Copper price is waiting for the bullish momentum– Forecast today – 2-9-2025

AI Summary

- Copper prices are currently in a sideways trading pattern, waiting for positive momentum to push them higher

- Critical support levels at $4.0900 and $4.2600 are key for maintaining a bullish track towards targets at $4.6200 and $4.7500

- The expected trading range for today is between $4.4200 and $4.7500, with a bullish trend forecasted

Copper prices didn’t move any news by forming repeated sideways trading, due to its neediness for the positive momentum, due to the continuation of stochastic fluctuation within the oversold level until this moment.

While the stability within the bullish track that depends on the stability of the critical support at $4.0900, besides forming extra support at $4.2600 level, these factors make us wait to gather positive momentum to ease the mission of recording the positive targets that might begin at $4.6200 and $4.7500.

The expected trading range for today is between $4.4200 and $4.7500

Trend forecast: Bullish

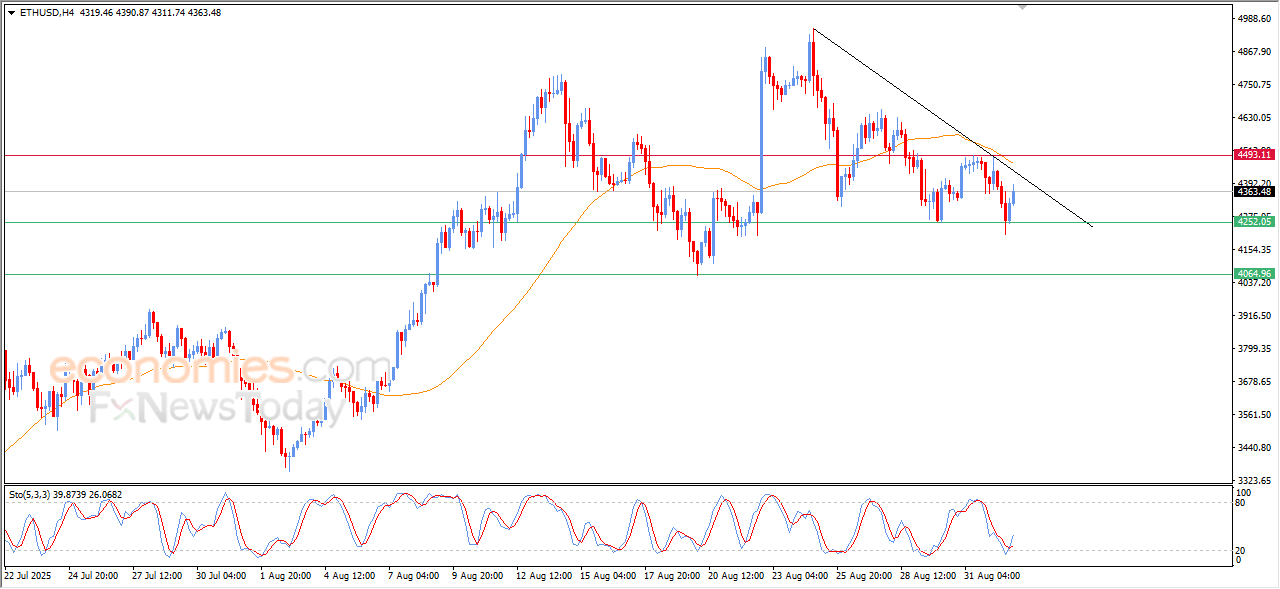

The (ETHUSD) rises, affected by key support- Analysis- 02-09-2025

The (ETHUSD) price rose in its last intraday trading, due to the stability of the key support at $4,250, gaining the bullish momentum that helped it to achieve these gains, especially with the emergence of the positive signals on the (RSI), after reaching oversold levels, to attempt to offload some of this oversold condition, amid the continuation of the negative pressure that comes from its trading below EMA50, and under the dominance of the bearish correctional trend on the short-term basis and its trading alongside bias line.

VIP Trading Signals Performance by BestTradingSignal.com (August 25–29, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for August 25–29, 2025:

Brent crude oil gets ready to attack critical resistance- Analysis-02-09-2025

The (Brent) price rose in its last intraday trading, preparing to attack the critical resistance level at $68.50, amid the dominance of the bullish correctional trend on the short-term basis and its trading alongside a supportive bias line for this track, taking advantage of the dynamic support that is represented by its trading above EMA50, intensifying the bullish momentum, on the other hand, we notice that the (RSI) reached overbought levels, with the beginning of negative overlapping signals appearance from them, which might reduce its upcoming gains.

VIP Trading Signals Performance by BestTradingSignal.com (August 25–29, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for August 25–29, 2025:

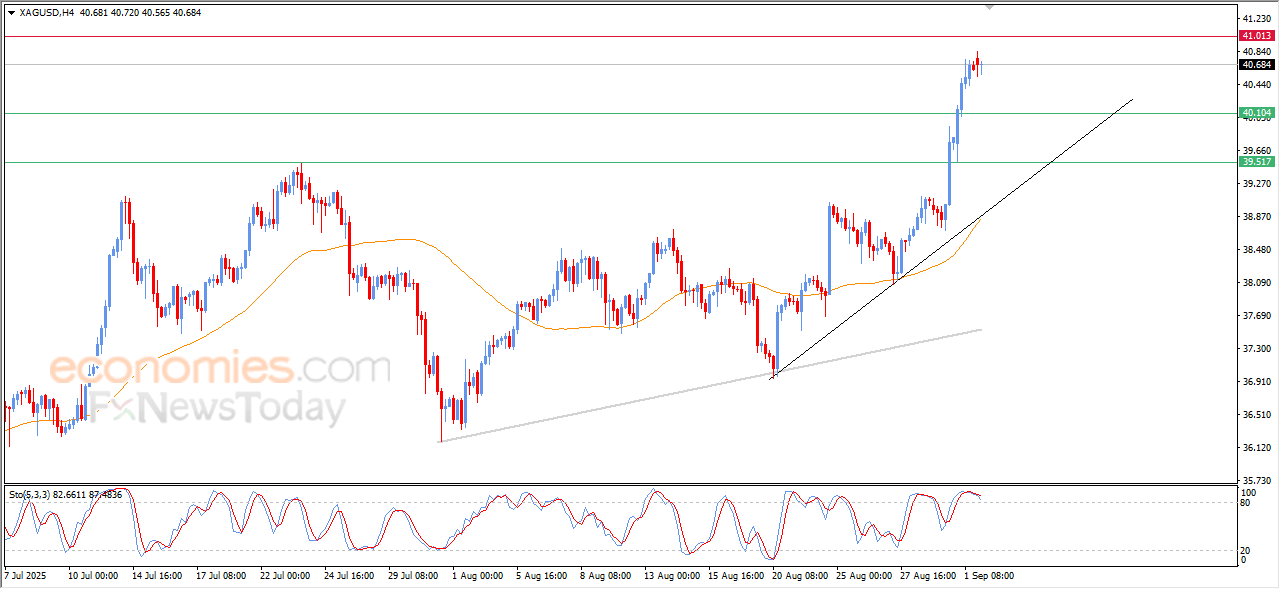

Silver Price is in a truce to catch breath-Analysis-02-09-2025

The (silver) price declined in its last intraday trading, gathering the gains of its previous rise, and attempts to gain bullish momentum that might help it to keep the strong bullish track on the short-term basis, amid its trading alongside a bullish trend line, as the price is attempting to offload some of its clear overbought condition on the (RSI), especially with the emergence of the negative signals from there.

VIP Trading Signals Performance by BestTradingSignal.com (August 25–29, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for August 25–29, 2025: