3,061 Pips with 89% Accuracy in One Week (8–12 December 2025) – BestTradingSignal Weekly Performance Report

Financial markets experienced elevated volatility during the week of 8–12 December 2025, driven by shifting expectations around interest rates, commodity flows, and renewed momentum in global indices. In such environments, traders who rely on structured decision-making and timely execution tend to outperform those who trade reactively.

During this week, BestTradingSignal delivered a strong performance across multiple asset classes, demonstrating consistency in both execution and risk management.

Weekly Performance Overview

For the period 8–12 December 2025, BestTradingSignal recorded:

-

Total pips: +3,061

-

Overall accuracy: 89%

-

Markets traded: Gold, Silver, USOIL, DAX, S&P 500, USDCHF, GBPUSD, EURUSD, EURJPY

The performance was primarily driven by sustained momentum in Gold, supported by directional moves in energy markets and selective opportunities across FX and equity indices.

Market Contribution and Trade Context

The week was characterized by strong follow-through in precious metals, with Gold accounting for a significant portion of the total pips captured. Commodity-linked volatility also created actionable setups in USOIL, while DAX and S&P 500 provided short-term index opportunities aligned with broader sentiment.

In foreign exchange, selective trades on USDCHF, EURUSD, and GBPUSD were executed within defined risk parameters, ensuring that losses remained contained while gains were allowed to run.

Risk Management and Accuracy

An accuracy level of 89% reflects disciplined trade selection and strict adherence to predefined stop-loss and target levels. Losing trades were limited in size and frequency, allowing overall performance to remain strongly positive despite normal market fluctuations.

This approach emphasizes:

-

Capital preservation

-

Consistent execution

-

Avoidance of emotional decision-making

-

Favorable risk-to-reward structures

Position Sizing Illustration

To provide perspective on potential outcomes, the weekly result translates approximately to:

-

0.01 lot: ~$306

-

0.10 lot: ~$3,061

-

1.00 lot: ~$30,610

These figures are illustrative and depend on execution, broker conditions, and individual risk settings.

Why Structured Signals Matter

Many traders struggle during volatile weeks due to overtrading, late entries, or unclear risk limits. BestTradingSignal focuses on delivering:

-

Clear entry zones

-

Defined stop-loss levels

-

Logical profit targets

-

Real-time delivery via Telegram

This structure enables traders to act decisively rather than react emotionally.

Conclusion

The week of 8–12 December 2025 highlighted the value of disciplined trading supported by structured signals. With 3,061 pips captured at 89% accuracy, BestTradingSignal maintained consistency across commodities, indices, and FX markets.

Traders seeking clarity, structure, and repeatable execution can access ongoing updates and future setups via the official Telegram channel:

The CADJPY begins gathering gains– Forecast today – 15-12-2025

The CADJPY ended the last bullish rally by attacking 113.40 resistance, that is located alongside 61.8%Fibonacci corrective level, which forces it to activate the scenario of gathering gains by reaching 112.75.

Despite the stability within the bullish channel’s levels, stochastic begin providing negative momentum by its exit from the overbought level, which might increase the efficiency of the bearish corrective track, to target 112.40 level reaching the next support at 112.00.

The expected trading range for today is between 122.40 and 113.10

Trend forecast: Bearish

The EURJPY surrenders to the stability of the barrier– Forecast today – 15-12-2025

The EURJPY pair surrendered since this morning to the bearish corrective scenario, affected by the stability of the barrier near 183.30 besides stochastic exit from the overbought level, activating the attempts of gathering the gains by reaching 182.15.

Renewing the corrective attempts to test the extra support at 181.70, attempting to gather the positive momentum to form bullish waves and recover the current losses by its rally towards 182.80,

Waiting to breach the barrier to open the way for recording new gains that might extend towards 183.50 reaching the next main target at 184.10 in the near sessions.

