End of day crude oil price forecast update - 03-02-2025

Crude oil price traded with strong negativity to break 73.90$ level and reactivate the negative scenario on the intraday basis, opening the way to visit 72.30$ initially, noting that breaking it will extend the bearish wave to reach 70.30$ on the near-term basis, while the expected decline will remain valid unless the price rallied to breach 73.90$ and hold above it.

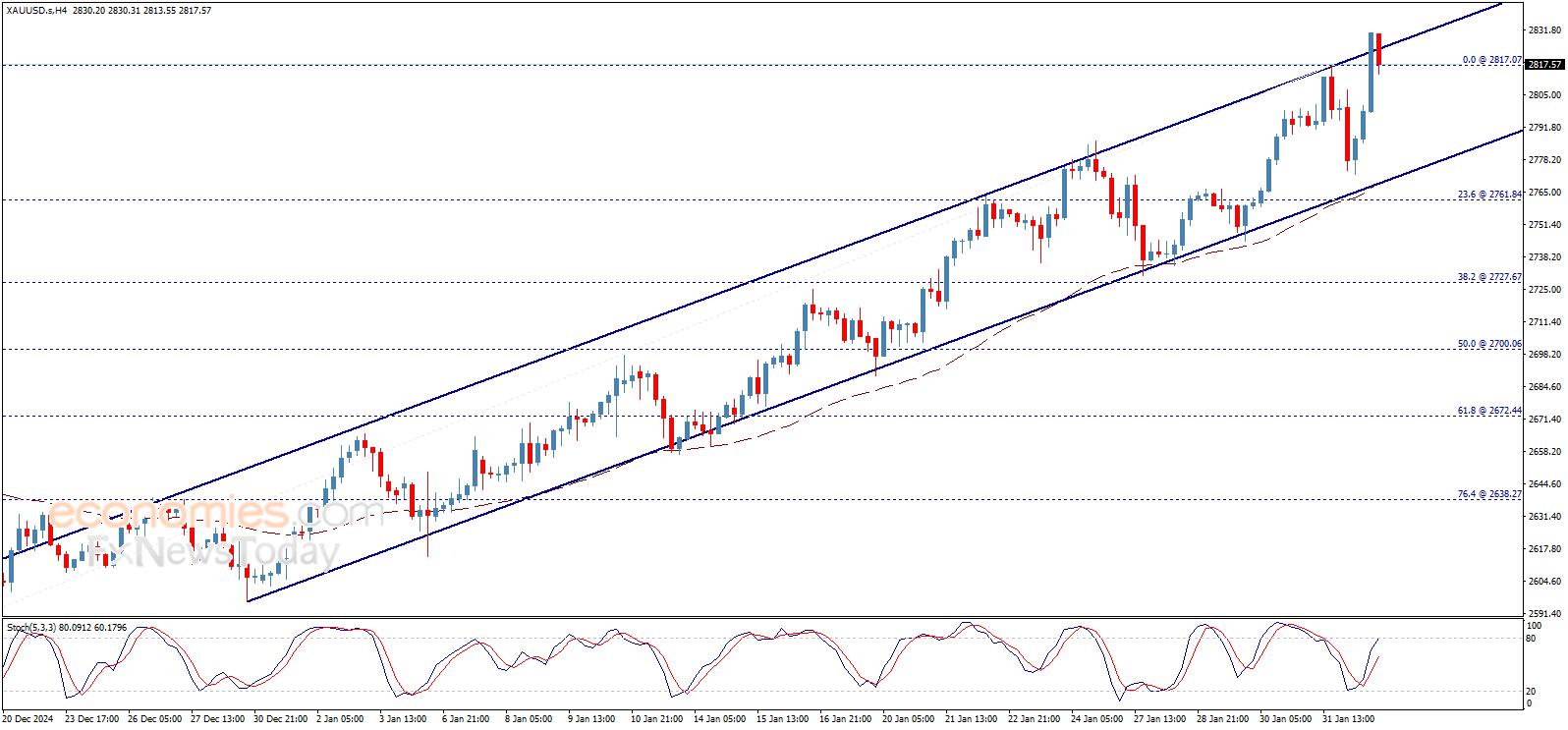

End of day gold price forecast update - 03-02-2025

Gold price rallied upwards strongly to succeed achieving our waited target at 2820.00$, and attempted to breach it but it faces negative pressure now, which urges monitoring the upcoming trading carefully, as failing to confirm the consolidation above the mentioned level will push the price to build intraday bearish wave that targets 2766.00$ areas, while breaching 2825.00$ will lead the price to resume the bullish wave that its next main target reaches 2850.00$.

