Natural gas price repeats the negative stability– Forecast today – 18-9-2025

AI Summary

- Natural gas prices ended bullish rally, now showing negative stability below resistance at $3.240

- Moving average 55 and stochastic approach suggest negative momentum targeting $2.940 and $2.820

- Forecast for trading range today is between $2.940 and $3.200, with a bearish trend predicted

Natural gas prices ended their bullish correctional rally by providing a new negative close below the resistance at $3.240, keeping the chances of renewing the suggested negative attempts.

The stability of the moving average 55 below the main resistance and stochastic approach from 80 level will increase the chances for gaining the required negative momentum to renew the negative attempts, to keep waiting for targeting $2.940 and $2.820 level.

The expected trading range for today is between $2.940 and $3.200

Trend forecast: Bearish

The EURJPY prefers the positivity– Forecast today – 18-9-2025

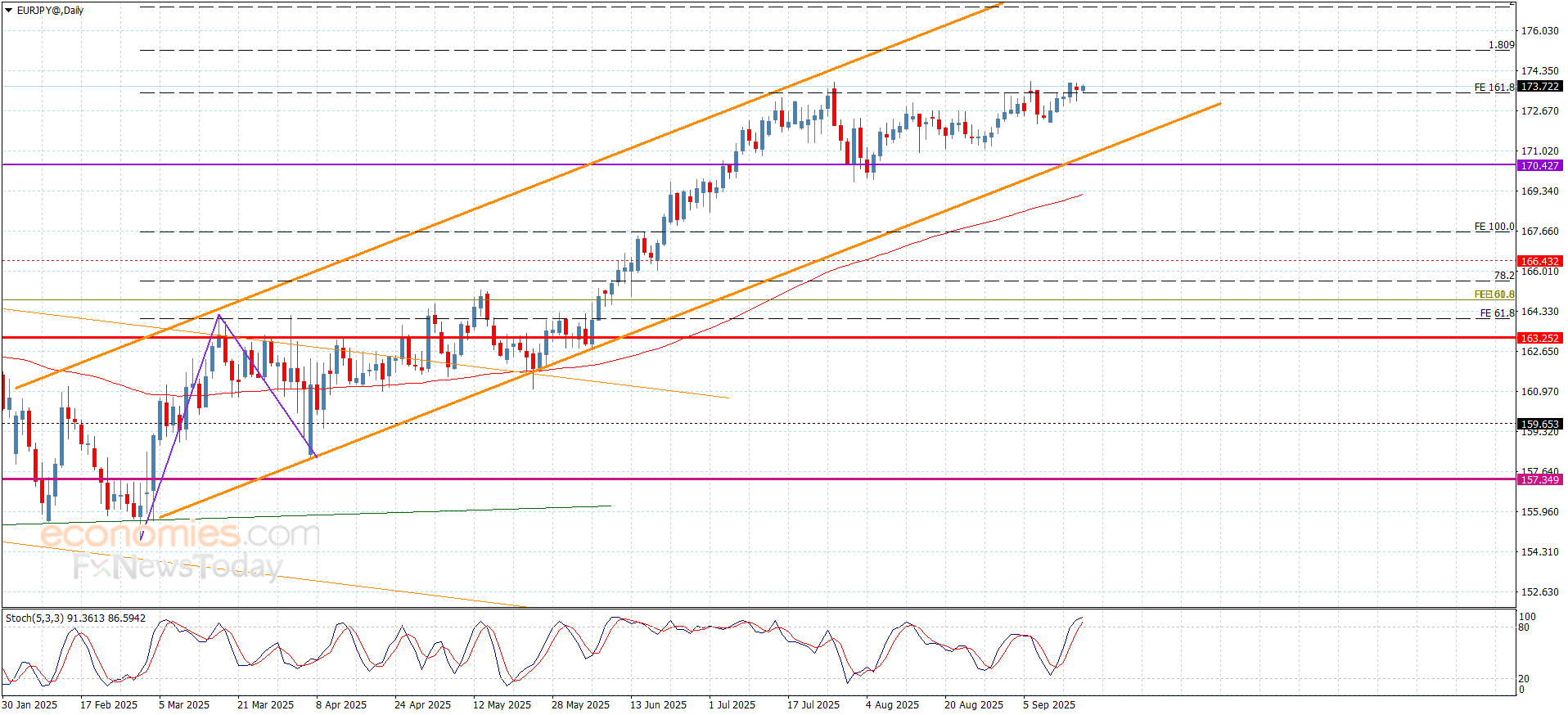

The EURJPY pair provided new positive close yesterday above the barrier at 173.50 level, increasing the chances of resuming the main bullish attack that depends on its stability within the main bullish channel’s levels that appear in the above image.

Note that the attempt of stochastic stability within the overbought level, providing a new positive momentum to motivate it to target some of the positive stations, to expect its rally to 174.25 reaching the next main target near 175.20.

The expected trading range for today is between 173.00 and 174.25

Trend forecast: Bullish

The GBPJPY remains fluctuating near the barrier– Forecast today – 18-9-2025

The GBPJPY pair formed some bearish correctional waves, targeting 199.45 level to bounce again positively, to settle near the barrier at 200.45 level as appears in the above image.

The negative stability below the current barrier confirms delaying the attempt of resuming the bullish attack, to keep our bearish correction suggestion that might target 198.60 and 197.80 level, while the price success in achieving the breach and holding above the barrier will provide strong chance to record extra gains that might extend initially towards 201.55 reaching 202.40.

The expected trading range for today is between 198.60 and 200.40

Trend forecast: Bearish

Platinum price is affected by the contradiction between the indicators– Forecast today – 18-9-2025

Platinum price is affected by the contradiction between the main indicators, which forces it to delay the bullish attack by reaching below $1400,00, to provide mixed trading to keep its stability main stability above the critical support at $1355.00.

We expect the continuation of forming mixed trading until gathering the positive momentum, to pave the way for holding above $1400.00, to begin recording extra gains that might begin at $1435.00, while the decline below the critical support and holding below it will force the price to activate the negative track, which forces it to suffer several losses by reaching $1315.00 and $1300.00.

The expected trading range for today is between $1355.00 and $1395.00

Trend forecast: Fluctuated within the bullish trend