The expected trading range for today is between 181.70 and 182.70

Trend forecast: Fluctuated within the bullish trend

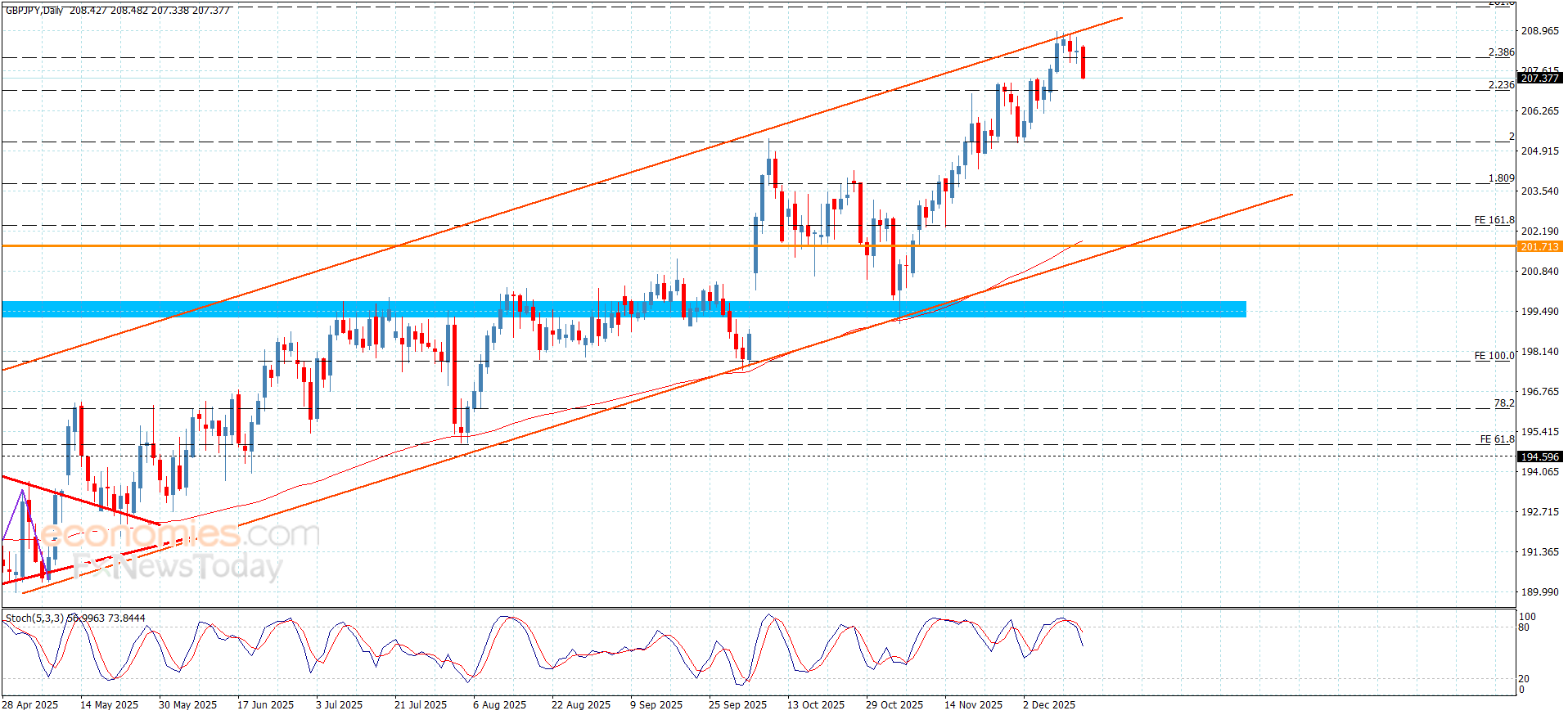

The GBPJPY begins to gather the gains– Forecast today – 15-12-2025

The GBPJPY pair provided a new negative close below the resistance at 208.95, to force it to activate the attempts of gathering gains, to reach 207.35 this morning, facing negative pressures by stochastic exit from the overbought level confirms the importance of reaching extra support at 206.95.

The stability above the targeted support will reinforce the chances of forming positive attempts to target 208.10 level, reaching the mentioned main resistance, while the decline below this support and providing negative close will open the way for resuming the bearish corrective attack, which might target 206.30 and 205.80 level.

The expected trading range for today is between 206.95 and 208.20

Trend forecast: Bearish