Copper price press on the barrier– Forecast today – 4-2-2026

Copper price formed more bullish waves yesterday, to repeat the pressure at $5.9700, attempting to find an exit to resume the bullish attack again.

The contradiction between the main indicators might push the price to provide sideways trading, reminding you that the stability above $5.5100 support forms a main factor to confirm the bullish scenario, therefore, we will keep waiting for breaching the barrier to open the way for recording more gains by its rally towards $6.1500 and $6.2500.

The expected trading range for today is between $5.8500 and $6.1500

Trend forecast: Bullish

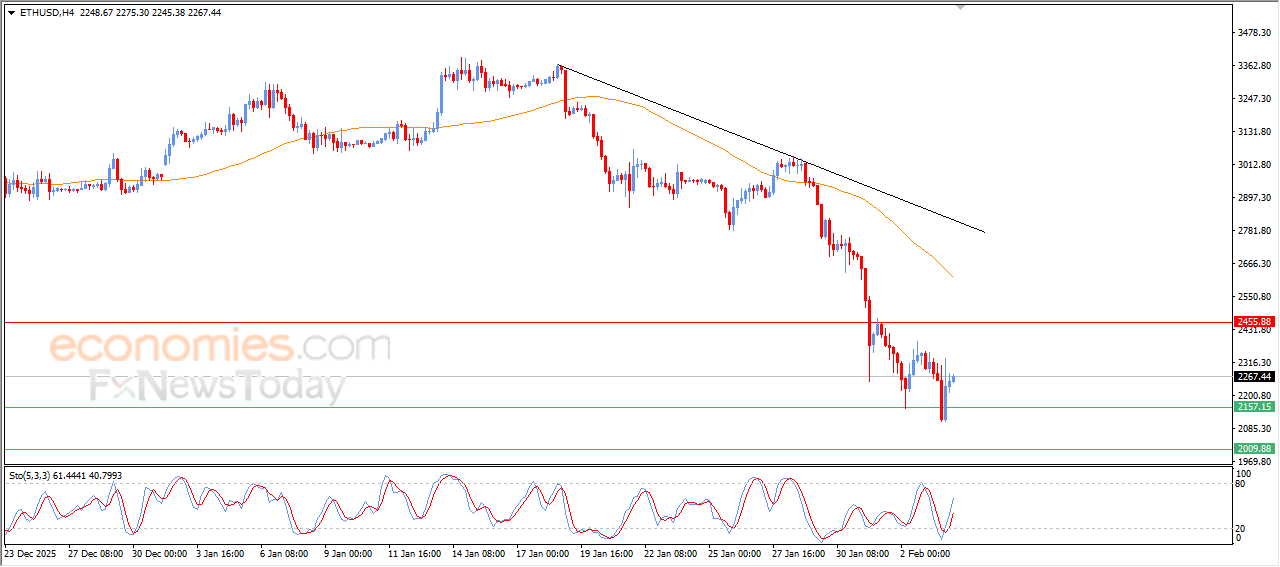

The (ETHUSD) is attempting to recover some of its losses- Analysis- 04-02-2026

The (ETHUSD) price rose in its last intraday trading, supported by the positive signals from relative strength indicators after reaching oversold levels, affected by the stability of $2,070 support, this support was our expected target in our previous analysis, gaining bullish momentum that helped it to achieve these gains, to recover some of its previous losses, amid the continuation of the negative pressure due to its trading below EMA50, reinforcing the dominance of the main bearish trend on short-term basis.

