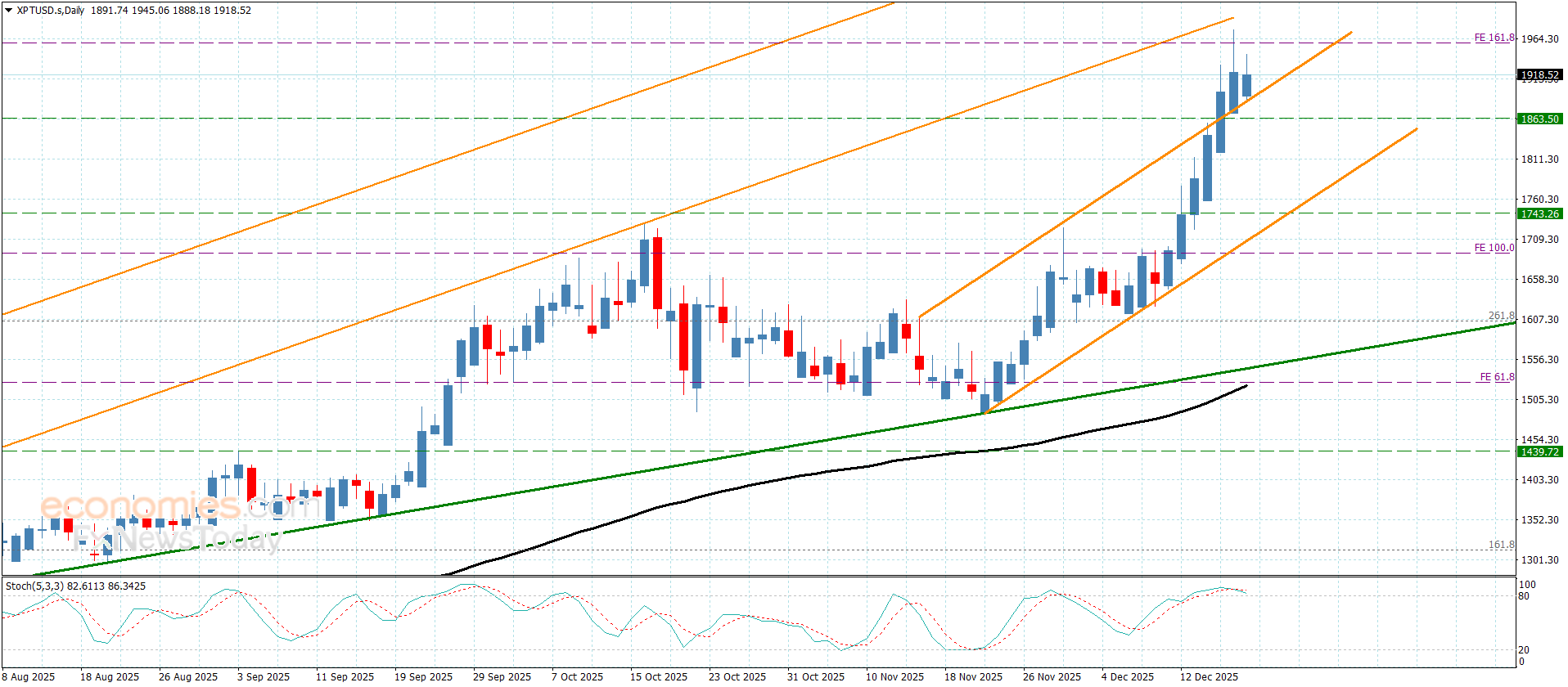

Platinum price is fluctuating within the bullish track– Forecast today – 19-12-2025

Platinum price provided sideways trading due to its stability below the barrier of $1960.00, which forms %161.8 Fibonacci extension level, forcing it to decline temporarily towards $1890.00.

The continuation of providing mixed trading is expected until breaching the barrier, to confirm its readiness to achieve new historical gains that might begin from $2000.00 psychological barrier, while breaking the extra support at $1860.00 level will force it to provide strong corrective trading, to expect reaching $1835.00 and $1790.00.

The expected trading range for today is between $1870.00 and $ 1960.00

Trend forecast: Fluctuated within the bullish track

Copper price is moving slowly– Forecast today – 19-12-2025

Copper prices remain slow, despite several positive factors such as the stability within the main bullish channel’s levels besides providing bullish momentum by stochastic reach to the overbought levels.

Reminding you that the stability of the trading above the extra support level at $5.1300 supports our bullish scenario, to keep waiting to hit $5.5000, surpassing it will push the price to begin recording extra gains by its rally to $5.6300 and $5.7400.