End of day EURUSD price forecast update - 03-02-2025

The EURUSD price trades with clear positivity to test the key resistance 1.0325$ now, which urges caution from the upcoming trading, as breaching this level will stop the negative scenario and push the price to achieve additional gains that reach 1.0455$ as a next positive station.

After the Chinese AI Earthquake: Who Are the Biggest Winners and Losers in the U.S. Market?

AI stocks have been the primary driver of the bull market over the past two years, with semiconductor shares in particular achieving enormous gains, as large language models powering tools like ChatGPT relied on the latest and most advanced electronic chips.

However, news about the open-source R1 model from the Chinese company DeepSeek—which can perform advanced tasks without requiring the most complex chips—led to a decline in many of those stocks. The Morningstar Semiconductor Index dropped by 14.5% on Monday, January 27, after it had surged by 107% in 2023 and 83% in 2024.

The downturn wasn’t limited to tech companies alone. Over the past two years, the wave of AI investment has included stocks in diverse sectors such as utilities, energy, and heavy industries. Even companies involved in the heating, ventilation, and air conditioning (HVAC) industry—key to cooling massive data centers—experienced a decline.

It is expected that this storm will persist for a while, especially with the release of a new AI model by the Chinese e-commerce giant Alibaba called Qwen 2.5, which the company claims outperforms its sibling DeepSeek R1. The announcement came on the first day of the Lunar New Year, the officially adopted calendar in China.

What happened:

Semiconductor stocks such as Nvidia and Broadcom faced significant sell-offs on Monday, as investors worried that DeepSeek’s efficiency could temper enthusiasm for AI infrastructure spending. Previously high-flying networking and energy stocks also tumbled.

By contrast, software stocks rose, supported by expectations of improved profit margins and higher demand for AI-based products, particularly as the cost of running such technologies decreases.

The high-performance model, which DeepSeek claims was trained in just a few months at a cost of around $6 million, raised concerns about the possibility of developing useful AI without ultra-powerful, expensive hardware. It also threatened to undermine the investment thesis that has so far dominated American tech companies: lavish spending to build strong computing capabilities and develop the most advanced AI models.

Following Monday’s heavy sell-off in semiconductor and computer networking stocks, the market saw a slight rebound, but the impact of DeepSeek’s shock remained evident at Friday’s close.

Wall Street Concerns:

Although it’s true that AI will be massive and transformative, the winners and losers may not be the same entities we see today. The current concern resembles the dot-com bubble of the late 1990s, when the internet was viewed as a force that would change everything; while some empires thrived and others went bankrupt, the rest disappeared among the skyscrapers of the new tech giants.

In this article, we look at some of the winners and losers after throwing the so-called “DeepSeek stone” into the pond of global stock markets.

Nvidia (Nvidia)

Nvidia was the undisputed biggest winner in the AI revolution, but it became the biggest loser in the DeepSeek panic; its stock plunged 17% on Monday, marking its steepest single-day drop since March 2020.

The digital giant’s market cap fell from USD 3.6 trillion to around USD 590 billion—a record loss in market value for a single company.

While some investors believe DeepSeek might force American tech giants to refocus their efforts on building more flexible and efficient AI models, Bank of America analysts suggest DeepSeek could spur more investment in this domain, which might ultimately benefit Nvidia. However, some caution that DeepSeek’s success could dampen AI spending enthusiasm and push the Trump administration to tighten semiconductor export restrictions. Nvidia ended last week down 16%.

Meta Platforms (META)

Among the “Magnificent Seven” tech stocks, Meta Platforms performed the best, recording a 6.4% gain at week’s end while avoiding the severe sell-off that hit the AI sector.

Its stock rose by about 2% even as others, such as Nvidia, plunged. Investors noted the success of DeepSeek, which resembles Meta’s open-source AI model (Llama).

During Meta’s weekly earnings conference, CEO Mark Zuckerberg said DeepSeek “reinforces our belief that focusing on open-source AI is the right approach,” helping calm worries about DeepSeek’s impact on the company’s strategy.

ServiceNow (NOW)

ServiceNow’s enterprise software stock finished a turbulent week with a slight 1% decline, after initially rising 4% during the first two trading sessions, supported by optimism that DeepSeek might reduce the costs of developing low-cost AI models.

However, in its weekly earnings conference, the company reported disappointing quarterly results, causing the stock to plummet 11% due to slowing subscription revenue growth and projections of further deceleration in the current quarter.

Conclusion:

As DeepSeek continues to affect markets, semiconductor and computer networking stocks face significant sell-offs, while software companies benefit from lower operating costs and rising demand for AI-powered products. However, the challenge is how to redirect investment enthusiasm toward building robust computing capabilities without excessive spending.

Wall Street faces challenges reminiscent of the dot-com bubble of the 1990s, where the landscape of winners and losers may shift as future business models and technologies evolve.