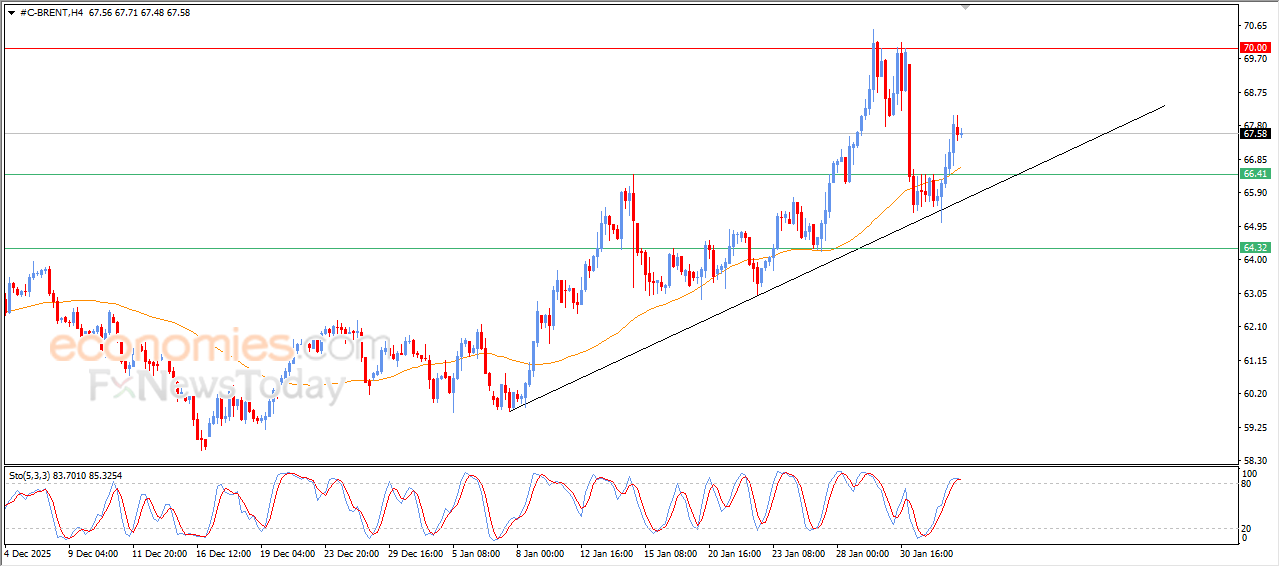

Brent crude oil price is taking a breather- Analysis- 04-02-2026

The (Brent) price declined in its last intraday trading, to gather the gains of its previous rises, attempting to offload some of its overbought conditions on relative strength indicators, especially with the emergence of negative overlapping signals from there, amid the continuation of the dynamic support that is represented by its trading above EMA50, reinforcing the stability and dominance of the main bullish trend on short-term basis, with its trading alongside supportive trend line for this track.

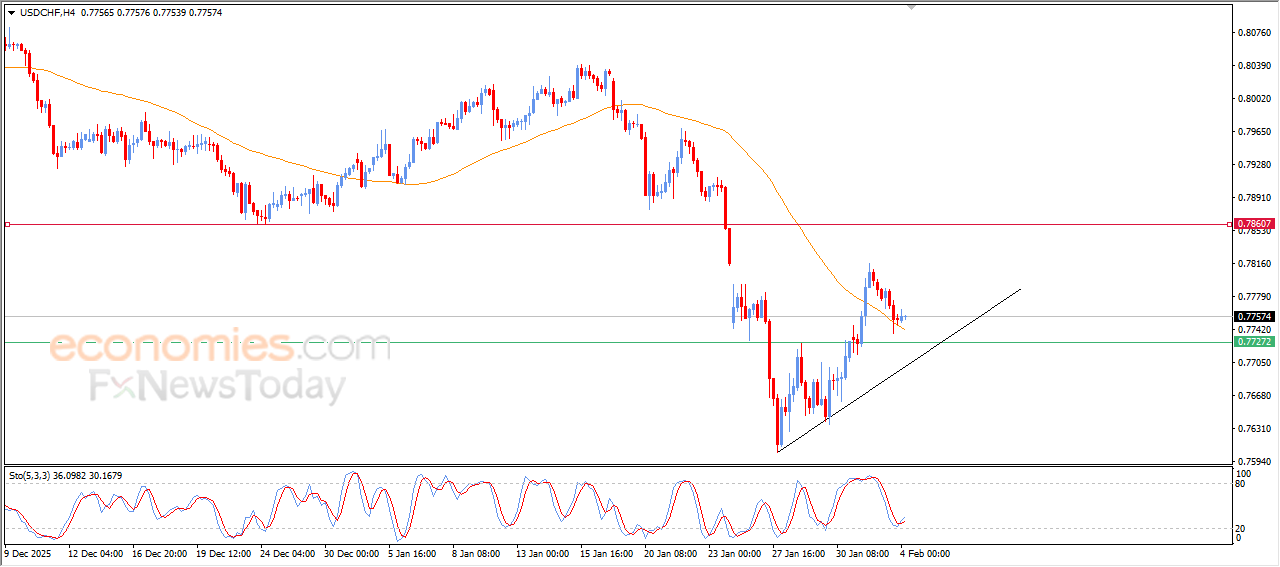

The USDCHF Price is looking for higher low- Analysis-04-02-2026

The (USDCHF) price witnessed slight gains in its last intraday trading, after looking for higher low to take it as a base that might help it to gain the required bullish momentum for its recovery, leaning on EMA50’s support, amid the dominance of the main bullish trend on short-term basis, with its trading alongside supportive trendline for this path, also we notice the beginning of forming positive divergence on relative strength indicators, after reaching exaggerated oversold levels compared to the price move, with the emergence of positive signals from there.