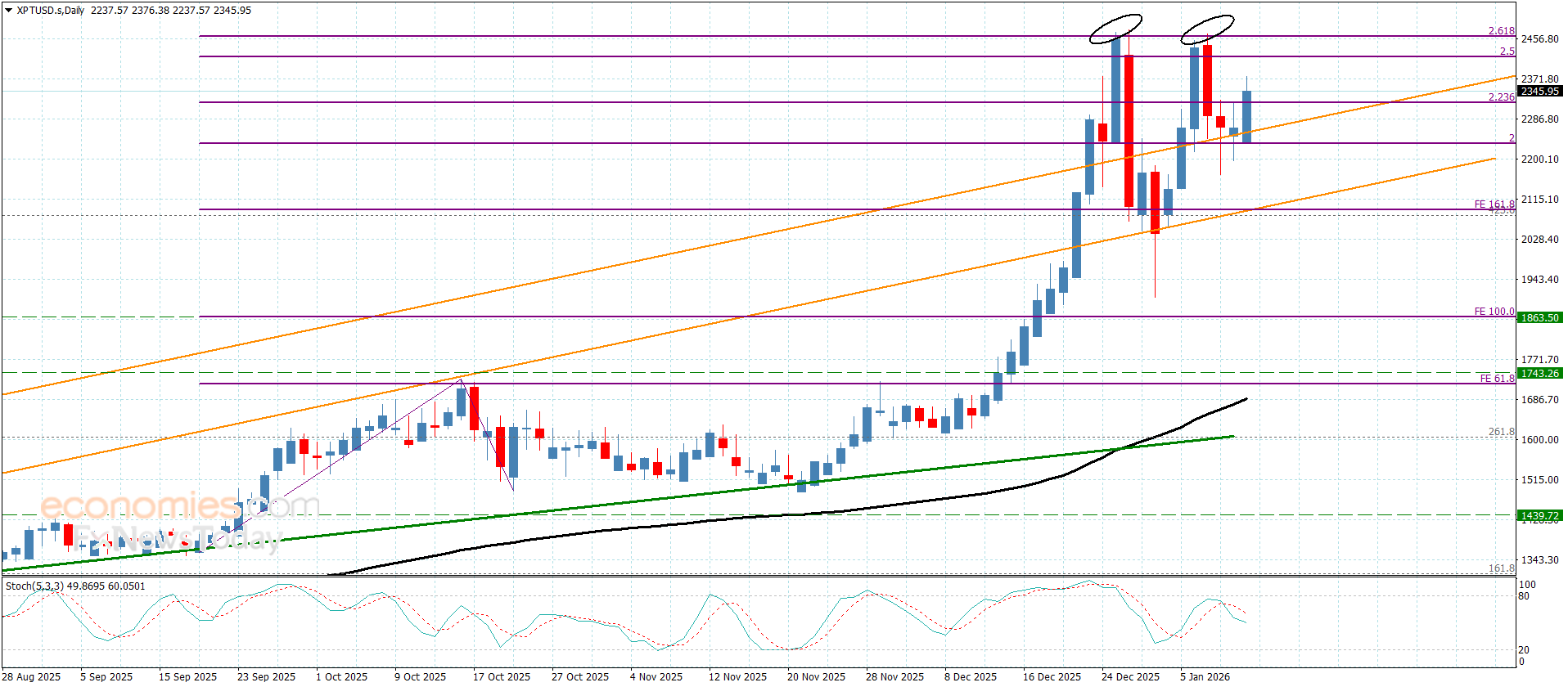

Platinum price renews the positive attempts– Forecast today – 12-1-2026

Platinum price leaned in its last trading above %2.0 Fibonacci extension level at $2230.00, to form strong bullish rally this morning to surpass the barrier at $2320, recording some gains by hitting $2375.00 level.

Despite the continuation of the main indicators’ contradiction, the stability above $2320.00 will provide a chance for resume the bullish attempts, to expect targeting $2415.00, to repeat the pressure on the resistance at $2467.00.

