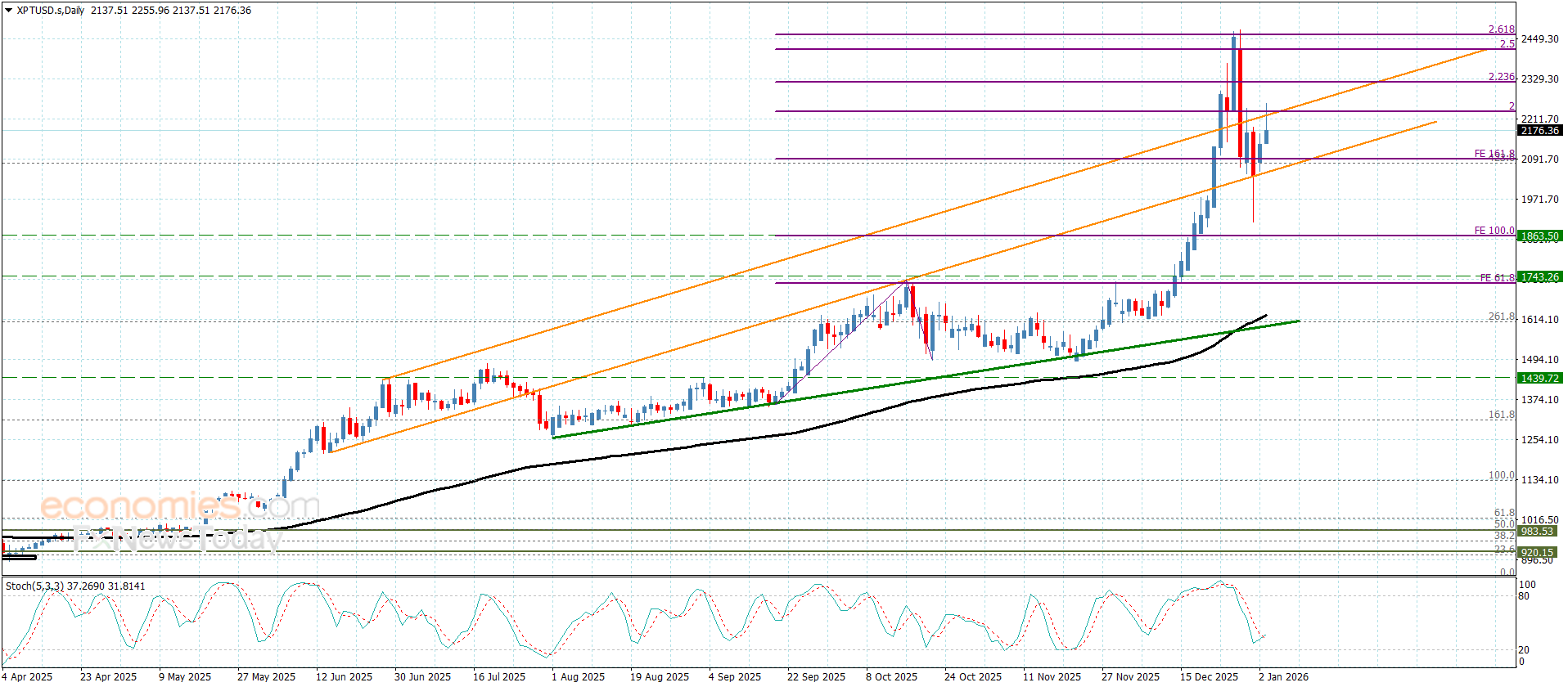

Platinum price renews the positive action– Forecast today – 5-1-2026

Platinum price ended the bearish corrective attack by targeting $1905.00 level, forming key liquidity sweep zones, enabling it to renew the bullish rally to reach $2255.00 level, announcing the continuation of the main bullish scenario.

To confirm gathering extra bullish momentum to ease the mission of holding above $2235.00 level is important to reinforce the chances of recording new gains by its rally towards $2325.00 reaching the next barrier near $2415.00.

The expected trading range for today is between $2095.00 and $2290.00

Trend forecast: Bullish

Copper price gets ready to rise– Forecast today – 5-1-2026

Copper price kept the positive stability above $5.5100 support in the last trading, to rally towards the initial target at $5.8100, taking advantage of stochastic stability within the overbought level.

The continuation of the pressure on $5.8100 level might allow it find an exit for resuming the bullish attack, to expect breaching $5.9700 to extend the trading towards the bullish channel’s resistance at $6.1700 level.