The expected trading range for today is between $5.3000 and $5.5000

Trend forecast: Bullish

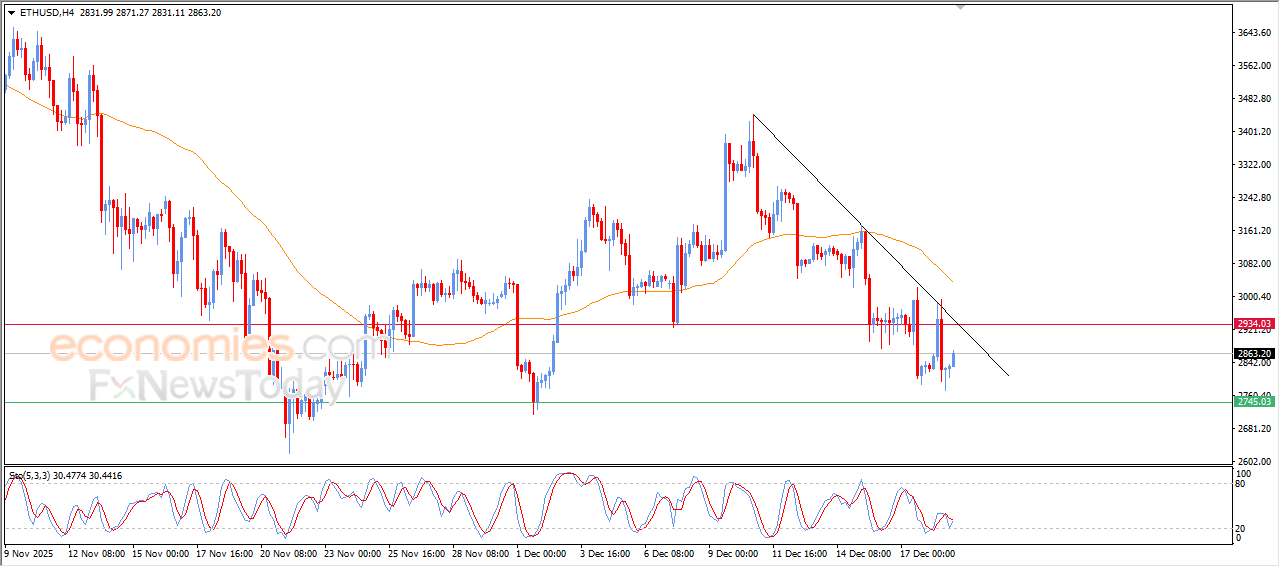

The (ETHUSD) is attempting to recover some of its losses- Analysis- 19-12-2025

The (ETHUSD) price rose during its last intraday trading, attempting to recover some previous losses, amid the dominance of the main bearish trend and its trading alongside minor bearish trend line on the short-term basis, with the continuation of the negative pressure due to its trading below EMA50, which reduces the chances of the price recovery on the near-term basis, especially with the emergence of negative signals on the relative strength indicators.

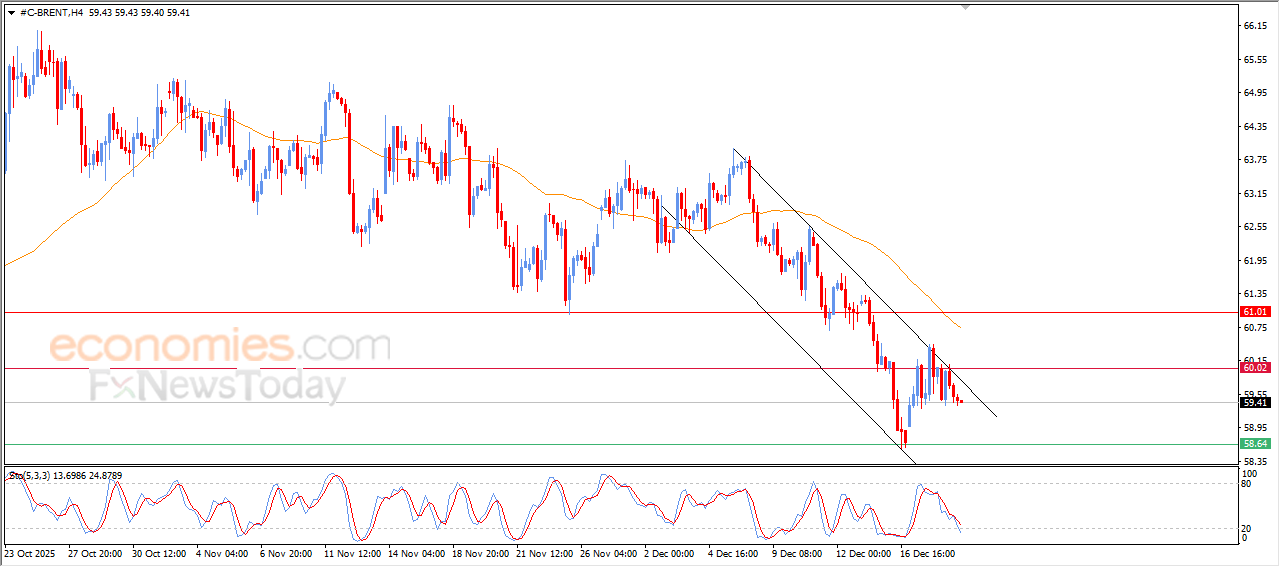

Brent crude oil surrenders to the negative pressures- Analysis- 19-12-2025

The (Brent) price declined on its last intraday trading, due to the stability of the resistance at $60.00, amid the continuation of the negative pressure due to its trading below EMA50, reinforcing the strength and dominance of the main bearish trend and reduces the recovery chances, especially with its trading within minor bearish channel’s range on the short-term basis, with the emergence of the negative signals on the relative strength indicators.