The expected trading range for today is between $2265.00 and $2415.00

Trend forecast: Bullish

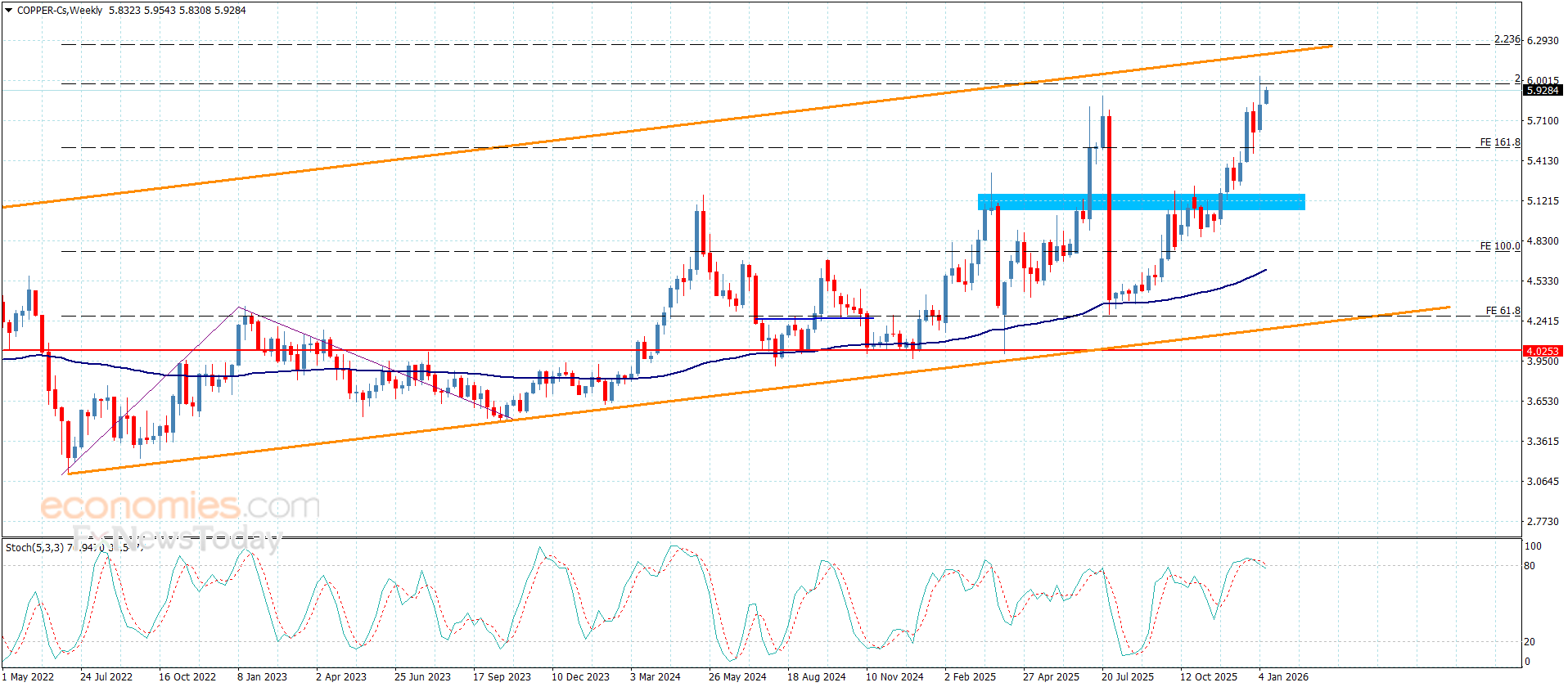

Copper price is hovering near the barrier– Forecast today – 12-1-2026

Copper price provided since morning more positive attempts, approaching from the barrier at $5.9700, forming %2.00 Fibonacci extension level to obstruct the chances of recording any new historical gains, and there is a chance for providing new corrective trading to target $5.7500 and $5.5800.

While breaching the barrier and holding above it will reinforce the main bullish attack, to expect reaching $6.1200 then press on the resistance of the main bullish channel at $6.2000.