The expected trading range for today is between $5.6100 and $5.9700

Trend forecast: Bullish

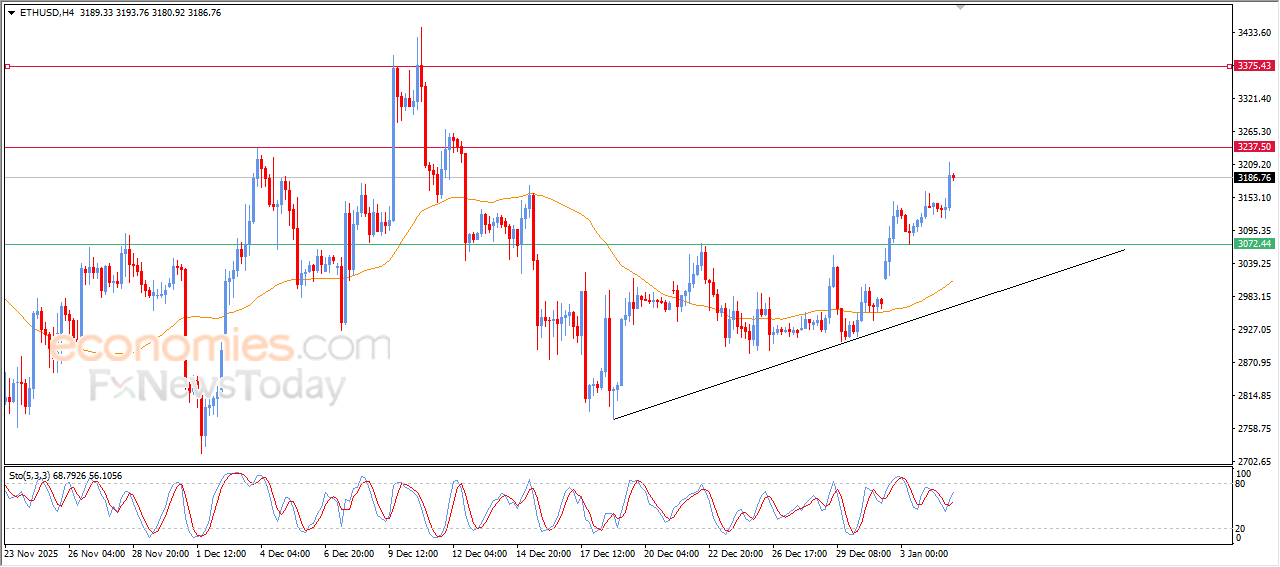

The (ETHUSD) is amid bullish expectations- Analysis- 05-01-2026

The (ETHUSD) price rose in its last intraday trading, amid the dominance of minor bullish wave on the short-term basis, with the trading alongside supportive trend line for this trend, especially with the continuation of the dynamic support that is represented by its trading above EMA50, besides the emergence of the positive signals from the relative strength indicators, after forming positive divergence that is reinforced by the chances of extending the gains on the near-term basis.

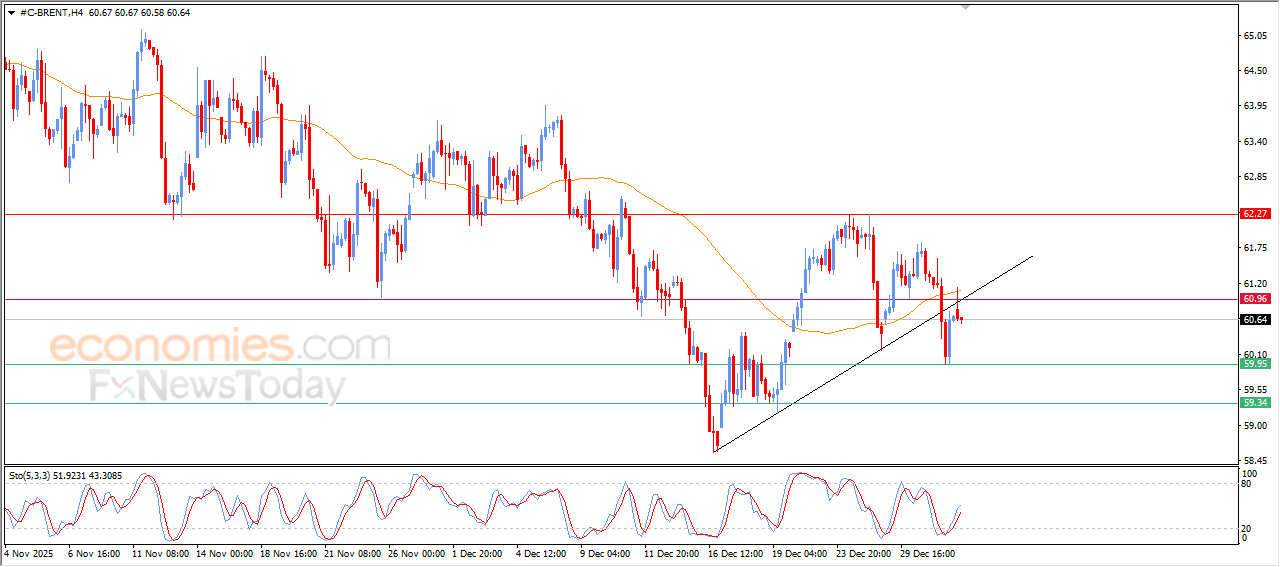

Brent crude oil surrenders to the negative pressure- Analysis- 05-01-2026

The (Brent) price declined in its last trading on the intraday levels, reaching the resistance of its EMA50, which put it under negative pressure that intensified by retesting the previously broken bullish corrective trend line on the short-term basis, especially with offloading its oversold conditions on the relative strength indicators, opening the way for recording more of the losses in the upcoming period.