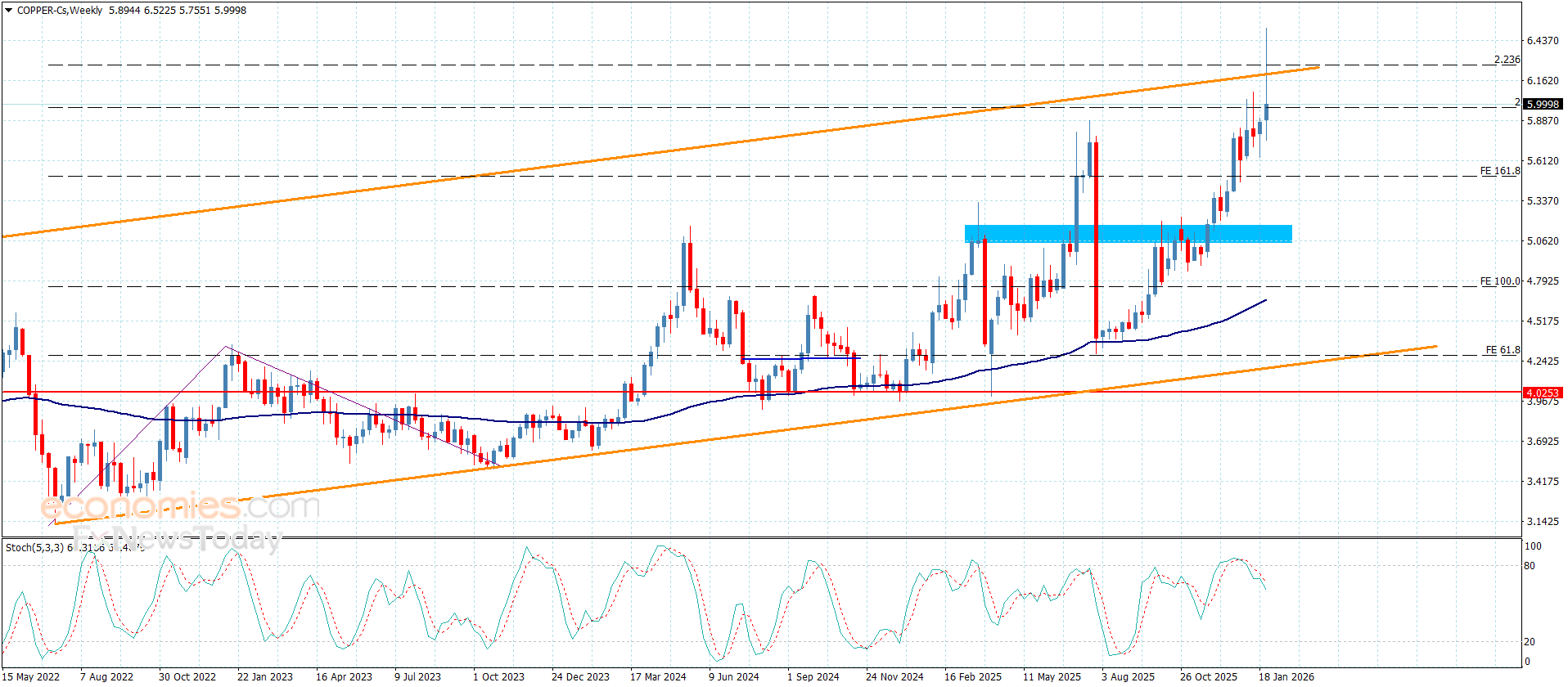

Copper price fails to settle above resistance– Forecast today – 30-1-2026

Copper price’s trading extended towards $6.5225 level, achieving new historical gains but its neediness to the negative momentum pushed it to decline again to settle below $6.2100 resistance, to begin gathering some gains by reaching $6.000.

The contradiction between the main indicators by the stability below the resistance might increase the efficiency of the bearish corrective track, which might target $5.7500 level reaching the initial support at $5.5100.

The expected trading range for today is between $5.8000 and $6.2000

Trend forecast: Bearish

The (ETHUSD) breaks key support- Analysis- 30-01-2026

The (ETHUSD) price slipped lower in its last intraday trading, breaking $2,785 key support, amid the dominance of the main bearish trend on short-term basis with its trading alongside supportive trend line for this path, besides the continuation of the negative pressure due to its trading below EMA50, on the other hand, we notice the emergence of positive signals from relative strength indicators, after reaching oversold levels, which might decrease the upcoming losses temporarily.

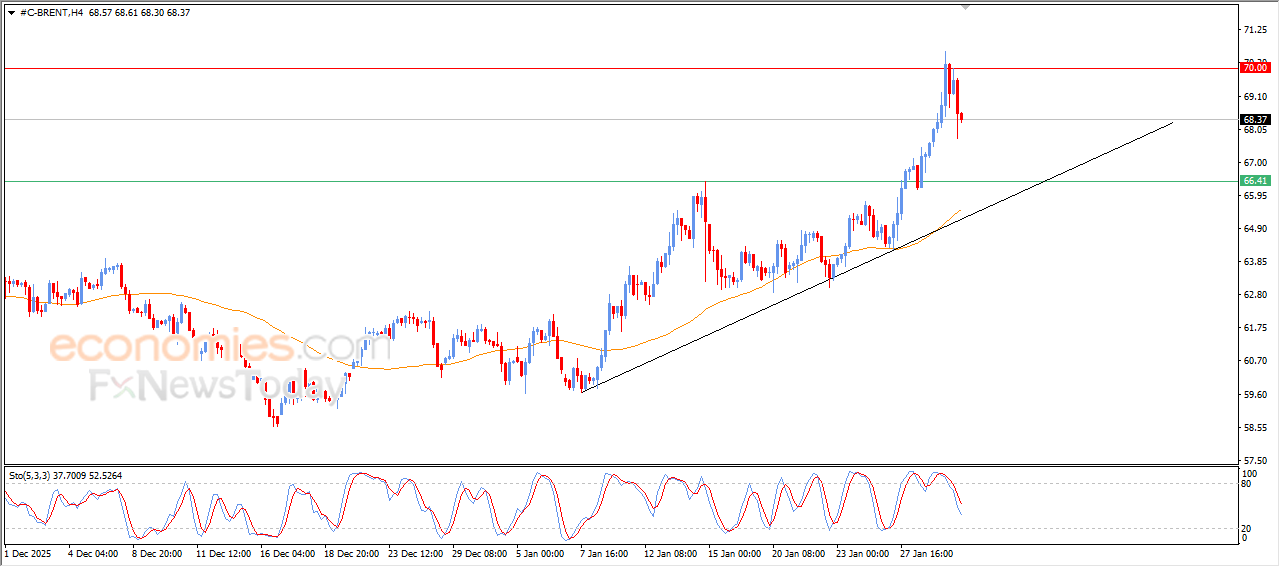

Brent crude oil price is experiencing a technical correction that does not change the bullish trend- Analysis- 30-01-2026

The (Brent) price declined in its last intraday trading, amid the emergence of negative signals from relative strength indicators, after reaching overbought levels, attempting to look for higher low to use it as a base that might help it to gain the required bullish momentum for its recovery, amid the dominance of the main bullish trend on short-term basis, with its trading alongside supportive trend line for this path, noticing that the relative strength indicators reached exaggerated oversold levels compared to the price move.

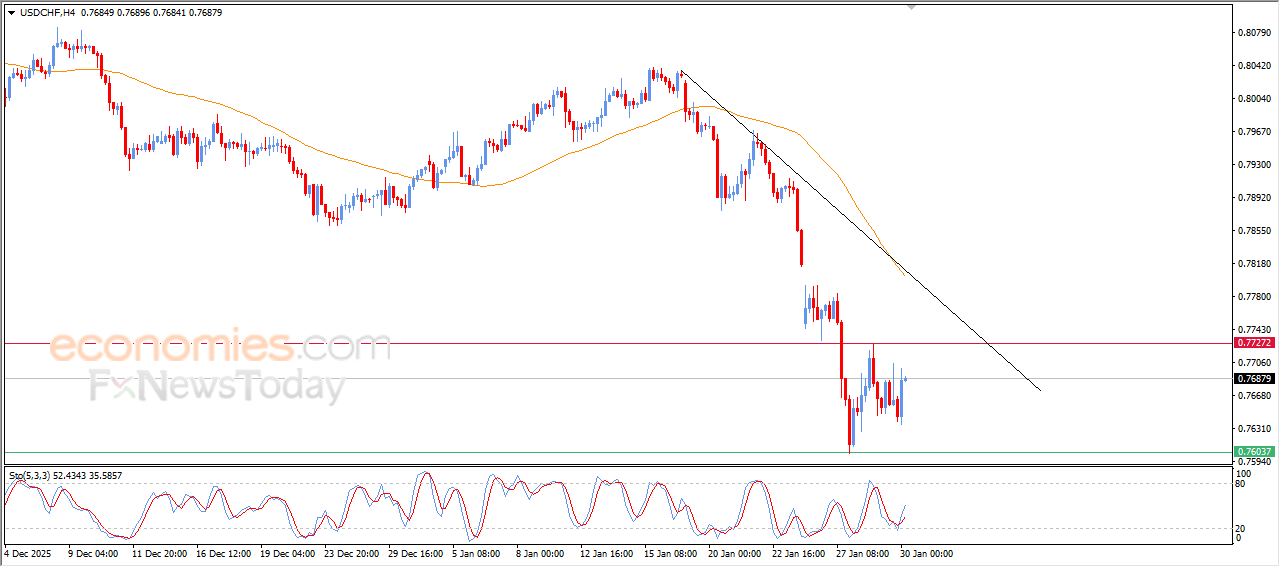

The USDCHF Price is attempting to offload its oversold conditions- Analysis-30-01-2026

The (USDCHF) price rose in its last intraday trading, attempting to offload some of its clear oversold conditions on relative strength indicators, especially with the emergence of positive signals from there, amid the continuation of the negative pressure due to its trading below EMA50, which reinforces the stability and dominance of the main bullish trend on short-term basis, especially with its trading alongside steep trendline.