The expected trading range for today is between $5.7500 and $5.9700

Trend forecast: Bearish

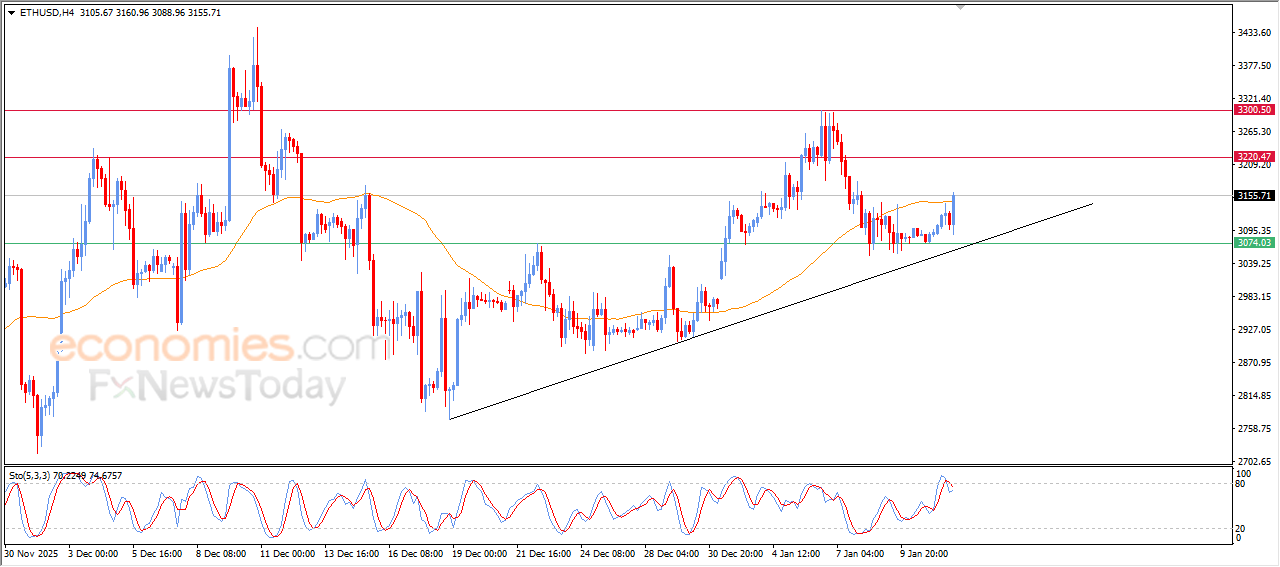

The (ETHUSD) is attempting to get rid of its negative pressure- Analysis- 12-01-2026

The (ETHUSD) price surged higher in its last intraday trading, attempting to get rid of the negative pressure of EMA50, announcing its recovery to reinforce the chances of extending these gains on the intraday basis, amid the dominance of the main bullish trend with its trading alongside minor trend line on the short-term basis, this rise came despite the negative signals emergence from the relative strength indicators, after reaching overbought levels, indicating the volume and strength of the bullish momentum.

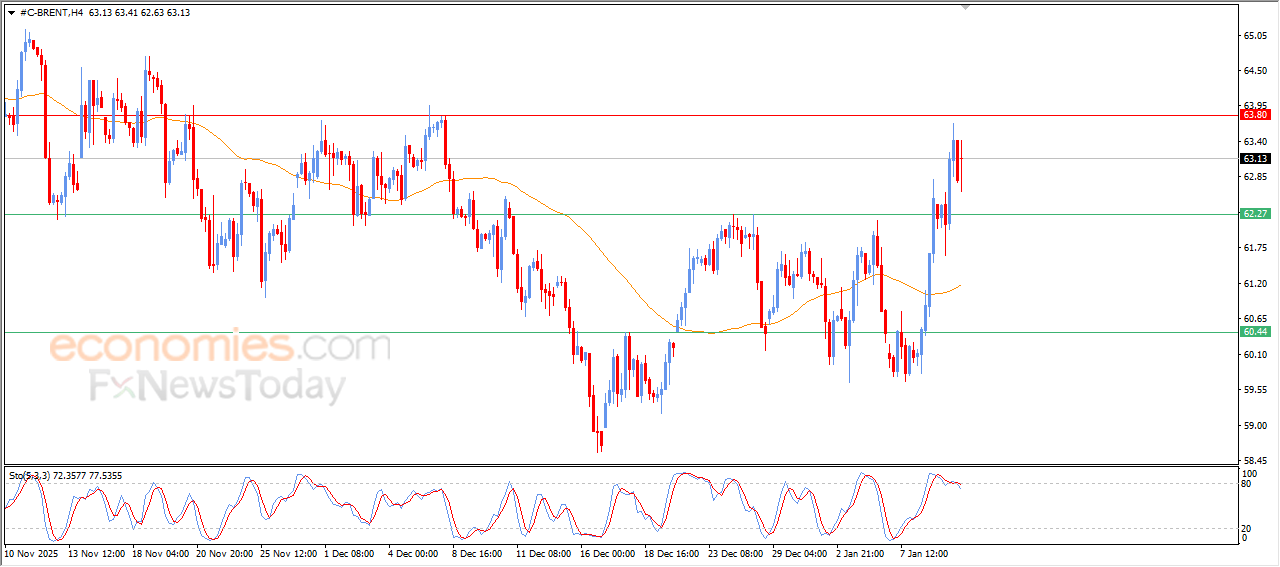

Brent crude oil is declining within fluctuating trading- Analysis- 12-01-2026

The (Brent) price declined in its last intraday trading, to witness fluctuating trading to use it to offload its clear overbought conditions on the relative strength indicators, especially with the emergence of negative signals from there, to gather the bullish momentum that might help the price to rise again, amid the dominance of the dynamic support that is represented by its trading above EMA50, reinforcing the chances of the price recovery in the upcoming period.